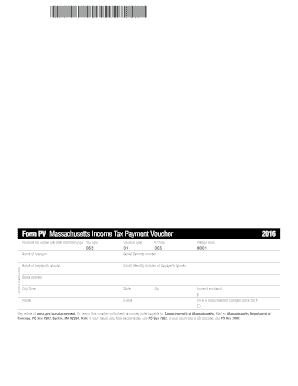

Form PV Massachusetts Income Tax Payment Voucher Mass

What is the Form PV Massachusetts Income Tax Payment Voucher

The Form PV is the Massachusetts Income Tax Payment Voucher used by individuals and businesses to submit payments for their state income tax liabilities. This form is essential for taxpayers who owe taxes and wish to make a payment directly to the Massachusetts Department of Revenue. It serves as a record of the payment and ensures that the funds are applied correctly to the taxpayer's account.

Steps to Complete the Form PV Massachusetts Income Tax Payment Voucher

Completing the Form PV involves several straightforward steps. First, taxpayers should gather their tax information, including their Social Security number or Employer Identification Number. Next, fill in the required fields, which include the taxpayer's name, address, and the amount being paid. Ensure that the payment amount matches the tax owed as indicated on the tax return. Finally, sign and date the form before submitting it along with the payment.

How to Obtain the Form PV Massachusetts Income Tax Payment Voucher

The Form PV can be obtained directly from the Massachusetts Department of Revenue's website. Taxpayers can download and print the form, ensuring they have the most current version. Additionally, physical copies may be available at local tax offices or through tax professionals who assist with tax filings.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form PV. Payments can be made online through the Massachusetts Department of Revenue's eServices portal, which allows for immediate processing. Alternatively, taxpayers can mail the completed form along with their payment to the designated address provided on the form. For those who prefer in-person submissions, payments can be made at local tax offices during business hours.

Key Elements of the Form PV Massachusetts Income Tax Payment Voucher

The Form PV includes several key elements necessary for proper processing. These elements consist of the taxpayer's identification information, the payment amount, and the tax year for which the payment is being made. Additionally, there is a section for the taxpayer's signature, which is crucial for validating the submission. Accurate completion of these elements ensures that payments are credited to the correct account.

Penalties for Non-Compliance

Failure to submit the Form PV or to pay the owed taxes on time can result in penalties imposed by the Massachusetts Department of Revenue. These penalties may include late fees and interest on the unpaid balance. It is essential for taxpayers to adhere to filing deadlines and ensure timely payments to avoid these additional costs.

Eligibility Criteria

Eligibility to use the Form PV is generally determined by whether the taxpayer has a tax liability for the state of Massachusetts. This includes individuals, businesses, and self-employed persons who owe state income taxes. Taxpayers should review their tax obligations to confirm that they are required to submit this form when making payments.

Quick guide on how to complete form pv massachusetts income tax payment voucher 2016 mass

Complete Form PV Massachusetts Income Tax Payment Voucher Mass effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly and without interruptions. Manage Form PV Massachusetts Income Tax Payment Voucher Mass on any device using airSlate SignNow’s Android or iOS applications and enhance your document-based workflows today.

The simplest way to modify and eSign Form PV Massachusetts Income Tax Payment Voucher Mass with ease

- Locate Form PV Massachusetts Income Tax Payment Voucher Mass and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Select important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Decide how you want to share your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing fresh copies. airSlate SignNow caters to your document management needs with just a few clicks from your chosen device. Edit and eSign Form PV Massachusetts Income Tax Payment Voucher Mass and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form pv massachusetts income tax payment voucher 2016 mass

How to generate an e-signature for your PDF document in the online mode

How to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Massachusetts tax type 999?

Massachusetts tax type 999 refers to a specific tax code that businesses must understand when filing their taxes in the state. It typically involves various rules and regulations that govern how certain transactions are taxed. It's essential for businesses to stay informed about tax type 999 to ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with Massachusetts tax type 999 documentation?

airSlate SignNow streamlines the process of sending and signing documents related to Massachusetts tax type 999. Our platform allows you to create, send, and manage necessary tax documents securely and efficiently. By using our service, businesses can ensure that their tax-related documents are handled accurately and promptly.

-

Is airSlate SignNow compliant with Massachusetts tax regulations, including tax type 999?

Yes, airSlate SignNow is designed to comply with all relevant Massachusetts tax regulations, including tax type 999. Our platform adheres to legal standards for electronic signatures and document management. This ensures that all documents processed through our system are valid and recognized by the state.

-

What features does airSlate SignNow offer for managing Massachusetts tax type 999 documents?

airSlate SignNow offers features such as customizable templates, secure eSignature options, and automatic reminders, which facilitate the management of Massachusetts tax type 999 documents. Our intuitive interface allows you to easily set up workflows that can save your team time and enhance productivity. With these tools, you can efficiently handle tax-related documents.

-

What are the pricing options for airSlate SignNow regarding handling Massachusetts tax type 999?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes when managing documents related to Massachusetts tax type 999. You can choose from our various subscription levels, allowing you to find the best fit based on your volume of transactions and document requirements. Each plan provides access to our full suite of features and customer support.

-

Can I integrate airSlate SignNow with my accounting software for Massachusetts tax type 999?

Yes, airSlate SignNow can be integrated with several popular accounting software solutions to assist in managing Massachusetts tax type 999 documentation. This seamless integration allows for easy access to financial records, making it simpler to prepare and file taxes. Connections with platforms like QuickBooks and others enhance your workflow efficiency.

-

What are the benefits of using airSlate SignNow for Massachusetts tax type 999 compliance?

The benefits of using airSlate SignNow for Massachusetts tax type 999 compliance include enhanced security, improved signing speed, and streamlined document management. Our solution minimizes the risk of errors and helps ensure that all required signatures are obtained efficiently. With airSlate SignNow, businesses can focus more on their operations rather than administrative hassles.

Get more for Form PV Massachusetts Income Tax Payment Voucher Mass

- Letter from landlord to tenant about time of intent to enter premises north dakota form

- North dakota letter landlord form

- Letter from tenant to landlord about sexual harassment north dakota form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children north dakota form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure north 497317524 form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497317525 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497317526 form

- North dakota landlord 497317527 form

Find out other Form PV Massachusetts Income Tax Payment Voucher Mass

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy