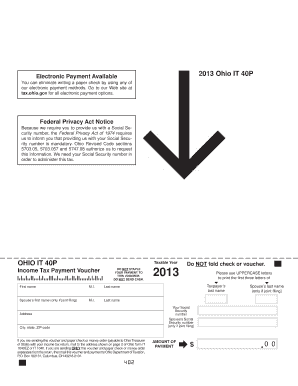

Ohio it 40P Form

What is the Ohio IT 40P

The Ohio IT 40P form is a state tax document specifically designed for individuals who are required to report their income tax liability to the state of Ohio. This form is primarily used by part-year residents and non-residents who earn income in Ohio. The IT 40P allows these taxpayers to calculate their tax obligations accurately based on the income earned while residing or working in the state.

How to use the Ohio IT 40P

Using the Ohio IT 40P involves several steps to ensure accurate reporting of income and tax liability. First, gather all relevant income documents, such as W-2s and 1099s, that reflect earnings during the period you were a resident or earned income in Ohio. Next, complete the form by entering your personal information, including your name, address, and Social Security number. Then, report your income and any deductions or credits you may qualify for. Finally, calculate your total tax due and ensure that all information is accurate before submission.

Steps to complete the Ohio IT 40P

Completing the Ohio IT 40P requires careful attention to detail. Follow these steps:

- Gather all necessary income documentation, including W-2s and 1099 forms.

- Fill in your personal information at the top of the form.

- Report your total income from all sources during the tax year.

- Apply any applicable deductions or credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the Ohio IT 40P

The Ohio IT 40P form is legally binding when completed and submitted in accordance with Ohio tax laws. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. The form must be filed by the appropriate deadline to avoid late fees and interest charges on any owed taxes. Compliance with state regulations regarding income reporting is crucial for maintaining good standing with the Ohio Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio IT 40P are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by April 15 of the year following the tax year in question. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to the filing schedule annually, as these can affect your tax obligations.

Required Documents

To complete the Ohio IT 40P, certain documents are required to substantiate your income and tax claims. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for any deductions or credits claimed, such as receipts for charitable contributions.

Form Submission Methods

The Ohio IT 40P can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission through the Ohio Department of Taxation website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if available.

Quick guide on how to complete 2013 ohio it 40p

Ease of Preparation for [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

How to Modify and eSign [SKS] Effortlessly

- Locate [SKS] and then click Get Form to initiate.

- Utilize our tools to fill in your form.

- Emphasize important sections of your documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, a process that takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from your chosen device. Modify and eSign [SKS] while ensuring smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ohio IT 40P

Create this form in 5 minutes!

People also ask

-

What is Ohio IT 40P and how does it work?

Ohio IT 40P is a powerful electronic signature platform that streamlines the document signing process. It allows businesses to send, sign, and manage documents electronically, ensuring compatibility and compliance with Ohio state regulations. With Ohio IT 40P, you can easily track document statuses, making your workflows more efficient.

-

What are the pricing options available for Ohio IT 40P?

Ohio IT 40P offers a range of pricing plans that cater to different business sizes and needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget. Check the airSlate SignNow website for detailed pricing tiers and any ongoing promotions for Ohio IT 40P.

-

What features does Ohio IT 40P offer?

Ohio IT 40P provides a slew of features such as customizable templates, document tracking, and secure cloud storage. Additionally, it supports various file formats, allowing for versatile document handling. These features collectively enhance productivity and simplify the signing process for users.

-

How can Ohio IT 40P benefit my business?

Implementing Ohio IT 40P can signNowly improve your business's efficiency by reducing paperwork and speeding up the signature process. It helps in cutting operational costs and minimizing delays in document handling. By using Ohio IT 40P, businesses can focus on growth instead of administrative tasks.

-

Is Ohio IT 40P secure for sensitive documents?

Yes, Ohio IT 40P prioritizes security with industry-standard encryption and compliance with relevant legal regulations. This ensures that all documents are protected during transmission and storage. Businesses can confidently use Ohio IT 40P for sensitive information without risking data bsignNowes.

-

Can I integrate Ohio IT 40P with other software?

Ohio IT 40P offers various integration options to enhance your existing software ecosystem. It seamlessly connects with CRM systems, cloud storage solutions, and productivity tools, allowing for a smoother workflow. Check airSlate SignNow's integration details to see how Ohio IT 40P can fit into your tech stack.

-

What types of documents can I sign using Ohio IT 40P?

With Ohio IT 40P, you can sign a wide array of documents, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring you can handle virtually any document type. This versatility makes Ohio IT 40P an invaluable tool for various industries.

Get more for Ohio IT 40P

- Gettysburg street vendor form

- Penndot sales store 2008 form

- Philadelphia school guard applicationpdffillercom form

- Khubakiqbrtwebeo 2014 form

- New business registration city of pittsburgh form

- Job application form webpages charter

- Northampton st patrick association form

- Patient care report template form

Find out other Ohio IT 40P

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe