Submitting a Lot of Record Verification Multnomah County 2013-2026

What is the submitting a lot of record verification Multnomah County?

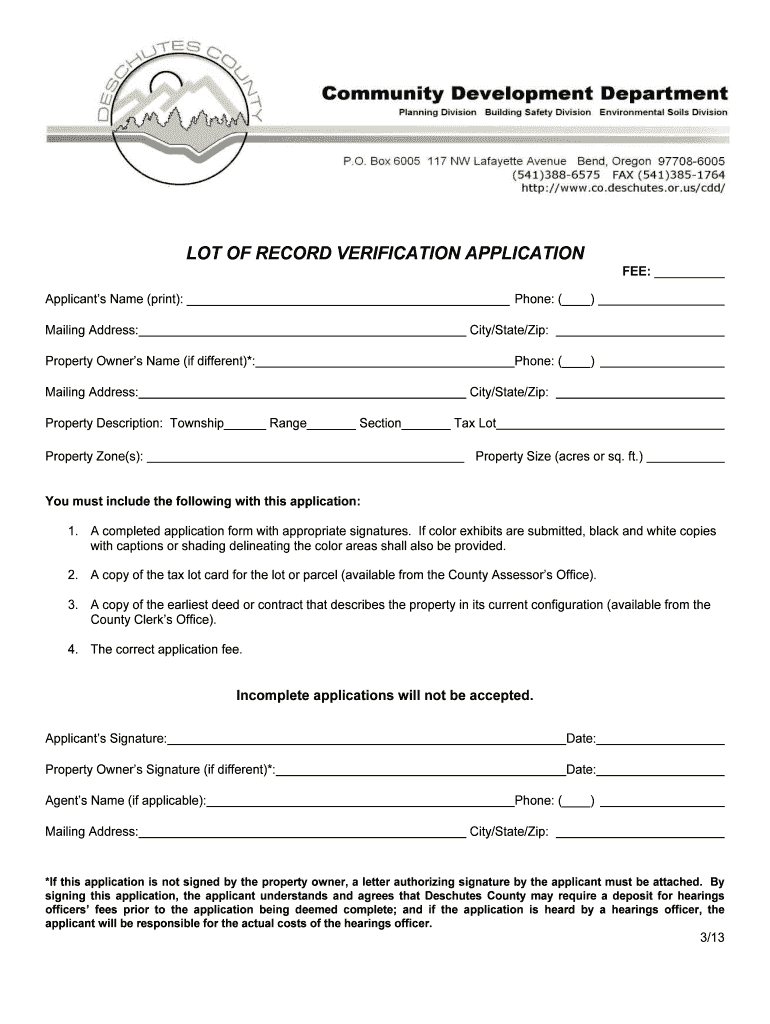

The submitting a lot of record verification Multnomah County is a formal process used to verify the details of a specific lot or parcel of land within the county. This verification is essential for various purposes, including property transactions, zoning applications, and legal disputes. The form typically requires detailed information about the property, including its legal description, ownership details, and any relevant historical data. By submitting this form, individuals and businesses can ensure that their records are accurate and up to date, which is crucial for maintaining compliance with local regulations.

Steps to complete the submitting a lot of record verification Multnomah County

Completing the submitting a lot of record verification form involves several key steps:

- Gather necessary information about the lot, including its legal description, tax parcel number, and current ownership details.

- Access the official form from the Multnomah County website or designated office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the specified method, which may include online submission, mailing, or in-person delivery.

Legal use of the submitting a lot of record verification Multnomah County

The legal use of the submitting a lot of record verification form is crucial in establishing the legitimacy of property claims and ensuring compliance with local laws. This form serves as an official record that can be referenced in legal proceedings, property disputes, or when applying for permits. It is essential that the information provided is accurate and truthful, as any discrepancies could lead to legal complications or penalties. By utilizing this form, property owners can protect their interests and maintain clear records with the county.

Key elements of the submitting a lot of record verification Multnomah County

Several key elements are essential for the submitting a lot of record verification form:

- Legal Description: A detailed description of the property, including boundaries and dimensions.

- Ownership Information: Names and contact details of the current owner(s).

- Tax Parcel Number: A unique identifier assigned to the property by the county.

- Purpose of Verification: A statement explaining the reason for the request.

- Signatures: Required signatures from the property owner or authorized representative.

How to obtain the submitting a lot of record verification Multnomah County

To obtain the submitting a lot of record verification form, individuals can visit the Multnomah County government website or contact the county clerk's office. The form is often available in both digital and paper formats, allowing users to choose their preferred method of access. For those who prefer online access, the form can typically be downloaded directly from the website. If assistance is needed, county staff are available to provide guidance on completing the form and understanding the submission process.

Form submission methods

Submitting the lot record verification form can be done through various methods:

- Online: Many counties offer an online submission option for convenience.

- Mail: Completed forms can be sent via postal service to the appropriate county office.

- In-Person: Individuals may also choose to deliver the form in person at the county clerk's office.

Quick guide on how to complete lot of record verification application deschutes county oregon

Dot Your i's and Cross Your t's on Submitting Numerous Record Verifications for Multnomah County

Negotiating contracts, overseeing listings, organizing meetings, and conducting showings—realtors and real estate professionals handle a variety of responsibilities each day. Many of these responsibilities involve a signNow amount of paperwork, such as Submitting A Lot Of Record Verification Multnomah County, which must be filled out quickly and accurately.

airSlate SignNow is a comprehensive solution that allows real estate professionals to alleviate the burden of paperwork and focus more on achieving their clients’ objectives throughout the entire negotiation phase, enabling them to secure the most favorable terms for their agreements.

How to complete Submitting A Lot Of Record Verification Multnomah County with airSlate SignNow:

- Go to the Submitting A Lot Of Record Verification Multnomah County page or utilize our library’s search options to locate the document you require.

- Select Get form—you’ll be directed immediately to the editor.

- Begin filling out the document by selecting fillable fields and inputting your information.

- Add additional text and modify its settings if necessary.

- Select the Sign option in the top toolbar to create your electronic signature.

- Explore other tools available for annotating and improving your document, such as drawing, highlighting, and adding shapes.

- Access the notes tab and add comments regarding your document.

- Conclude the process by downloading, sharing, or emailing your document to the relevant parties or entities.

Eliminate paper for good and simplify the home buying process with our user-friendly and powerful platform. Experience enhanced convenience when completing Submitting A Lot Of Record Verification Multnomah County and other real estate documents online. Try our tool today!

Create this form in 5 minutes or less

FAQs

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the lot of record verification application deschutes county oregon

How to create an electronic signature for the Lot Of Record Verification Application Deschutes County Oregon online

How to make an electronic signature for your Lot Of Record Verification Application Deschutes County Oregon in Google Chrome

How to create an eSignature for signing the Lot Of Record Verification Application Deschutes County Oregon in Gmail

How to generate an eSignature for the Lot Of Record Verification Application Deschutes County Oregon right from your mobile device

How to make an eSignature for the Lot Of Record Verification Application Deschutes County Oregon on iOS devices

How to generate an eSignature for the Lot Of Record Verification Application Deschutes County Oregon on Android devices

People also ask

-

What are record keeping forms in Multnomah County?

Record keeping forms in Multnomah County are official documents used to maintain accurate records for various purposes, such as legal, financial, and operational activities. Using airSlate SignNow, you can easily manage these forms electronically, enhancing efficiency in your record-keeping processes.

-

How can airSlate SignNow help with record keeping forms in Multnomah County?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign record keeping forms for Multnomah County quickly. By leveraging our digital solution, you can streamline your documentation process, ensuring compliance and ease of access.

-

Is there a cost for using airSlate SignNow for Multnomah County record keeping forms?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Each plan provides access to essential features for managing record keeping forms in Multnomah County efficiently, ensuring that you can find a solution that fits your budget.

-

Can I integrate airSlate SignNow with other software for record keeping in Multnomah County?

Absolutely! airSlate SignNow supports integrations with various business applications, allowing you to enhance your workflow when managing record keeping forms in Multnomah County. Seamlessly connect with tools like Google Drive, Salesforce, and more for a complete solution.

-

What features does airSlate SignNow offer for managing record keeping forms in Multnomah County?

airSlate SignNow provides various features such as document templates, cloud storage, secure eSigning, and tracking for your record keeping forms in Multnomah County. These powerful tools enhance the effectiveness and reliability of your document management process.

-

How does using airSlate SignNow benefit my business for record keeping forms in Multnomah County?

Using airSlate SignNow for your record keeping forms in Multnomah County can signNowly improve your operational efficiency. It reduces paperwork, enhances security with encrypted eSignatures, and allows for quick access to your documents, saving you both time and resources.

-

Are record keeping forms in Multnomah County compliant with airSlate SignNow?

Yes, all record keeping forms in Multnomah County can be made compliant when using airSlate SignNow. The platform adheres to legal standards for electronic documents, ensuring that your records meet necessary regulations for validity and security.

Get more for Submitting A Lot Of Record Verification Multnomah County

Find out other Submitting A Lot Of Record Verification Multnomah County

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document