Enclose This Form and Form OW8P with Your Return

What is the Enclose This Form And Form OW8P With Your Return

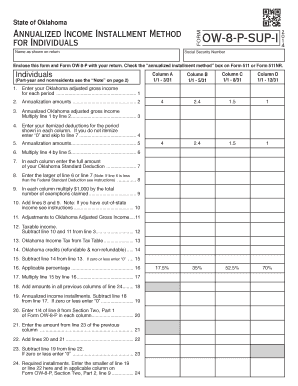

The phrase "Enclose This Form And Form OW8P With Your Return" refers to a specific requirement when submitting certain tax documents to the IRS. Form OW8P is typically associated with tax filings and is essential for ensuring that the return is processed correctly. This form may include important information about your income, deductions, and credits that affect your tax liability. Properly enclosing this form with your return helps the IRS to efficiently process your submission and verify your claims.

Steps to complete the Enclose This Form And Form OW8P With Your Return

Completing the process of enclosing this form with your return involves several important steps:

- Gather all necessary documents, including your completed tax return and Form OW8P.

- Review Form OW8P for accuracy, ensuring that all information is filled out correctly.

- Sign and date your tax return, as well as Form OW8P, where required.

- Place Form OW8P and your tax return in the same envelope, ensuring they are securely attached.

- Mail the envelope to the appropriate IRS address based on your state and the type of return you are filing.

Legal use of the Enclose This Form And Form OW8P With Your Return

The legal use of enclosing this form with your return is crucial for compliance with IRS regulations. When properly completed, both your tax return and Form OW8P serve as official documents that are legally binding. It is important to ensure that all information is accurate and truthful, as submitting false information can lead to penalties or audits. The IRS recognizes eSignatures and digital submissions as valid, provided they meet specific legal standards, such as those outlined in the ESIGN Act.

Filing Deadlines / Important Dates

Filing deadlines for enclosing this form and Form OW8P with your return are typically aligned with the annual tax filing deadline. For most taxpayers, this date falls on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to be aware of any changes to these dates, as late submissions can result in penalties. Additionally, certain forms may have different deadlines, so always verify the specific requirements for Form OW8P.

Required Documents

To properly enclose this form and Form OW8P with your return, you will need several required documents:

- Your completed tax return, including all schedules and attachments.

- Form OW8P, filled out accurately.

- Any supporting documentation that substantiates the claims made in your return, such as W-2s or 1099s.

- Proof of identity, if required, such as a driver's license or Social Security number.

Form Submission Methods (Online / Mail / In-Person)

There are various methods for submitting your tax return along with Form OW8P. These include:

- Online Submission: Many taxpayers choose to file electronically through authorized e-filing services. This method is often quicker and allows for faster processing.

- Mail: If you prefer to submit your forms by mail, ensure that you use the correct address based on your location and the type of return being filed.

- In-Person: Some taxpayers may opt to deliver their returns in person at designated IRS offices, although this is less common.

Quick guide on how to complete enclose this form and form ow8p with your return

Effortlessly Prepare Enclose This Form And Form OW8P With Your Return on Any Device

The management of documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, adjust, and eSign your documents quickly without delays. Manage Enclose This Form And Form OW8P With Your Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Enclose This Form And Form OW8P With Your Return effortlessly

- Obtain Enclose This Form And Form OW8P With Your Return and click Get Form to begin.

- Make use of the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your preference. Revise and eSign Enclose This Form And Form OW8P With Your Return and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What forms should I include with my tax return?

When submitting your tax return, it's essential to ensure you properly enclose this form and Form OW8P with your return. These forms are crucial for accurate processing and avoiding delays. Make sure to check that all required signatures are in place before mailing.

-

How can airSlate SignNow help me with Form OW8P?

AirSlate SignNow provides an efficient platform to manage your Form OW8P and ensure it's signed digitally. By using our solution, you can easily prepare, send, and securely enclose this form and Form OW8P with your return. This streamlines the process and saves you time.

-

What pricing plans does airSlate SignNow offer?

AirSlate SignNow offers various pricing plans that cater to different business needs. Each plan is designed to provide value, ensuring you can easily manage and securely eSign documents. Enclose this form and Form OW8P with your return while enjoying our cost-effective solutions.

-

Is airSlate SignNow user-friendly for new users?

Yes, airSlate SignNow is designed with user experience in mind. Its intuitive platform allows new users to quickly understand how to send and sign documents. Get started by enclosing this form and Form OW8P with your return effortlessly.

-

Can I integrate airSlate SignNow with other apps?

Absolutely! AirSlate SignNow offers integrations with various applications to enhance your workflow. With our tool, you’ll be able to enclose this form and Form OW8P with your return seamlessly across platforms.

-

What are the key benefits of using airSlate SignNow?

The primary benefits of using airSlate SignNow include increased efficiency, cost savings, and enhanced security for document signing. It simplifies the process of enclosing this form and Form OW8P with your return, ensuring you have peace of mind throughout.

-

Is my data secure with airSlate SignNow?

Yes, airSlate SignNow places a high priority on data security. We employ advanced encryption and security measures to protect your documents, including when you enclose this form and Form OW8P with your return. Your privacy is our commitment.

Get more for Enclose This Form And Form OW8P With Your Return

- Refrigeration contract for contractor michigan form

- Drainage contract for contractor michigan form

- Foundation contract for contractor michigan form

- Plumbing contract for contractor michigan form

- Brick mason contract for contractor michigan form

- Roofing contract for contractor michigan form

- Electrical contract for contractor michigan form

- Sheetrock drywall contract for contractor michigan form

Find out other Enclose This Form And Form OW8P With Your Return

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile