OW 8 P SUP I Oklahoma Form

What is the OW 8 P SUP I Oklahoma

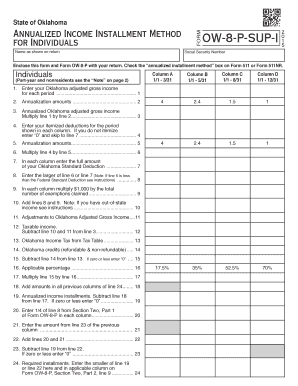

The OW 8 P SUP I Oklahoma form is a specific document used in the state of Oklahoma, primarily related to tax and financial reporting. This form is typically utilized by individuals and businesses to report certain types of income or deductions. Understanding the purpose of this form is essential for compliance with state tax regulations and ensuring proper documentation of financial activities.

How to use the OW 8 P SUP I Oklahoma

Using the OW 8 P SUP I Oklahoma form involves several steps that ensure accurate reporting. First, gather all necessary financial documents and information related to the income or deductions you need to report. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, it can be submitted electronically or by mail, depending on your preference and state guidelines. It is crucial to keep a copy of the completed form for your records.

Steps to complete the OW 8 P SUP I Oklahoma

Completing the OW 8 P SUP I Oklahoma form requires attention to detail. Follow these steps:

- Collect necessary financial documents, such as income statements and receipts.

- Access the form via the Oklahoma state tax website or other designated platforms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income or deductions in the appropriate sections of the form.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, as per state guidelines.

Legal use of the OW 8 P SUP I Oklahoma

The OW 8 P SUP I Oklahoma form holds legal significance as it is used for reporting income and deductions to the state tax authority. Properly completing and submitting this form ensures compliance with Oklahoma tax laws. It is essential to adhere to all legal requirements, including deadlines and submission methods, to avoid potential penalties or legal issues.

State-specific rules for the OW 8 P SUP I Oklahoma

Oklahoma has specific regulations governing the use of the OW 8 P SUP I form. These rules dictate how the form should be completed, what information must be included, and the deadlines for submission. Familiarizing yourself with these state-specific guidelines is crucial for ensuring compliance and avoiding errors that could lead to penalties.

Examples of using the OW 8 P SUP I Oklahoma

Examples of using the OW 8 P SUP I Oklahoma form include reporting income from freelance work, rental properties, or other sources of income that require documentation for tax purposes. Individuals and businesses may also use this form to claim deductions related to business expenses or other allowable deductions under Oklahoma tax law.

Quick guide on how to complete ow 8 p sup i oklahoma

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Effortlessly Modify and Electronically Sign [SKS]

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that function.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and electronically sign [SKS] while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to OW 8 P SUP I Oklahoma

Create this form in 5 minutes!

People also ask

-

What is OW 8 P SUP I Oklahoma?

OW 8 P SUP I Oklahoma refers to a specific requirement or endorsement related to document signing in Oklahoma. Understanding this terminology is essential for businesses that operate in the state and require compliant document management solutions.

-

How can airSlate SignNow help with OW 8 P SUP I Oklahoma?

airSlate SignNow provides a seamless platform for eSigning documents that comply with OW 8 P SUP I Oklahoma. Our easy-to-use interface allows users to understand and adhere to state-specific requirements, improving compliance and efficiency.

-

What are the pricing options for airSlate SignNow in relation to OW 8 P SUP I Oklahoma?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs, including those that require OW 8 P SUP I Oklahoma compliance. You can choose from monthly or annual subscriptions that fit your budget and usage requirements.

-

What features does airSlate SignNow offer for OW 8 P SUP I Oklahoma?

Our features for OW 8 P SUP I Oklahoma include customizable templates, advanced document tracking, and secure storage options. These tools ensure that your documents meet state requirements and are managed efficiently, streamlining your workflow.

-

Can airSlate SignNow integrate with other software for OW 8 P SUP I Oklahoma?

Yes, airSlate SignNow offers robust integration options with various software platforms to enhance your workflow, particularly for OW 8 P SUP I Oklahoma needs. This allows you to manage your documents seamlessly across different applications, increasing productivity.

-

What benefits does airSlate SignNow provide for businesses dealing with OW 8 P SUP I Oklahoma?

airSlate SignNow helps businesses save time and reduce paperwork related to OW 8 P SUP I Oklahoma. Our platform not only simplifies eSigning but also ensures that your documents are compliant with state regulations, leading to smoother operations.

-

Is airSlate SignNow secure for documents requiring OW 8 P SUP I Oklahoma?

Absolutely, airSlate SignNow prioritizes security, especially for documents related to OW 8 P SUP I Oklahoma. We use top-notch encryption and secure storage practices to protect your sensitive information and ensure compliance with state guidelines.

Get more for OW 8 P SUP I Oklahoma

Find out other OW 8 P SUP I Oklahoma

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile