Nebraska Tax Calculation Schedule for Individual Income Tax Form

What is the Nebraska Tax Calculation Schedule For Individual Income Tax

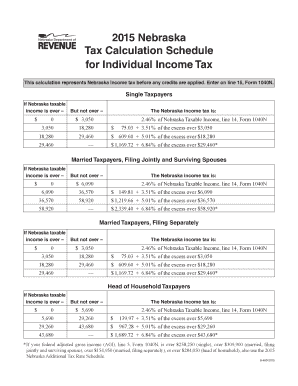

The Nebraska Tax Calculation Schedule for Individual Income Tax is a specific form used by residents of Nebraska to determine their state income tax liability. This schedule is essential for accurately calculating the amount owed based on various income sources and applicable deductions. It provides a structured approach to ensure taxpayers comply with state tax regulations while maximizing potential deductions.

How to use the Nebraska Tax Calculation Schedule For Individual Income Tax

To effectively use the Nebraska Tax Calculation Schedule for Individual Income Tax, individuals should first gather all necessary financial documents, including W-2 forms, 1099s, and any records of deductions. The schedule guides users through the process of entering income, calculating taxable income, and applying the appropriate tax rates. It is crucial to follow the instructions carefully to ensure accurate calculations and compliance with state tax laws.

Steps to complete the Nebraska Tax Calculation Schedule For Individual Income Tax

Completing the Nebraska Tax Calculation Schedule involves several key steps:

- Gather all relevant financial documents, including income statements and deduction records.

- Begin by entering total income from all sources on the schedule.

- Subtract any eligible deductions to arrive at the taxable income.

- Apply the appropriate tax rate based on the taxable income to calculate the total tax owed.

- Review the calculations for accuracy before finalizing the form.

Legal use of the Nebraska Tax Calculation Schedule For Individual Income Tax

The Nebraska Tax Calculation Schedule is legally recognized as part of the state’s tax filing process. To ensure its legal validity, taxpayers must complete the form accurately and submit it by the designated deadline. Utilizing electronic signature solutions can enhance the legal standing of the document, provided they comply with relevant eSignature laws, such as the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Taxpayers in Nebraska should be aware of important deadlines associated with the Tax Calculation Schedule. Typically, individual income tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates to avoid penalties for late filing.

Required Documents

To complete the Nebraska Tax Calculation Schedule, taxpayers must have several documents on hand, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest or medical expenses

- Previous year’s tax return for reference

Examples of using the Nebraska Tax Calculation Schedule For Individual Income Tax

Examples of using the Nebraska Tax Calculation Schedule include various taxpayer scenarios, such as:

- A salaried employee calculating their income tax based on W-2 earnings.

- A self-employed individual reporting income from multiple sources and applying relevant deductions.

- A retiree determining tax liability based on pension and Social Security income.

Quick guide on how to complete 2015 nebraska tax calculation schedule for individual income tax

Effortlessly Prepare Nebraska Tax Calculation Schedule For Individual Income Tax on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents promptly without any delays. Handle Nebraska Tax Calculation Schedule For Individual Income Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Nebraska Tax Calculation Schedule For Individual Income Tax Effortlessly

- Locate Nebraska Tax Calculation Schedule For Individual Income Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as an old-fashioned wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether it be via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Nebraska Tax Calculation Schedule For Individual Income Tax to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Tax Calculation Schedule For Individual Income Tax?

The Nebraska Tax Calculation Schedule For Individual Income Tax is a comprehensive guide that details how to calculate your individual income tax obligations in Nebraska. It provides essential information on tax rates, exemptions, and deductions that individuals can claim to minimize their tax liabilities.

-

How can airSlate SignNow assist with the Nebraska Tax Calculation Schedule For Individual Income Tax?

airSlate SignNow can streamline the process of signing and sending documents related to your Nebraska Tax Calculation Schedule For Individual Income Tax. Our platform allows for easy eSigning of tax forms, ensuring that you meet deadlines without the hassle of paper documents.

-

Are there any costs associated with using airSlate SignNow for tax document signing?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, starting from affordable rates for solo users to comprehensive packages for businesses. You can choose a plan that aligns with the document volume related to your Nebraska Tax Calculation Schedule For Individual Income Tax.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features like document templates, automated workflows, and secure cloud storage specifically beneficial for managing tax documents. These functionalities ensure that your Nebraska Tax Calculation Schedule For Individual Income Tax documents are easily accessible and organized.

-

Can I integrate airSlate SignNow with other tax software?

Yes, airSlate SignNow integrates seamlessly with various tax software, enabling you to import and export documents efficiently. This integration simplifies managing your Nebraska Tax Calculation Schedule For Individual Income Tax by allowing data transfer without duplication of efforts.

-

What security measures does airSlate SignNow have in place for tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your tax documents. This ensures that your information related to the Nebraska Tax Calculation Schedule For Individual Income Tax remains confidential and secure during the signing process.

-

Is airSlate SignNow user-friendly for individuals handling Nebraska tax calculations?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, offering a straightforward interface that makes it easy for individuals to manage their tax-related documents. Whether you’re using the Nebraska Tax Calculation Schedule For Individual Income Tax or other forms, our platform simplifies the process.

Get more for Nebraska Tax Calculation Schedule For Individual Income Tax

Find out other Nebraska Tax Calculation Schedule For Individual Income Tax

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word