Itemized Deduction Limitation for Taxpayers with an Adjusted Gross Income Which Form

Understanding the Itemized Deduction Limitation for Taxpayers with an Adjusted Gross Income

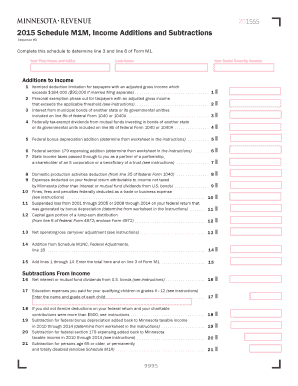

The itemized deduction limitation for taxpayers with an adjusted gross income (AGI) is a crucial aspect of tax filing in the United States. This limitation affects how much of your itemized deductions you can claim based on your income level. Generally, taxpayers with higher AGI may find their itemized deductions reduced, impacting their overall tax liability. Understanding this limitation helps taxpayers make informed decisions about their deductions and potential tax savings.

Steps to Complete the Itemized Deduction Limitation for Taxpayers with an Adjusted Gross Income

Completing the itemized deduction limitation form involves several steps. First, gather all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses. Next, calculate your total itemized deductions, which may include medical expenses, mortgage interest, and charitable contributions. Once you have your total, compare it to the standard deduction to determine which option benefits you more. Finally, fill out the appropriate tax forms, ensuring you accurately report your AGI and itemized deductions. This careful approach helps maximize your tax benefits.

IRS Guidelines for the Itemized Deduction Limitation

The Internal Revenue Service (IRS) provides specific guidelines regarding the itemized deduction limitation for taxpayers with an adjusted gross income. Taxpayers should refer to IRS publications and instructions, which detail the thresholds for AGI that trigger the limitation. These guidelines also clarify the types of expenses that qualify for itemization and any caps on certain deductions. Staying informed about these regulations ensures compliance and helps avoid potential issues during tax filing.

Eligibility Criteria for the Itemized Deduction Limitation

To qualify for the itemized deduction limitation, taxpayers must meet specific eligibility criteria. Primarily, your adjusted gross income must exceed certain thresholds set by the IRS. Additionally, taxpayers must choose to itemize deductions rather than take the standard deduction. This choice is often influenced by the total amount of deductible expenses incurred throughout the tax year. Understanding these criteria is essential for effective tax planning and maximizing potential deductions.

Required Documents for the Itemized Deduction Limitation

When preparing to file using the itemized deduction limitation for taxpayers with an adjusted gross income, certain documents are essential. These include proof of income such as W-2 and 1099 forms, receipts for deductible expenses, and any relevant tax forms. Keeping organized records simplifies the filing process and ensures that all deductions are accurately reported. This thorough documentation is vital for substantiating claims in case of an audit.

Digital vs. Paper Version of the Itemized Deduction Limitation Form

Taxpayers have the option to complete the itemized deduction limitation form either digitally or on paper. The digital version often offers advantages such as ease of use, automatic calculations, and the ability to e-file. Conversely, some taxpayers may prefer the traditional paper method for various reasons, including familiarity or comfort. Regardless of the method chosen, ensuring accuracy and compliance with IRS guidelines is paramount for a successful filing.

Quick guide on how to complete itemized deduction limitation for taxpayers with an adjusted gross income which

Easily Prepare [SKS] on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the required format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

Effortlessly Modify and Electronically Sign [SKS]

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which

Create this form in 5 minutes!

People also ask

-

What is the Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which?

The Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which refers to the restrictions placed on how much taxpayers can deduct from their taxable income. High-income earners may face a reduction in the total amount they can itemize, impacting their overall tax liability.

-

How can airSlate SignNow help me manage tax-related documents regarding the Itemized Deduction Limitation?

airSlate SignNow provides an efficient platform for organizing and signing important tax documents electronically. This can be particularly beneficial when dealing with records related to the Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which, as it ensures you have all necessary paperwork readily accessible and signed securely.

-

Is there a pricing model for businesses using airSlate SignNow in relation to tax document management?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including straightforward pricing that helps manage expenses related to tax documentation efficiently. Businesses can choose a plan that aligns with their usage frequencies, such as dealing with the Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which.

-

What features does airSlate SignNow offer to simplify the signing process for tax documents?

airSlate SignNow includes features like document templates, customizable workflows, and in-app reminders that streamline the signing process. These tools are designed to facilitate compliance and organization, especially when navigating the complexities of the Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which.

-

Can airSlate SignNow integrate with other software I use for tax preparation?

Absolutely! airSlate SignNow can integrate with popular tax preparation software, allowing for seamless data transfer and document management. This integration is essential for addressing the Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which, as it keeps all relevant information organized in one platform.

-

What are the benefits of using airSlate SignNow for handling tax-related modifications under the Itemized Deduction Limitation?

Using airSlate SignNow helps streamline processes, save time, and improve accuracy when dealing with tax-related modifications. These benefits are crucial when considering the Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which, ensuring all changes are documented and signed swiftly.

-

How secure is eSigning with airSlate SignNow for tax documents involving itemized deductions?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This high level of security is vital for ensuring the integrity of documents related to the Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which, safeguarding sensitive financial information.

Get more for Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which

Find out other Itemized Deduction Limitation For Taxpayers With An Adjusted Gross Income Which

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile