Form 4, Instructions for Application for Extension State of Michigan

What is the Form 4, Instructions For Application For Extension State Of Michigan

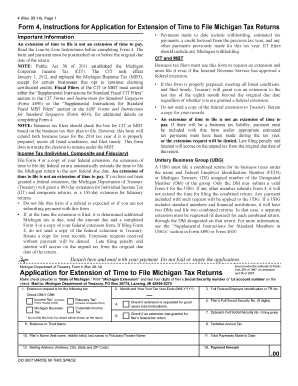

The Form 4, Instructions For Application For Extension State Of Michigan is a document designed for individuals or businesses seeking an extension for filing their state tax returns. This form provides detailed guidelines on how to apply for an extension, ensuring that applicants understand the requirements and processes involved. It serves as an essential tool for taxpayers who may need additional time to prepare their tax documents accurately.

Steps to complete the Form 4, Instructions For Application For Extension State Of Michigan

Completing the Form 4 requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information, including your tax identification number and income details.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the instructions provided with the form to ensure compliance with state regulations.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Form 4, Instructions For Application For Extension State Of Michigan

The legal use of the Form 4 is crucial for ensuring that the extension request is recognized by the state. To be legally valid, the form must be completed in accordance with Michigan state laws and regulations. This includes providing accurate information and submitting the form within the designated timeframe. Utilizing a reliable eSignature platform can help ensure that the submission meets all legal requirements.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form 4. Typically, the application for an extension must be submitted by the original due date of the tax return. Failing to meet this deadline may result in penalties or interest on unpaid taxes. Keeping track of important dates can help ensure compliance and avoid unnecessary complications.

Required Documents

When applying for an extension using the Form 4, certain documents may be required to support your application. These may include:

- Your previous year's tax return for reference.

- Any relevant income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

Having these documents ready can streamline the application process and help ensure that your extension is granted.

Form Submission Methods (Online / Mail / In-Person)

The Form 4 can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online submission via the Michigan Department of Treasury's website.

- Mailing the completed form to the appropriate address provided in the instructions.

- In-person submission at designated state offices, if applicable.

Choosing the right submission method can help ensure that your application is processed efficiently.

Eligibility Criteria

To qualify for an extension using the Form 4, applicants must meet specific eligibility criteria. Generally, this includes being a resident of Michigan or having income sourced from Michigan. Additionally, individuals and businesses must demonstrate a valid reason for requesting an extension, such as unforeseen circumstances that hinder timely filing. Understanding these criteria can help ensure a successful application process.

Quick guide on how to complete form 4 instructions for application for extension state of michigan

Accomplish [SKS] effortlessly on any device

Online document administration has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow applications for Android or iOS and enhance any document-centric procedure today.

The simplest method to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click on Get Form to initiate the process.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your files or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your document, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious document searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign [SKS] and ensure outstanding communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4, Instructions For Application For Extension State Of Michigan

Create this form in 5 minutes!

How to create an eSignature for the form 4 instructions for application for extension state of michigan

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Form 4, Instructions For Application For Extension State Of Michigan?

The Form 4, Instructions For Application For Extension State Of Michigan is a document that provides guidance on how to apply for an extension on tax-related forms. This specific form outlines the steps and necessary information needed to ensure your application is processed efficiently. Understanding these instructions is crucial for timely submissions.

-

How does airSlate SignNow help with the Form 4, Instructions For Application For Extension State Of Michigan?

airSlate SignNow simplifies the process of completing and submitting the Form 4, Instructions For Application For Extension State Of Michigan. Our platform allows users to easily fill out the form, incorporate e-signatures, and securely send the document. This streamlines the entire application process, making it faster and more efficient.

-

What are the pricing options for using airSlate SignNow with the Form 4, Instructions For Application For Extension State Of Michigan?

airSlate SignNow offers flexible pricing plans to accommodate different user needs, whether you're an individual or a business. Our plans include features specifically designed for handling documents like the Form 4, Instructions For Application For Extension State Of Michigan. You can choose a plan that fits your budget while gaining access to our comprehensive e-signature solutions.

-

What features of airSlate SignNow enhance my experience with the Form 4, Instructions For Application For Extension State Of Michigan?

Key features of airSlate SignNow include user-friendly templates, customizable workflows, and automated reminders. These tools help ensure that the Form 4, Instructions For Application For Extension State Of Michigan is completed accurately and submitted on time. Additionally, e-signature capabilities enhance the document's authenticity and reduce turnaround time.

-

Can I integrate airSlate SignNow with other software for the Form 4, Instructions For Application For Extension State Of Michigan?

Yes, airSlate SignNow offers seamless integration with various software platforms including CRM and document management systems. This means you can easily handle the Form 4, Instructions For Application For Extension State Of Michigan within your existing workflows. Our integrations help streamline processes and improve overall efficiency.

-

Is airSlate SignNow secure for using the Form 4, Instructions For Application For Extension State Of Michigan?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect your sensitive information. When using the Form 4, Instructions For Application For Extension State Of Michigan, you can trust that our platform employs encryption and secure authentication methods to keep your data safe.

-

What benefits can I expect when using airSlate SignNow for the Form 4, Instructions For Application For Extension State Of Michigan?

By using airSlate SignNow for the Form 4, Instructions For Application For Extension State Of Michigan, you can expect improved efficiency and reduced paperwork. Our platform makes it easy to collaborate and complete forms quickly. Moreover, the e-signature feature signNowly accelerates the approval process, saving you time and resources.

Get more for Form 4, Instructions For Application For Extension State Of Michigan

- Clearfield county public defenders office form

- Guardianship petition application cobb county form

- Dte form 100 2012

- Emergency custody in dauphin county pa form

- Deschutes restaurant form

- Visible landscape management application deschutes county form

- Lot of record verification application deschutes county oregon form

- Teleserve report city of baton rougeparish of east baton rouge form

Find out other Form 4, Instructions For Application For Extension State Of Michigan

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple