M1cr Form

What is the M1cr

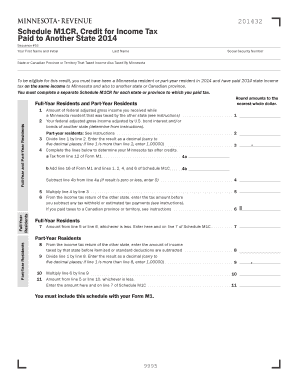

The M1cr form is a specific tax document used primarily in the United States for reporting certain income and deductions. It is part of the broader tax filing process and is essential for individuals and businesses to ensure compliance with IRS regulations. The form helps taxpayers accurately report their financial activities, making it easier to calculate their tax obligations or refunds.

How to use the M1cr

Using the M1cr form involves several steps to ensure that all necessary information is accurately reported. Taxpayers must first gather relevant financial documents, including income statements and records of deductions. Once the information is compiled, the M1cr form can be filled out, either electronically or on paper. It is crucial to review the completed form for accuracy before submission to avoid potential penalties or delays.

Steps to complete the M1cr

Completing the M1cr form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions.

- Access the M1cr form through the IRS website or a trusted tax software.

- Fill in personal information, including name, address, and Social Security number.

- Report income and deductions accurately in the designated sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the M1cr

The M1cr form is legally binding when completed and submitted according to IRS guidelines. It is essential for taxpayers to understand that providing false information can lead to severe penalties, including fines and legal action. To ensure legal compliance, taxpayers should keep copies of submitted forms and any supporting documentation for their records.

Filing Deadlines / Important Dates

Filing deadlines for the M1cr form are crucial for taxpayers to observe to avoid penalties. Typically, the deadline for submitting the M1cr form aligns with the standard tax filing deadline, which is usually April 15. However, it is advisable to check for any updates or changes in deadlines, especially for extensions or specific circumstances that may apply to individual taxpayers.

Required Documents

To successfully complete the M1cr form, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or charitable contributions.

- Any other relevant financial statements that support reported income and deductions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the M1cr form. Taxpayers should familiarize themselves with these guidelines to ensure compliance. This includes understanding the types of income that must be reported, allowable deductions, and the importance of accurate record-keeping. Adhering to these guidelines helps prevent errors and potential audits.

Quick guide on how to complete m1cr

Effortlessly prepare m1cr on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage m1cr on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign schedule m1cr with ease

- Locate m1cr and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to secure your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign schedule m1cr to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to m1cr

Create this form in 5 minutes!

People also ask schedule m1cr

-

What is m1cr, and how does it relate to airSlate SignNow?

m1cr refers to a powerful feature within airSlate SignNow that enables businesses to streamline their document signing processes. By leveraging m1cr, users can efficiently send and eSign documents, reducing turnaround time and enhancing overall productivity.

-

What are the pricing plans for using airSlate SignNow with m1cr?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Utilizing m1cr, companies can choose a plan that suits their document management needs without breaking the bank, ensuring a cost-effective solution for eSigning.

-

What features does m1cr provide in the airSlate SignNow platform?

m1cr enhances the airSlate SignNow platform with features such as customizable templates, real-time tracking, and automated reminders. These features help businesses manage their documents more effectively while providing a user-friendly eSigning experience.

-

How does using m1cr benefit businesses?

Utilizing m1cr within airSlate SignNow allows businesses to save time and increase efficiency by automating document workflows. This results in faster turnaround times for contracts and agreements, ultimately leading to improved customer satisfaction and reduced operational costs.

-

Can airSlate SignNow with m1cr integrate with other software tools?

Yes, airSlate SignNow with m1cr seamlessly integrates with various tools and platforms, including CRM and project management systems. This integration enables users to effortlessly manage their documents in conjunction with their existing workflows.

-

Is it easy to set up airSlate SignNow with m1cr?

Absolutely! Setting up airSlate SignNow with m1cr is straightforward, making it accessible even for those with minimal technical expertise. Users can quickly create an account and start sending documents for eSigning within minutes.

-

What types of documents can I send using m1cr?

With m1cr, you can send a wide variety of documents for eSigning, including contracts, agreements, and legal forms. airSlate SignNow ensures that your documents are secure and legally binding when signed using this feature.

Get more for m1cr

Find out other schedule m1cr

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien