What Need to Knowhttpswww Taxhow Netstaticformpdfstates1538366400IL 2210 PDF

What is the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf

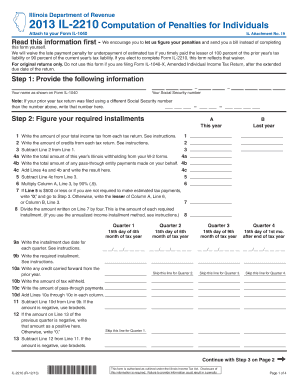

The What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf is a tax form used by individuals in the United States to report and calculate their estimated tax payments. This form is particularly relevant for taxpayers who expect to owe tax of $1,000 or more when they file their return. It helps ensure that individuals meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax season.

How to use the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf

Using the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf involves several steps. First, gather your financial information, including income sources, deductions, and credits. Next, determine your expected tax liability for the year. You will then fill out the form, providing necessary details about your income and any payments already made. Finally, submit the form electronically or by mail, ensuring you keep a copy for your records.

Steps to complete the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf

Completing the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf involves the following steps:

- Gather your financial documents, including W-2s and 1099s.

- Calculate your total expected income for the year.

- Estimate your deductions and credits to determine your taxable income.

- Calculate your estimated tax liability using the IRS tax tables.

- Fill out the form with your personal information and estimated payments.

- Review the form for accuracy before submission.

- Submit the form by the due date to avoid penalties.

Legal use of the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf

The legal use of the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf is crucial for compliance with IRS regulations. This form must be filled out accurately to reflect your estimated tax payments. Failure to do so may result in penalties or interest charges. It is important to ensure that all information provided is truthful and complete, as the IRS may audit tax returns and verify the information submitted.

Filing Deadlines / Important Dates

Filing deadlines for the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf are typically aligned with the tax year. Estimated tax payments are usually due quarterly, with specific dates set by the IRS. For the current tax year, the deadlines are generally:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Key elements of the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf

Key elements of the What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf include:

- Your personal identification information, such as name and Social Security number.

- Your estimated income and any adjustments.

- The total amount of estimated tax payments made.

- Any applicable credits that may reduce your tax liability.

- Signature and date to validate the form.

Quick guide on how to complete what need to knowhttpswwwtaxhownetstaticformpdfstates1538366400il 2210 2013pdf

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you would like to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf

Create this form in 5 minutes!

People also ask

-

What is the airSlate SignNow solution?

airSlate SignNow is an easy-to-use, cost-effective solution that enables businesses to send and eSign documents electronically. Whether you're dealing with contracts, agreements, or any other type of paperwork, this platform simplifies the entire signing process while maintaining compliance. For those who often reference tax-related forms, including 'What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf,' it offers robust features tailored to your needs.

-

How does airSlate SignNow streamline document management?

With airSlate SignNow, you can automate workflows, manage document storage, and track the signing process in real-time. This streamlining not only saves time but also reduces errors that may arise from manual processing. If you are familiar with forms like 'What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf,' you'll appreciate the organized approach this platform offers.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers several pricing tiers to accommodate different business needs and budgets. Plans typically range from basic functionality to advanced features, ensuring that you have access to the tools necessary for effective document management. When assessing pricing, don’t forget to consider how tools like 'What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf' can enhance your document processes.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates with various third-party applications, enhancing your workflow and ensuring seamless document handling. From CRM systems to cloud storage and other productivity apps, integrating these tools can improve efficiency. Users looking into tax documentation like 'What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf' will find these integrations especially beneficial for streamlining processes.

-

What security features does airSlate SignNow offer?

Security is paramount at airSlate SignNow, with features including encryption, multi-factor authentication, and secure cloud storage. They ensure that all your documents are protected throughout the signing process, which is essential for sensitive materials like tax forms. When using documents like 'What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf,' maintaining confidentiality and security is crucial.

-

How can airSlate SignNow improve my business efficiency?

By automating signing processes and providing easy access to documents, airSlate SignNow can signNowly enhance your business efficiency. This allows teams to focus on core tasks rather than getting bogged down by paperwork. If your business often deals with forms like 'What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf,' the efficiencies gained can be substantial.

-

Is airSlate SignNow easy to use for new users?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with eSigning processes. The intuitive interface guides users through sending and signing documents without extensive training. For new users looking into tax forms like 'What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf,' this ease of use is particularly valuable.

Get more for What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf

Find out other What Need To Knowhttpswww taxhow netstaticformpdfstates1538366400IL 2210 pdf

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast