Nebraska Tax Calculation Schedule for Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied Form

What is the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied

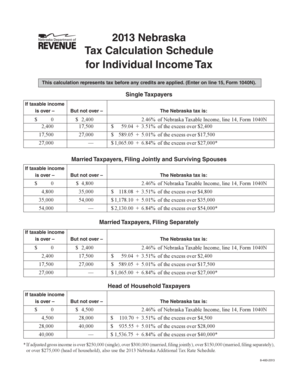

The Nebraska Tax Calculation Schedule for Individual Income Tax is a crucial document used to determine the tax liability of individuals before any credits are applied. This schedule outlines the tax rates and brackets applicable to various income levels, allowing taxpayers to calculate their owed taxes based on their reported income. Understanding this schedule is essential for accurate tax filing and compliance with state tax regulations.

How to use the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied

To utilize the Nebraska Tax Calculation Schedule effectively, taxpayers should first gather their total income from all sources. Next, they will refer to the schedule to identify their applicable tax bracket based on their income level. By applying the corresponding tax rate to their income, individuals can calculate their preliminary tax liability. This initial calculation does not include any deductions or credits that may further reduce the final tax amount.

Steps to complete the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied

Completing the Nebraska Tax Calculation Schedule involves several steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Calculate your total income by summing all sources of income.

- Consult the Nebraska Tax Calculation Schedule to determine your tax bracket.

- Apply the appropriate tax rate to your total income to find your preliminary tax amount.

- Record this amount on your tax return before considering any credits or deductions.

Key elements of the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied

Key elements of the Nebraska Tax Calculation Schedule include:

- Income brackets: These define the ranges of income that correspond to specific tax rates.

- Tax rates: The percentage of tax owed based on the income bracket.

- Filing status: Different rates may apply depending on whether the taxpayer is single, married, or head of household.

- Exemptions and deductions: While this schedule focuses on tax before credits, understanding available deductions is important for overall tax liability.

Legal use of the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied

The Nebraska Tax Calculation Schedule is legally recognized as an official document for tax purposes. Taxpayers must use this schedule to ensure compliance with Nebraska state tax laws. Accurate completion of this schedule is essential, as it forms the basis for calculating tax obligations and can be subject to review by tax authorities. Using this schedule correctly helps avoid penalties associated with incorrect tax filings.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines related to the Nebraska Tax Calculation Schedule. Generally, individual income tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be mindful of any extensions they may file, which can provide additional time to submit their returns but do not extend the time to pay any taxes owed.

Quick guide on how to complete 2013 nebraska tax calculation schedule for individual income tax this calculation represents tax before any credits are applied

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to finalize your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Tax Calculation Schedule For Individual Income Tax?

The Nebraska Tax Calculation Schedule For Individual Income Tax is a structured outline that details how individual income tax is calculated in Nebraska before any credits are applied. Understanding this schedule helps taxpayers ensure accurate tax reporting and compliance with state regulations.

-

How can I access the Nebraska Tax Calculation Schedule For Individual Income Tax?

You can access the Nebraska Tax Calculation Schedule For Individual Income Tax through the Nebraska Department of Revenue's official website, where it is available for download. This official document provides detailed information necessary for calculating your tax obligations effectively.

-

Are there any fees associated with using the Nebraska Tax Calculation Schedule For Individual Income Tax?

There are no fees to access the Nebraska Tax Calculation Schedule For Individual Income Tax as it is provided by the state government for free. However, if you choose to utilize tax software or professional services for calculation, there may be associated costs.

-

What features does airSlate SignNow offer to help with tax document management?

airSlate SignNow provides features such as document eSigning, templates, and secure storage that simplify managing tax-related documents. These features ensure that you can easily prepare and sign documents related to the Nebraska Tax Calculation Schedule For Individual Income Tax without the hassle of physical paperwork.

-

How does airSlate SignNow enhance compliance with the Nebraska Tax Calculation Schedule?

By using airSlate SignNow, you can ensure that your documents related to the Nebraska Tax Calculation Schedule For Individual Income Tax are securely signed and time-stamped, enhancing compliance. Our platform also allows for easy tracking of signatures and document versions for future reference.

-

Can I integrate airSlate SignNow with other tax software?

Yes, airSlate SignNow offers integrations with various tax software tools, making it easier to import data related to the Nebraska Tax Calculation Schedule For Individual Income Tax. This seamless integration streamlines your workflow and reduces the potential for errors during document handling.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides numerous benefits including improved efficiency, enhanced security, and ease of use. You can quickly prepare and sign documents related to the Nebraska Tax Calculation Schedule For Individual Income Tax, saving time and ensuring accuracy.

Get more for Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied

- Complaint form city of blue island blueisland

- City of calumet city freedom of information act request form calumetcity

- City of chicago general contractor license renewal notice cityofchicago form

- Form lr quarterly lead emission reporting city of chicago cityofchicago

- Compliance form chicago

- Stationary license form

- Chicago crane renewal form

- Lca local contact person affidavit city of chicago cityofchicago form

Find out other Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Tax Before Any Credits Are Applied

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement