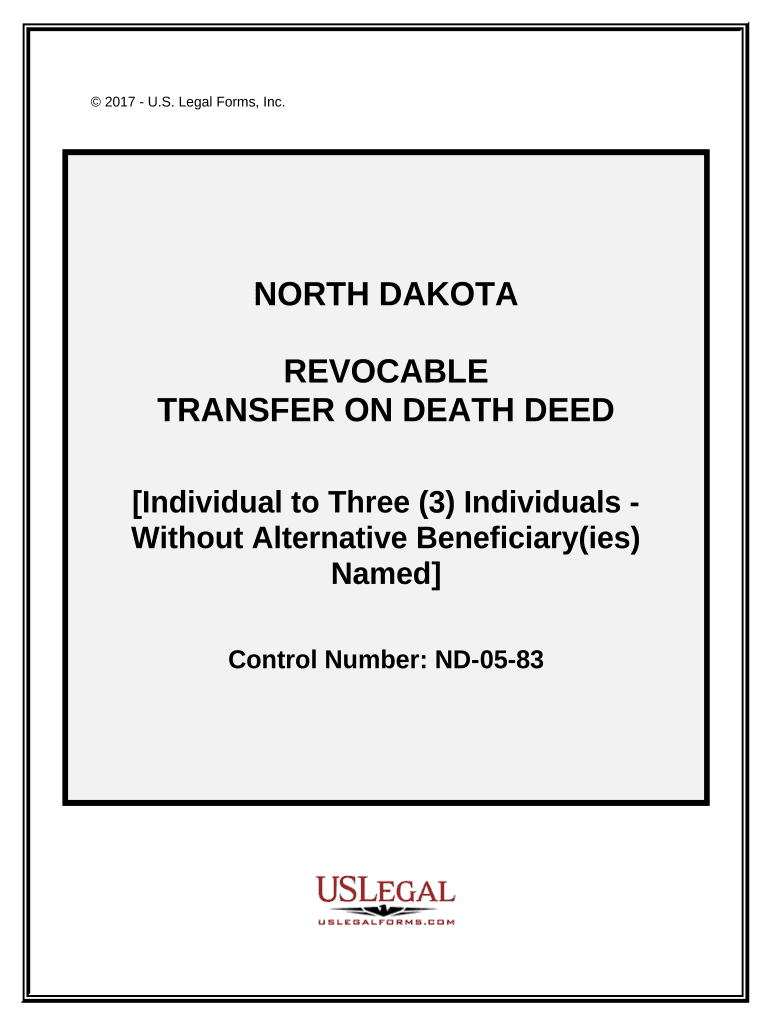

Nd Tod Form

What is the Nd Tod

The Nd Tod form is a legal document used primarily in the context of transferring ownership of real property. This form is essential for individuals or entities looking to formalize the transfer of property rights. It serves as a declaration of intent, ensuring that the transaction is documented and recognized under U.S. law. Understanding the specifics of this form is crucial for anyone involved in real estate transactions.

How to use the Nd Tod

Using the Nd Tod form involves several key steps to ensure proper execution. First, gather all necessary information regarding the property and the parties involved in the transfer. This includes legal descriptions of the property, names, and addresses of the grantor and grantee. Next, accurately fill out the form, ensuring that all details are correct to avoid future disputes. Finally, the form must be signed and notarized to validate the transfer legally.

Steps to complete the Nd Tod

Completing the Nd Tod form requires a systematic approach. Follow these steps:

- Obtain the Nd Tod form from a reliable source.

- Fill in the property details, including the legal description.

- Provide the names and addresses of both the grantor and grantee.

- Sign the form in the presence of a notary public.

- Submit the completed form to the appropriate local authority for recording.

Legal use of the Nd Tod

The Nd Tod form holds significant legal weight when executed correctly. It must adhere to state-specific regulations to be considered valid. The form is recognized under various legal frameworks that govern property transactions, ensuring that the transfer of ownership is enforceable in a court of law. Understanding these legal requirements is essential for both parties involved in the transaction.

Key elements of the Nd Tod

Several key elements must be included in the Nd Tod form to ensure its validity:

- The full legal description of the property.

- Names and contact information of the grantor and grantee.

- Signatures of both parties, along with a notary seal.

- Date of execution.

State-specific rules for the Nd Tod

Each state in the U.S. may have unique requirements regarding the Nd Tod form. These can include specific language that must be included, additional documentation that may be required, or particular filing procedures. It is important to consult state regulations or seek legal advice to ensure compliance with local laws when using the Nd Tod form.

Quick guide on how to complete nd tod

Complete Nd Tod with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Nd Tod across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Nd Tod effortlessly

- Locate Nd Tod and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to finalize your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Nd Tod and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to nd tod?

airSlate SignNow is a reliable e-signature solution that empowers businesses to send and eSign documents efficiently. By incorporating nd tod functionalities, users can simplify their document workflows and enhance collaboration across teams. This platform is designed for accuracy and speed, ensuring that your documents signNow the right people at the right time.

-

How much does airSlate SignNow cost?

airSlate SignNow offers a range of pricing plans to suit different business needs, including options for small businesses and enterprise solutions. The pricing is competitive, making it an affordable choice for those looking to implement nd tod solutions. Users can choose a plan that best aligns with their usage patterns and budget specifics.

-

What features does airSlate SignNow offer related to nd tod?

airSlate SignNow provides features such as document templates, team collaboration tools, and real-time tracking. These capabilities support nd tod by ensuring that users can easily manage their document workflows, set reminders, and streamline approvals. This results in a more efficient signing experience and enhanced productivity.

-

Can airSlate SignNow integrate with other tools I already use?

Yes, airSlate SignNow integrates seamlessly with a variety of popular applications, allowing users to connect their existing workflows. The nd tod integration capabilities enhance usability, making it easier to synchronize documents across platforms your team already employs. This can help to create a unified solution for your documentation needs.

-

What are the benefits of using airSlate SignNow for e-signatures?

Using airSlate SignNow for e-signatures offers numerous benefits, including time savings, increased efficiency, and reduced errors in document management. With its focus on nd tod, airSlate SignNow ensures that your signing processes remain secure and legally binding, providing peace of mind for all users. This also enhances customer satisfaction by delivering quick turnaround times.

-

Is airSlate SignNow compliant with industry standards and regulations?

Absolutely! airSlate SignNow is compliant with major industry standards and regulations, ensuring that your documents are handled securely. By implementing nd tod best practices, it adheres to legal requirements for e-signatures, giving you confidence in the compliance of your document processes. Users can rest assured that their data is safe and legally recognized.

-

How long does it take to set up airSlate SignNow?

The setup process for airSlate SignNow is quick and user-friendly, allowing you to start sending documents for e-signature in no time. With support for nd tod, you can quickly configure your account and integrate necessary tools. Most users report being able to get started within minutes, making it an excellent solution for businesses in need of immediate functionality.

Get more for Nd Tod

- Mistletoe therapy for form

- Bmo pad agreement form

- California boe 468 request for extension of time to file rev 12 form

- Abs record of approved gmdss radio installation form

- Dphhs montana form

- Remind workers to use hand tools properly to avoid injury form

- Phc authorization for release of personal health form

- Consent for blood and blood product transfusion sign this form to consent to acknowledge the treatment suggested by your doctor

Find out other Nd Tod

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word