MI 1040 V State of Michigan Michigan Form

What is the MI 1040 V State Of Michigan Michigan?

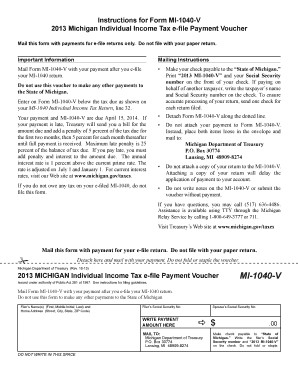

The MI 1040 V is a payment voucher used by residents of Michigan to submit payments for their state income tax. This form is essential for individuals who owe tax and want to ensure their payment is properly credited to their account. It is typically used in conjunction with the MI 1040 form, which is the state's individual income tax return. The MI 1040 V helps streamline the payment process, making it easier for taxpayers to manage their financial obligations to the state.

How to use the MI 1040 V State Of Michigan Michigan

Using the MI 1040 V involves filling out the form with your personal information, including your name, address, and Social Security number. You will also need to indicate the amount you are paying. Once completed, the form should be submitted along with your payment, either through the mail or electronically, depending on your preference. Ensuring that all information is accurate will help prevent delays in processing your payment.

Steps to complete the MI 1040 V State Of Michigan Michigan

To complete the MI 1040 V, follow these steps:

- Obtain the MI 1040 V form from the Michigan Department of Treasury website or a tax professional.

- Fill in your personal details, including your name, address, and Social Security number.

- Enter the amount of payment you are submitting.

- Review the form for accuracy to avoid any issues with processing.

- Submit the completed form along with your payment by mail or electronically.

Legal use of the MI 1040 V State Of Michigan Michigan

The MI 1040 V is legally recognized as a valid method for submitting state income tax payments. To ensure its legal standing, it must be completed accurately and submitted according to the guidelines set forth by the Michigan Department of Treasury. Compliance with state tax laws is crucial, as failure to submit the form correctly can result in penalties or delays in processing your payment.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the MI 1040 V. Typically, the deadline for submitting your state income tax payment coincides with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check the Michigan Department of Treasury's official website for the most current deadlines and any updates regarding tax filings.

Form Submission Methods (Online / Mail / In-Person)

The MI 1040 V can be submitted through various methods to accommodate different preferences:

- Online: Payments can be made electronically through the Michigan Department of Treasury's e-filing system.

- Mail: You can print the completed form and send it along with your payment to the designated address provided on the form.

- In-Person: Payments may also be made in person at local tax offices, where staff can assist with the process.

Quick guide on how to complete mi 1040 v state of michigan michigan

Effortlessly Prepare MI 1040 V State Of Michigan Michigan on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delay. Handle MI 1040 V State Of Michigan Michigan on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Steps to Modify and eSign MI 1040 V State Of Michigan Michigan with Ease

- Find MI 1040 V State Of Michigan Michigan and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to secure your changes.

- Select your preferred method of delivering your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the tedious search for forms, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you choose. Modify and eSign MI 1040 V State Of Michigan Michigan to ensure smooth communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040 v state of michigan michigan

How to make an e-signature for a PDF online

How to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

The way to create an e-signature for a PDF document on Android

People also ask

-

What is the MI 1040 V State Of Michigan Michigan and why do I need it?

The MI 1040 V State Of Michigan Michigan is a payment voucher used for submitting payments with your state tax return. It's essential for ensuring your payments are correctly processed and credited to your tax account, helping you avoid late fees and penalties.

-

How can airSlate SignNow help with MI 1040 V State Of Michigan Michigan forms?

With airSlate SignNow, you can easily fill out and eSign your MI 1040 V State Of Michigan Michigan forms online. Our platform simplifies the process of handling these documents, making it straightforward to ensure timely submissions and accurate records.

-

Are there any costs associated with using airSlate SignNow for MI 1040 V State Of Michigan Michigan?

airSlate SignNow offers various pricing plans tailored to fit different budgets. Depending on your needs, you can choose a plan that allows for unlimited eSigning and document management, making the handling of MI 1040 V State Of Michigan Michigan forms affordable.

-

What features does airSlate SignNow offer for managing MI 1040 V State Of Michigan Michigan documents?

Our platform provides features like customizable templates, automated workflows, and real-time tracking for your MI 1040 V State Of Michigan Michigan documents. These tools enhance efficiency, ensuring you can manage your tax forms with ease and precision.

-

Can I integrate airSlate SignNow with other applications for my MI 1040 V State Of Michigan Michigan needs?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and CRM systems. This integration capability allows for streamlined management of your MI 1040 V State Of Michigan Michigan forms within your existing workflows.

-

Is airSlate SignNow secure for handling sensitive MI 1040 V State Of Michigan Michigan documents?

Absolutely. airSlate SignNow prioritizes the security of all documents, including your MI 1040 V State Of Michigan Michigan forms. Our platform is equipped with military-grade encryption and complies with industry-leading security standards to protect your sensitive information.

-

How does airSlate SignNow ensure compliance with MI 1040 V State Of Michigan Michigan regulations?

airSlate SignNow stays updated with the latest regulations concerning the MI 1040 V State Of Michigan Michigan forms. Our platform enables compliance through features like electronic signatures that are legally valid and adherence to state guidelines.

Get more for MI 1040 V State Of Michigan Michigan

- North carolina widow form

- Legal last will and testament form for widow or widower with minor children north carolina

- Legal last will form for a widow or widower with no children north carolina

- North carolina will form

- Legal last will and testament form for divorced and remarried person with mine yours and ours children north carolina

- Legal last will and testament form with all property to trust called a pour over will north carolina

- Written revocation of will north carolina form

- Last will and testament for other persons north carolina form

Find out other MI 1040 V State Of Michigan Michigan

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document