KF, Beneficiary's Share of Minnesota Taxable Income Beneficiary's Share of Minnesota Taxable Income Form

What is the KF, Beneficiary's Share Of Minnesota Taxable Income

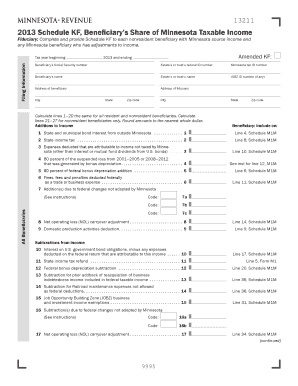

The KF, Beneficiary's Share Of Minnesota Taxable Income is a tax form used to report the income that beneficiaries receive from a trust or estate in Minnesota. This form is essential for individuals who are beneficiaries of a trust or estate, as it details their share of the taxable income generated by the trust or estate. Understanding this form is crucial for accurate tax reporting and compliance with state tax laws.

How to use the KF, Beneficiary's Share Of Minnesota Taxable Income

Using the KF, Beneficiary's Share Of Minnesota Taxable Income involves several steps. Beneficiaries must first receive a copy of the form from the trustee or executor of the estate. Once received, beneficiaries should review the form for accuracy, ensuring that their share of the taxable income is correctly reported. This form must then be included with the beneficiary’s personal tax return when filing with the state of Minnesota.

Steps to complete the KF, Beneficiary's Share Of Minnesota Taxable Income

Completing the KF, Beneficiary's Share Of Minnesota Taxable Income requires attention to detail. Here are the steps to follow:

- Obtain the form from the trustee or executor.

- Review the income reported to ensure it matches your records.

- Fill in your personal information, including your name and Social Security number.

- Report your share of the taxable income as indicated on the form.

- Sign and date the form to certify its accuracy.

Legal use of the KF, Beneficiary's Share Of Minnesota Taxable Income

The KF, Beneficiary's Share Of Minnesota Taxable Income is legally binding when completed correctly. It serves as an official record of the income beneficiaries receive from trusts or estates, which is necessary for tax purposes. Compliance with Minnesota tax laws requires beneficiaries to accurately report this income on their state tax returns, making the proper use of this form essential to avoid penalties.

Key elements of the KF, Beneficiary's Share Of Minnesota Taxable Income

Several key elements are included in the KF, Beneficiary's Share Of Minnesota Taxable Income. These elements typically include:

- Beneficiary’s name and Social Security number.

- Trust or estate name and identification number.

- Total taxable income allocated to the beneficiary.

- Signature of the trustee or executor certifying the information.

State-specific rules for the KF, Beneficiary's Share Of Minnesota Taxable Income

Minnesota has specific rules governing the use of the KF, Beneficiary's Share Of Minnesota Taxable Income. Beneficiaries must be aware of the state's tax regulations, including deadlines for filing and any additional documentation that may be required. It is important to stay informed about changes in tax laws that may affect the reporting process for beneficiaries in Minnesota.

Quick guide on how to complete 2008 kf beneficiarys share of minnesota taxable income 2013 beneficiarys share of minnesota taxable income

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the suitable form and securely store it online. airSlate SignNow supplies you with all the resources necessary to create, edit, and eSign your documents quickly without any holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Leave behind the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to KF, Beneficiary's Share Of Minnesota Taxable Income Beneficiary's Share Of Minnesota Taxable Income

Create this form in 5 minutes!

People also ask

-

What is KF, Beneficiary's Share Of Minnesota Taxable Income?

KF, Beneficiary's Share Of Minnesota Taxable Income refers to the portion of income that a beneficiary receives and is subject to Minnesota state taxes. Understanding this can help beneficiaries accurately report their income on tax returns and ensure compliance with state laws.

-

How can airSlate SignNow assist with managing KF, Beneficiary's Share Of Minnesota Taxable Income?

airSlate SignNow offers a seamless digital documentation process that helps in efficiently managing KF, Beneficiary's Share Of Minnesota Taxable Income. By streamlining eSigning and document management, businesses can ensure that all necessary tax-related documents are prepared and signed accurately and efficiently.

-

What features does airSlate SignNow offer that are relevant to KF, Beneficiary's Share Of Minnesota Taxable Income?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking, which are essential for managing KF, Beneficiary's Share Of Minnesota Taxable Income. These features help ensure compliance and provide a user-friendly experience for both senders and recipients.

-

Is airSlate SignNow cost-effective for handling KF, Beneficiary's Share Of Minnesota Taxable Income?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing KF, Beneficiary's Share Of Minnesota Taxable Income. With various pricing plans, users can choose the option that best fits their budget while benefiting from advanced eSigning capabilities.

-

How does airSlate SignNow ensure the security of documents related to KF, Beneficiary's Share Of Minnesota Taxable Income?

airSlate SignNow employs robust security measures including encryption and secure cloud storage to protect documents related to KF, Beneficiary's Share Of Minnesota Taxable Income. This ensures that sensitive information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow integrate with other tools to manage KF, Beneficiary's Share Of Minnesota Taxable Income?

Absolutely! airSlate SignNow offers integrations with various third-party applications that can help manage KF, Beneficiary's Share Of Minnesota Taxable Income efficiently. This allows users to seamlessly incorporate eSigning into their existing workflow and ensure all documentation is in order.

-

What are the benefits of using airSlate SignNow for KF, Beneficiary's Share Of Minnesota Taxable Income?

Using airSlate SignNow for KF, Beneficiary's Share Of Minnesota Taxable Income provides benefits like rapid document turnaround, reduced errors, and enhanced organization. These advantages help users maintain compliance and streamline their documentation processes for hassle-free tax reporting.

Get more for KF, Beneficiary's Share Of Minnesota Taxable Income Beneficiary's Share Of Minnesota Taxable Income

- Medex academy undergraduate application greenville hospital ghs form

- Clinical history form

- Bon secours financial aid care card form

- Standard uk dental registration form

- Jps connection form

- Jps apply form

- How to fill out the vertifcation of assistance and residency for jps form

- Shack restaurants employment application revised 02 form

Find out other KF, Beneficiary's Share Of Minnesota Taxable Income Beneficiary's Share Of Minnesota Taxable Income

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast