Montana Individual Income Tax Return Form 2 Ohio Taxhow

What is the Montana Individual Income Tax Return Form 2 Ohio Taxhow

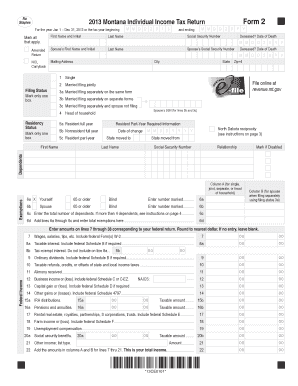

The Montana Individual Income Tax Return Form 2 is a state-specific tax document used by residents of Montana to report their income and calculate their tax liability. This form is essential for individuals who need to file their state income taxes accurately. It includes various sections that require information about the taxpayer's income, deductions, and credits. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax laws.

Steps to complete the Montana Individual Income Tax Return Form 2 Ohio Taxhow

Completing the Montana Individual Income Tax Return Form 2 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income on the form, ensuring accuracy to avoid discrepancies.

- Claim any deductions or credits for which you qualify, as these can reduce your taxable income.

- Review the completed form for errors and ensure all required signatures are included.

How to obtain the Montana Individual Income Tax Return Form 2 Ohio Taxhow

The Montana Individual Income Tax Return Form 2 can be obtained through the Montana Department of Revenue's official website. It is available for download in PDF format, allowing taxpayers to print and fill it out. Additionally, physical copies may be available at local tax offices or libraries. Ensuring you have the correct version of the form is important, as tax laws can change annually.

Legal use of the Montana Individual Income Tax Return Form 2 Ohio Taxhow

The legal use of the Montana Individual Income Tax Return Form 2 is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Electronic submissions are permitted, provided they comply with eSignature laws. Maintaining a record of the submission and any correspondence with the tax authorities is advisable for legal protection.

Filing Deadlines / Important Dates

Filing deadlines for the Montana Individual Income Tax Return Form 2 typically align with federal tax deadlines. Generally, individual income tax returns must be filed by April 15 of each year. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, as late submissions can result in penalties and interest on unpaid taxes.

Required Documents

When preparing to complete the Montana Individual Income Tax Return Form 2, several documents are necessary:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductions or credits, including receipts and statements.

- Previous year’s tax return for reference and consistency.

Quick guide on how to complete 2013 montana individual income tax return form 2 ohio taxhow

Accomplish [SKS] effortlessly on any gadget

Digital document management has gained popularity among companies and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the tools needed to create, adjust, and eSign your documents quickly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to adjust and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to commence.

- Utilize the tools we provide to complete your template.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just several clicks from any device of your choice. Adjust and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Montana Individual Income Tax Return Form 2 Ohio Taxhow

Create this form in 5 minutes!

People also ask

-

What is the Montana Individual Income Tax Return Form 2 Ohio Taxhow?

The Montana Individual Income Tax Return Form 2 Ohio Taxhow is a tax document used by residents of Ohio to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax regulations and avoiding penalties. Utilizing airSlate SignNow can simplify the submission process for this important form.

-

How can airSlate SignNow assist with the Montana Individual Income Tax Return Form 2 Ohio Taxhow?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Montana Individual Income Tax Return Form 2 Ohio Taxhow. This streamlines document management, saving you time and ensuring your forms are securely handled. Businesses can efficiently manage their tax documents with our robust features.

-

What are the pricing options for airSlate SignNow related to the Montana Individual Income Tax Return Form 2 Ohio Taxhow?

airSlate SignNow offers competitive pricing plans that cater to different business needs when handling the Montana Individual Income Tax Return Form 2 Ohio Taxhow. Plans typically include monthly and annual subscriptions, allowing businesses to choose according to their budget. You can explore various features included in each plan to find the best fit.

-

Is airSlate SignNow secure for submitting the Montana Individual Income Tax Return Form 2 Ohio Taxhow?

Absolutely! airSlate SignNow uses advanced encryption technologies to ensure that your Montana Individual Income Tax Return Form 2 Ohio Taxhow and other documents are securely transmitted and stored. We take data privacy seriously, giving you peace of mind while handling sensitive tax information.

-

Can airSlate SignNow integrate with other software for filing the Montana Individual Income Tax Return Form 2 Ohio Taxhow?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax preparation software to enhance the filing process for the Montana Individual Income Tax Return Form 2 Ohio Taxhow. This integration allows for a smoother workflow, enabling you to manage all your tax-related documents in one place efficiently.

-

What features does airSlate SignNow offer for the Montana Individual Income Tax Return Form 2 Ohio Taxhow?

AirSlate SignNow provides features like electronic signatures, document templates, and customizable workflows designed to simplify the completion of the Montana Individual Income Tax Return Form 2 Ohio Taxhow. These tools help you streamline your tax filing process while maintaining compliance with state guidelines.

-

How quickly can I complete the Montana Individual Income Tax Return Form 2 Ohio Taxhow using airSlate SignNow?

Using airSlate SignNow, you can complete and file the Montana Individual Income Tax Return Form 2 Ohio Taxhow much faster than traditional methods. The platform allows you to fill out forms electronically, and the eSignature feature eliminates delays often associated with physical signatures. This efficiency is especially beneficial during tax season.

Get more for Montana Individual Income Tax Return Form 2 Ohio Taxhow

- Db2 gp medicare form

- Plumbing certificate of compliance template south africa form

- Minor claim form

- The john franklin memoral fellowship application gold coast city goldcoast qld gov form

- Section 29a brimbank city council form

- Commercial operatoramp39s licence application form department of 22541547

- Late logement medicare form

- Mlr 100 form

Find out other Montana Individual Income Tax Return Form 2 Ohio Taxhow

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement