Form M1x 2011

What is the Form M1x

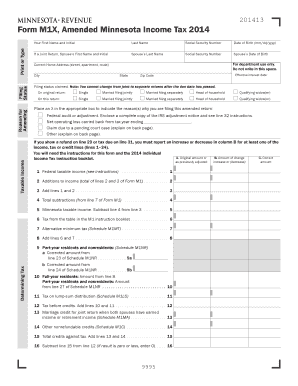

The Form M1x is a specific tax form used for amending an individual income tax return in the United States. This form allows taxpayers to correct errors or make changes to their previously filed M1 form, ensuring that their tax records are accurate and up-to-date. The M1x form is essential for individuals who need to report additional income, claim missed deductions, or adjust their tax liability. By filing this form, taxpayers can rectify any discrepancies that may affect their overall tax situation.

How to use the Form M1x

Using the Form M1x involves several steps to ensure proper completion and submission. First, gather all necessary documentation related to your original M1 form, including any new information that needs to be reported. Next, carefully fill out the M1x form, providing accurate details about the changes you are making. It is crucial to clearly indicate the specific lines on the original M1 form that are being amended. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Form M1x

Completing the Form M1x requires attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the M1x form from the official tax authority website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and reference the original M1 form.

- List the changes you are making, specifying the line numbers from the original form.

- Provide any additional documentation that supports your amendments.

- Sign and date the form before submission.

Legal use of the Form M1x

The legal use of the Form M1x is governed by IRS regulations, which stipulate that taxpayers must file this form to correct any inaccuracies in their tax filings. The form must be submitted within a specific timeframe, typically within three years from the original filing date. Ensuring compliance with these regulations is vital to avoid penalties or legal issues. When properly executed, the M1x form serves as a legally binding document that reflects the taxpayer's accurate financial situation.

Filing Deadlines / Important Dates

Filing deadlines for the Form M1x are crucial for compliance. Generally, taxpayers have three years from the original due date of their M1 form to submit an M1x for amendments. Additionally, if you are claiming a refund, the deadline is typically within three years from the date you filed your original return. It is essential to keep track of these dates to ensure that your amendments are accepted and processed in a timely manner.

Required Documents

When preparing to file the Form M1x, certain documents are necessary to support your amendments. These may include:

- A copy of the original M1 form that you are amending.

- Any relevant tax documents that provide evidence for the changes you are making, such as W-2s or 1099s.

- Documentation for any deductions or credits you are claiming for the first time.

Having these documents ready will facilitate a smoother filing process and help ensure that your amendments are accurately processed.

Quick guide on how to complete form m1x

Complete Form M1x seamlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form M1x on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Form M1x effortlessly

- Locate Form M1x and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal weight as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form M1x to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form m1x

Create this form in 5 minutes!

How to create an eSignature for the form m1x

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the form m1x and how does it work?

The form m1x is a customizable document solution offered by airSlate SignNow that allows businesses to create, send, and eSign forms easily. It streamlines the signing process and helps users manage their documents more efficiently, ensuring that all signatures are captured securely and in real-time.

-

How much does the form m1x cost?

The cost of the form m1x depends on the chosen subscription plan, which accommodates businesses of various sizes. airSlate SignNow provides competitive pricing options that are designed to fit your budget while maximizing value with features tailored to meet your eSigning needs.

-

What features does the form m1x include?

The form m1x includes several powerful features such as customizable templates, secure storage, real-time notifications, and automated workflows. These features enhance productivity and reliability, making it easier for businesses to manage their eSigning processes seamlessly.

-

What are the benefits of using the form m1x?

Using the form m1x elevates the efficiency of document management by reducing paperwork and increasing turnaround times for agreements. Additionally, it provides a user-friendly interface that ensures a positive experience for both senders and signers.

-

Can the form m1x integrate with other software?

Yes, the form m1x seamlessly integrates with various business applications, enhancing its functionality. Whether it's CRM systems, project management tools, or cloud storage solutions, airSlate SignNow ensures that you can connect with your existing workflows effortlessly.

-

Is the form m1x secure for sensitive information?

Absolutely! The form m1x prioritizes security by using advanced encryption methods to protect sensitive information during the signing process. airSlate SignNow complies with industry standards to ensure that your documents are safe and secure.

-

How can I create a form m1x for my business?

Creating a form m1x for your business is straightforward with airSlate SignNow’s intuitive interface. You can simply select a template, modify the content to fit your needs, and begin sending it out for eSigning, all in just a few clicks.

Get more for Form M1x

Find out other Form M1x

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will