PIT IT1040 Final 02 121613 STANY Stany Form

What is the PIT IT1040 Final 02 121613 STANY Stany

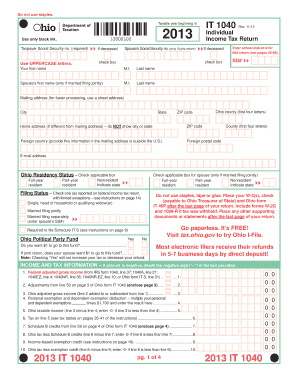

The PIT IT1040 Final 02 121613 STANY Stany form is a specific tax document used for reporting income and calculating tax obligations for individuals in the United States. It is part of the broader category of tax forms required by the Internal Revenue Service (IRS) and state tax authorities. This form is essential for taxpayers to accurately declare their earnings, claim deductions, and ensure compliance with tax regulations. Understanding the purpose and requirements of this form is crucial for effective tax management.

Steps to complete the PIT IT1040 Final 02 121613 STANY Stany

Completing the PIT IT1040 Final 02 121613 STANY Stany form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your total income from all sources on the appropriate lines of the form.

- Claim applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the PIT IT1040 Final 02 121613 STANY Stany

The legal use of the PIT IT1040 Final 02 121613 STANY Stany form is governed by federal and state tax laws. It must be filled out accurately to reflect your financial situation. Misrepresentation or errors can lead to penalties, including fines or audits by the IRS. To ensure the form is legally valid, it is essential to adhere to all guidelines provided by the IRS and to maintain supporting documentation for any claims made on the form.

Filing Deadlines / Important Dates

Filing deadlines for the PIT IT1040 Final 02 121613 STANY Stany form are crucial for compliance. Typically, individual taxpayers must submit their forms by April fifteenth of the following tax year. However, extensions may be available, allowing additional time to file, though any taxes owed must still be paid by the original deadline to avoid penalties. It is important to stay informed about any changes to these dates each tax year.

Form Submission Methods (Online / Mail / In-Person)

The PIT IT1040 Final 02 121613 STANY Stany form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers choose to file electronically using tax software or through a tax professional, which can expedite the process and reduce errors.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-Person: Some individuals may opt to deliver their forms directly to local IRS offices or authorized tax preparation services.

Key elements of the PIT IT1040 Final 02 121613 STANY Stany

Key elements of the PIT IT1040 Final 02 121613 STANY Stany form include:

- Personal Information: This section requires basic details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income, including wages, dividends, and other earnings.

- Deductions and Credits: This part allows taxpayers to claim various deductions and credits that can lower their tax liability.

- Signature: A valid signature is required to authenticate the form, confirming that the information provided is accurate.

Quick guide on how to complete pit it1040 final 02 2013 121613 stany stany

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, modify, and electronically sign your documents swiftly and without issues. Handle [SKS] on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of the document or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is PIT IT1040 Final 02 121613 STANY Stany?

PIT IT1040 Final 02 121613 STANY Stany is a specific tax form used for filing individual income taxes in the United States. It is crucial for taxpayers to accurately complete this form to ensure compliance with IRS regulations and benefit from potential deductions.

-

How can airSlate SignNow help with PIT IT1040 Final 02 121613 STANY Stany?

airSlate SignNow provides a streamlined way to eSign and send the PIT IT1040 Final 02 121613 STANY Stany form securely. With its user-friendly interface, users can easily manage document signing processes, ensuring timely submissions to tax authorities.

-

What are the pricing options for using airSlate SignNow for PIT IT1040 Final 02 121613 STANY Stany?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it cost-effective for managing PIT IT1040 Final 02 121613 STANY Stany documents. Users can choose from monthly or annual subscriptions that best fit their usage requirements.

-

What are the key features of airSlate SignNow for handling PIT IT1040 Final 02 121613 STANY Stany?

Key features of airSlate SignNow include customizable templates, team collaboration tools, and secure document storage. These functionalities ensure that users can efficiently handle the PIT IT1040 Final 02 121613 STANY Stany form with a smooth eSignature process.

-

Is airSlate SignNow secure for handling sensitive PIT IT1040 Final 02 121613 STANY Stany documents?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect sensitive information, including the PIT IT1040 Final 02 121613 STANY Stany documents. Customers can trust that their data remains safe throughout the signing process.

-

Can I integrate airSlate SignNow with other software for PIT IT1040 Final 02 121613 STANY Stany?

Absolutely! airSlate SignNow offers integrations with popular software and applications, simplifying the workflow for preparing and submitting the PIT IT1040 Final 02 121613 STANY Stany form. This seamless connection enhances productivity and reduces the risk of errors.

-

What are the benefits of eSigning PIT IT1040 Final 02 121613 STANY Stany with airSlate SignNow?

eSigning the PIT IT1040 Final 02 121613 STANY Stany form with airSlate SignNow allows for faster processing times and reduces paperwork. Users can save time and ensure accuracy while maintaining compliance with tax regulations.

Get more for PIT IT1040 Final 02 121613 STANY Stany

Find out other PIT IT1040 Final 02 121613 STANY Stany

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online