Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Form

What is the Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan

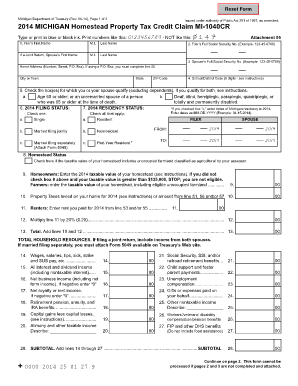

The Michigan Homestead Property Tax Credit Claim MI 1040CR is a tax form designed to provide financial relief to eligible homeowners in Michigan. This credit helps reduce property taxes based on income and the amount of property taxes paid. The form is specifically for individuals who own or rent their homes and meet certain income criteria. By filing this claim, taxpayers can receive a credit that lowers their overall tax burden, making homeownership more affordable.

Eligibility Criteria

To qualify for the Michigan Homestead Property Tax Credit, individuals must meet specific income and residency requirements. Generally, applicants must be homeowners or renters occupying their principal residence. The total household income must fall below a certain threshold, which is adjusted annually. Additionally, the property must be used as the primary residence, and applicants must provide proof of property tax payments or rental payments to support their claims.

Steps to Complete the Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan

Completing the Michigan Homestead Property Tax Credit Claim MI 1040CR involves several key steps:

- Gather necessary documentation, including proof of income, property tax statements, and any rental agreements.

- Obtain the MI 1040CR form from the Michigan Department of Treasury website or local tax office.

- Fill out the form accurately, ensuring all personal and financial information is complete.

- Calculate the credit amount based on the provided guidelines and your financial situation.

- Submit the completed form by the designated deadline, either online, by mail, or in person.

Required Documents

When filing the Michigan Homestead Property Tax Credit Claim MI 1040CR, certain documents are essential to support your application. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Property tax statements or rental agreements that demonstrate payments made.

- Identification documents to verify residency and ownership.

Form Submission Methods

Taxpayers have various options for submitting the Michigan Homestead Property Tax Credit Claim MI 1040CR. The form can be submitted:

- Online through the Michigan Department of Treasury's e-filing system.

- By mail, using the address specified on the form.

- In person at local tax offices or designated government buildings.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Michigan Homestead Property Tax Credit Claim MI 1040CR. Typically, the deadline aligns with the state income tax filing deadline, which is usually April 15. However, it is advisable to check for any changes or extensions that may apply for the current tax year. Timely submission ensures eligibility for the credit and avoids potential penalties.

Quick guide on how to complete 2014 michigan homestead property tax credit claim mi 1040cr michigan

Prepare Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan effortlessly

- Locate Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2014 michigan homestead property tax credit claim mi 1040cr michigan

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What is the Michigan homestead property tax credit for 2020?

The Michigan homestead property tax credit for 2020 is a program designed to help residents offset property taxes based on their household income and property taxes paid. It aims to provide financial relief for eligible homeowners, ensuring they can maintain their property without excessive taxation.

-

How do I apply for the Michigan homestead property tax credit 2020?

To apply for the Michigan homestead property tax credit 2020, you need to complete the appropriate application form, typically MI-1040CR. You can submit your application through the state’s online portal or by mailing it to your local tax assessor’s office before the deadline to ensure you receive the credit.

-

What are the eligibility requirements for the Michigan homestead property tax credit 2020?

Eligibility for the Michigan homestead property tax credit 2020 generally requires that you own or rent your primary residence, meet specific income limits, and have paid property taxes during the year. It's important to review the details carefully to ensure you meet all requirements for the credit.

-

What benefits does the Michigan homestead property tax credit 2020 provide?

The Michigan homestead property tax credit 2020 provides financial relief by reducing the amount of property taxes that eligible homeowners need to pay. This can lead to signNow savings, allowing you to allocate funds towards other essential expenses or savings.

-

Are there any changes to the Michigan homestead property tax credit for 2020 compared to previous years?

Yes, there can be changes to the Michigan homestead property tax credit for 2020 compared to previous years, including adjustments in income thresholds and the percentage of property taxes that can be claimed. It’s crucial to stay informed about updates from the Michigan Department of Treasury for any new regulations.

-

How does the Michigan homestead property tax credit 2020 impact my overall taxes?

The Michigan homestead property tax credit 2020 can directly reduce your taxable income by lowering the amount of property tax paid, which might save you money on state taxes as well. This credit can enhance your overall tax situation by providing much-needed relief for homeowners.

-

Can I use airSlate SignNow to submit my Michigan homestead property tax credit application?

Yes, you can use airSlate SignNow to electronically sign and send your Michigan homestead property tax credit application. This easy-to-use tool not only streamlines the process but also ensures that your documents are securely submitted to the relevant authorities.

Get more for Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan

- Wedding planning or consultant package north dakota form

- Hunting forms package north dakota

- Identity theft recovery package north dakota form

- North dakota statutory form

- Revocation of statutory durable power of attorney for health care north dakota form

- Aging parent package north dakota form

- Sale of a business package north dakota form

- Legal documents for the guardian of a minor package north dakota form

Find out other Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free