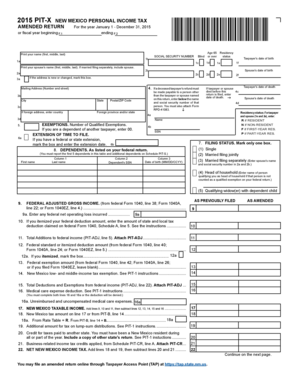

NEW MEXICO PERSONAL INCOME TAX Form

What is the New Mexico Personal Income Tax?

The New Mexico personal income tax is a state-level tax imposed on the income of residents and certain non-residents earning income within New Mexico. This tax is progressive, meaning that the rate increases as income rises. The tax applies to various income sources, including wages, salaries, and investment income. Understanding this tax is crucial for residents to ensure compliance and accurate filing.

Steps to Complete the New Mexico Personal Income Tax

Completing the New Mexico personal income tax form involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and deductions.

- Calculate your total income by adding all sources of income.

- Apply any deductions and credits that you qualify for, which can reduce your taxable income.

- Complete the New Mexico personal income tax form accurately, ensuring all information is correct.

- Review the completed form for any errors before submission.

- Submit the form either electronically or by mail, following the guidelines provided by the New Mexico Taxation and Revenue Department.

Legal Use of the New Mexico Personal Income Tax

The legal use of the New Mexico personal income tax form is essential for ensuring that your submission is recognized by the state. To be legally binding, the form must be filled out accurately and submitted by the designated deadlines. Additionally, using an electronic signature via a compliant platform can enhance the legal validity of your submission, as it meets the requirements set forth by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for avoiding penalties and interest. The typical deadline for filing the New Mexico personal income tax is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and ensure they file any necessary forms on time to maintain compliance.

Required Documents

When preparing to file the New Mexico personal income tax, certain documents are required to ensure accurate reporting. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any additional income, such as rental or investment income

- Documentation for deductions and credits, such as receipts for charitable donations or medical expenses

Having these documents organized will streamline the filing process and help ensure that all income and deductions are accurately reported.

Form Submission Methods

Taxpayers in New Mexico have several options for submitting their personal income tax forms. These methods include:

- Online submission through the New Mexico Taxation and Revenue Department's website, which offers a secure and efficient way to file.

- Mailing a paper form to the appropriate address provided by the state, ensuring that it is postmarked by the filing deadline.

- In-person submission at local tax offices, which may provide assistance with the filing process.

Choosing the right submission method can help ensure that your form is filed correctly and on time.

Quick guide on how to complete new mexico income tax

Prepare new mexico income tax effortlessly on any device

Online document handling has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed materials, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage new mexico income tax on any device using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The simplest way to edit and electronically sign signnow com fill and sign pdf form without difficulty

- Locate new mexico income tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Verify the information and then click on the Done button to confirm your modifications.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign signnow com fill and sign pdf form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to new mexico income tax

Create this form in 5 minutes!

People also ask signnow com fill and sign pdf form

-

What is new mexico income tax?

New Mexico income tax is a state tax imposed on individuals and businesses based on their earnings. It varies by income level, with different rates applied to various income brackets. Understanding new mexico income tax is crucial for anyone seeking to adhere to state regulations while optimizing their taxes.

-

How does airSlate SignNow assist with new mexico income tax documents?

airSlate SignNow provides a secure platform to send and eSign tax-related documents efficiently. By utilizing our service, businesses can manage their new mexico income tax forms seamlessly, ensuring that all signatures are collected online quickly and accurately. This not only saves time but also enhances compliance with state requirements.

-

What are the pricing options for airSlate SignNow regarding new mexico income tax services?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, making it cost-effective for managing new mexico income tax documentation. Users can select from different tiers based on the features required, ensuring that you only pay for what you need. Check our website for specific pricing details and features included in each plan.

-

Can airSlate SignNow integrate with accounting software for new mexico income tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting software to streamline new mexico income tax management. This integration allows users to consolidate their financial data, making it easier to prepare and file tax documents. Leveraging these integrations ensures a more efficient workflow and minimizes errors in your tax filings.

-

What features does airSlate SignNow offer to simplify new mexico income tax processes?

airSlate SignNow offers a range of features designed to simplify the new mexico income tax process, including easy document editing, templates for tax forms, and automated reminders for deadlines. These tools enable businesses to manage their documentation more effectively and ensure compliance with state tax laws. Users can also track the signing process in real-time, enhancing visibility and efficiency.

-

How can airSlate SignNow benefit businesses dealing with new mexico income tax?

By using airSlate SignNow, businesses can signNowly reduce the time and resources spent on managing new mexico income tax paperwork. Our platform allows for quick eSigning, document sharing, and storage, making tax season less stressful. Furthermore, an organized approach to document management helps in maintaining clear records for audits and compliance.

-

What security measures does airSlate SignNow have for new mexico income tax documents?

airSlate SignNow implements robust security protocols to protect new mexico income tax documents. These include encryption of data in transit and at rest, secure access controls, and certified compliance with industry standards. This level of security ensures that sensitive financial information is safeguarded throughout the eSigning process.

Get more for new mexico income tax

- Liability claim form city of yucaipa yucaipa

- Return form city of delta

- Manufactured home transfer form

- Blank marriage application 2013 form

- Personal trainer health screen form ci westminster co

- Quadrennial exempt status form m 3 city of bridgeport ct bridgeportct

- Application for admission to practice as an attorney nycourts form

- Student certificate enrolment form institute of health sciences

Find out other signnow com fill and sign pdf form

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF