Check the Annualized Installment Method Box on Form 511 or Form 511NR

What is the Check The Annualized Installment Method Box On Form 511 Or Form 511NR

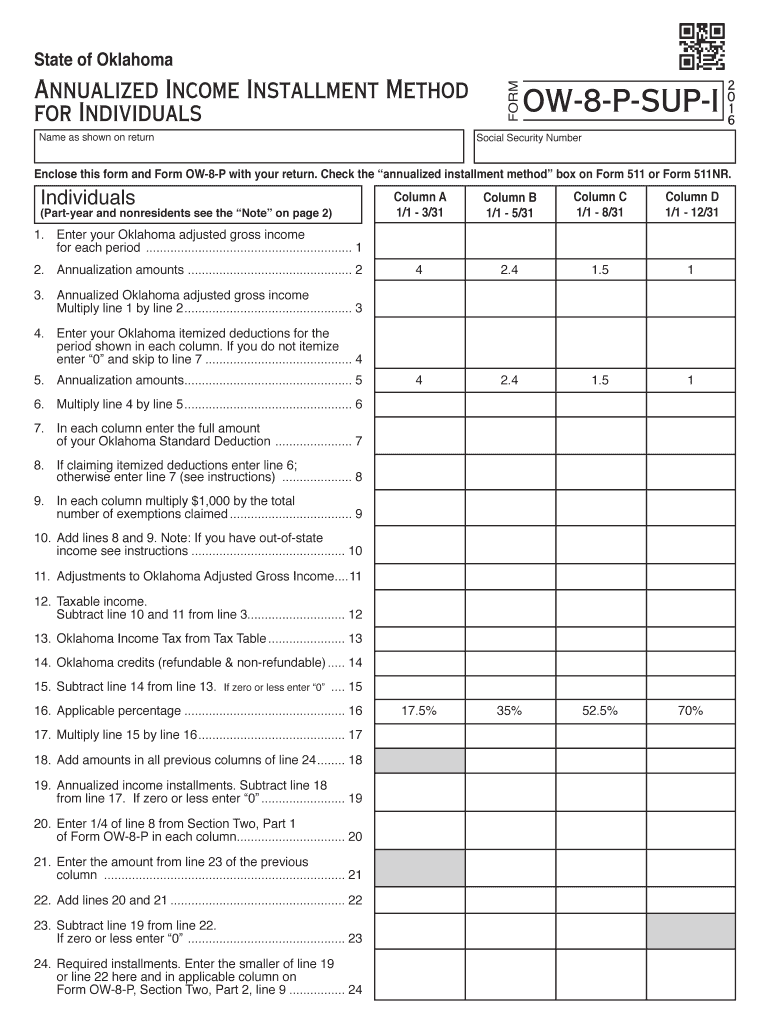

The check the annualized installment method box on Form 511 or Form 511NR is a specific selection that taxpayers can make when filing their state income tax returns in certain jurisdictions. This option allows individuals to calculate their tax liability based on an annualized method, which can be beneficial for those with fluctuating income throughout the year. By selecting this box, taxpayers indicate their preference for a calculation method that reflects their income more accurately, potentially leading to a more favorable tax outcome.

Steps to Complete the Check The Annualized Installment Method Box On Form 511 Or Form 511NR

Completing the check the annualized installment method box on Form 511 or Form 511NR involves several straightforward steps:

- Obtain the correct version of Form 511 or Form 511NR from your state’s tax authority.

- Review the instructions provided with the form to understand the eligibility criteria for using the annualized installment method.

- Locate the section on the form where the annualized installment method box is situated.

- Carefully check the box to indicate your choice of using the annualized method.

- Complete the remainder of the form as required, ensuring all income and deductions are accurately reported.

- Review your completed form for accuracy before submission.

Legal Use of the Check The Annualized Installment Method Box On Form 511 Or Form 511NR

The legal use of the check the annualized installment method box on Form 511 or Form 511NR is governed by state tax laws. When taxpayers select this option, they must ensure compliance with all relevant regulations and guidelines set forth by their state’s tax authority. This method is legally binding, and proper documentation must be maintained to support the income calculations used in the annualized method. Failing to comply with the legal requirements may result in penalties or additional tax liabilities.

IRS Guidelines

While the check the annualized installment method box on Form 511 or Form 511NR is primarily a state-level consideration, it is essential to be aware of IRS guidelines that may impact your overall tax filing. The IRS provides general rules regarding income reporting, deductions, and tax calculations that can influence how state forms are filled out. Taxpayers should ensure that their state filings align with federal requirements to avoid discrepancies that could lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 511 or Form 511NR vary by state, and it is crucial for taxpayers to be aware of these dates to avoid late fees or penalties. Typically, state income tax returns are due on April 15, but some states may have different deadlines. Additionally, if you are using the annualized installment method, there may be specific deadlines for making estimated tax payments throughout the year. Always check with your state’s tax authority for the most accurate and up-to-date information.

Required Documents

When completing the check the annualized installment method box on Form 511 or Form 511NR, certain documents may be required to support your income calculations. Commonly needed documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of any other income sources

- Records of deductions and credits claimed

Gathering these documents ahead of time can streamline the process of filling out the form and ensure accuracy in your reporting.

Digital vs. Paper Version

Taxpayers have the option to complete the check the annualized installment method box on Form 511 or Form 511NR either digitally or on paper. The digital version allows for easier calculations and often includes built-in error checks, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that all information is accurately reported and that the form is submitted by the appropriate deadline.

Quick guide on how to complete check the annualized installment method box on form 511 or form 511nr

Prepare [SKS] effortlessly on any gadget

Managing documents online has become widely accepted among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the proper form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without holdups. Handle [SKS] on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Check The Annualized Installment Method Box On Form 511 Or Form 511NR

Create this form in 5 minutes!

People also ask

-

What is the Annualized Installment Method and how does it apply to Form 511 and Form 511NR?

The Annualized Installment Method is a tax calculation method for evenly distributing income and deductions over the year. To accurately report using this method, it’s crucial to Check The Annualized Installment Method Box On Form 511 Or Form 511NR. This ensures that your tax obligations reflect the income accurately according to the chosen method.

-

How can airSlate SignNow help me in eSigning tax documents?

airSlate SignNow simplifies the eSigning process for tax documents, including Form 511 and Form 511NR. You can effortlessly send, receive, and store signed documents securely. With SignNow, you can also Check The Annualized Installment Method Box On Form 511 Or Form 511NR before finalizing your submissions.

-

Is there a cost associated with using airSlate SignNow for eSigning forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost allows you to access efficient features, including the ability to Check The Annualized Installment Method Box On Form 511 Or Form 511NR. It is a cost-effective solution that empowers businesses to manage their signing processes effectively.

-

What features does airSlate SignNow offer that support tax-related document management?

airSlate SignNow provides a variety of features that simplify tax-related document management such as customizable templates, automated workflows, and secure storage. One vital aspect is the ability to Check The Annualized Installment Method Box On Form 511 Or Form 511NR, ensuring compliance and accuracy in your filings.

-

Can I integrate airSlate SignNow with other software for accounting or tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software, enhancing your document management processes. This integration allows you to automatically Check The Annualized Installment Method Box On Form 511 Or Form 511NR within your existing workflows, saving time and reducing errors.

-

What benefits can I expect from using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including enhanced efficiency, improved document security, and legal compliance. One of the time-saving features is the ability to Check The Annualized Installment Method Box On Form 511 Or Form 511NR, allowing your business to file taxes accurately and on time.

-

How secure is my data when using airSlate SignNow?

Data security is a top priority for airSlate SignNow. The platform uses state-of-the-art encryption and complies with legal regulations to protect sensitive information. Consequently, when you Check The Annualized Installment Method Box On Form 511 Or Form 511NR, you can be assured that your data is secure.

Get more for Check The Annualized Installment Method Box On Form 511 Or Form 511NR

Find out other Check The Annualized Installment Method Box On Form 511 Or Form 511NR

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile