Michigan Tax Return Form

What is the Michigan Tax Return

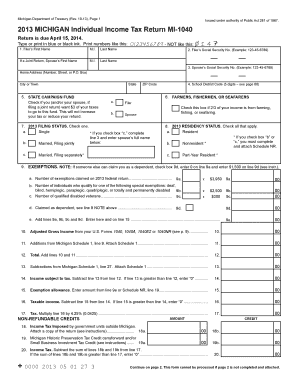

The Michigan tax return is a document that residents and certain non-residents must file to report their income and calculate their state tax liability. This form is essential for determining the amount of Michigan state income tax owed or the refund due. The primary form used for individual taxpayers is the MI-1040, which allows for the reporting of various income sources, deductions, and credits applicable under Michigan tax law.

Steps to complete the Michigan Tax Return

Completing the Michigan tax return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can impact your tax rate and eligibility for certain credits.

- Calculate your total income by adding all sources of income reported on your documents.

- Identify applicable deductions and credits that can reduce your taxable income.

- Fill out the MI-1040 form, ensuring all information is accurate and complete.

- Review your completed form for any errors before submission.

- Submit your tax return electronically or by mail, depending on your preference.

How to obtain the Michigan Tax Return

Taxpayers can obtain the Michigan tax return form through several methods:

- Download the MI-1040 form directly from the Michigan Department of Treasury website.

- Request a paper form to be mailed to you by contacting the Michigan Department of Treasury.

- Access tax preparation software that includes the Michigan tax return as part of its filing process.

Legal use of the Michigan Tax Return

The Michigan tax return is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must comply with the following:

- Provide accurate and truthful information on the form.

- Sign the return, either electronically or physically, as required.

- File the return by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Taxpayers should be aware of the following important dates related to the Michigan tax return:

- The annual filing deadline for individual tax returns is typically April 15.

- If the deadline falls on a weekend or holiday, it is extended to the next business day.

- Extensions may be requested, allowing additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the Michigan tax return accurately, taxpayers should gather the following documents:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions or credits claimed, such as receipts for charitable contributions or medical expenses.

- Previous year's tax return, which can provide a useful reference.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their Michigan tax return:

- Electronically through the Michigan Department of Treasury's e-file system or approved tax software.

- By mail, sending the completed form to the designated address provided on the form.

- In-person at local tax offices, if assistance is needed or if preferred.

Quick guide on how to complete michigan tax return

Complete Michigan Tax Return effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It presents an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Michigan Tax Return on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centered workflow today.

How to modify and eSign Michigan Tax Return with ease

- Obtain Michigan Tax Return and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Michigan Tax Return while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan tax return

How to make an e-signature for a PDF document online

How to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the significance of understanding Michigan state income tax for businesses?

Understanding Michigan state income tax is crucial for businesses operating in the state, as it directly affects their financial planning and compliance. Proper knowledge can help avoid potential penalties and make informed decisions about expenses and investment strategies. Utilizing tools like airSlate SignNow can simplify document management related to tax filings and compliance.

-

How can airSlate SignNow help in managing Michigan state income tax documents?

airSlate SignNow offers an efficient platform for businesses to send, sign, and store important tax-related documents securely. With templates and automated workflows, businesses can manage Michigan state income tax forms and other financial documents easily. This not only saves time but also helps ensure that all forms are completed accurately and submitted on time.

-

Are there any costs associated with using airSlate SignNow for managing Michigan state income tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including features specifically designed for managing Michigan state income tax forms and documents. The cost-effective solution enables businesses to streamline their document processes without compromising on quality. Overall, the potential savings on time and penalties can outweigh the subscription costs.

-

What features make airSlate SignNow suitable for handling Michigan state income tax compliance?

airSlate SignNow provides features such as legally binding eSignatures, customizable templates, and secure cloud storage specifically tailored for essential documents like those involved in Michigan state income tax compliance. Additionally, the platform facilitates easy collaboration among team members, ensuring that everyone involved stays informed and organized throughout the tax filing process.

-

Can airSlate SignNow integrate with other software for managing Michigan state income tax records?

Absolutely, airSlate SignNow can seamlessly integrate with various accounting and CRM software that businesses may already be using to manage their Michigan state income tax records. This integration helps streamline workflows and ensures that all documents are synchronized and up-to-date. As a result, managing tax obligations becomes a more cohesive experience for users.

-

What benefits does airSlate SignNow offer for small businesses regarding Michigan state income tax?

For small businesses, airSlate SignNow offers signNow benefits when dealing with Michigan state income tax, such as reducing administrative burdens and minimizing manual errors in documentation. By digitizing and streamlining document workflows, small businesses can allocate more time to growth and less time on compliance issues. The user-friendly interface makes it accessible for businesses of all sizes.

-

How does airSlate SignNow ensure the security of Michigan state income tax documents?

AirSlate SignNow prioritizes the security of your documents, including Michigan state income tax paperwork, with features like encryption and two-factor authentication. This ensures that sensitive information is protected against unauthorized access. Compliance with industry standards for data security means users can confidently manage their tax documents without fear of bsignNowes.

Get more for Michigan Tax Return

- Paving contract for contractor north dakota form

- Site work contract for contractor north dakota form

- Siding contract for contractor north dakota form

- Nd contract form

- Drainage contract for contractor north dakota form

- Foundation contract for contractor north dakota form

- Plumbing contract for contractor north dakota form

- Brick mason contract for contractor north dakota form

Find out other Michigan Tax Return

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT