Individual Filing Status Montana Department of Revenue Form

What is the Individual Filing Status Montana Department Of Revenue

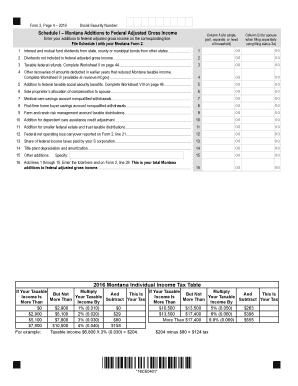

The Individual Filing Status Montana Department of Revenue is a crucial component for residents of Montana when filing their state income tax returns. This status determines the tax rate and the deductions applicable to an individual taxpayer. It reflects the taxpayer's marital status and whether they are filing jointly with a spouse or as a single individual. Understanding this status is essential for ensuring compliance with state tax regulations and optimizing tax liabilities.

Steps to Complete the Individual Filing Status Montana Department Of Revenue

Completing the Individual Filing Status form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including Social Security numbers and income details. Next, determine your filing status based on your marital situation. After that, fill out the form carefully, ensuring that all sections are completed accurately. Finally, review the form for any errors before submission. This process helps in minimizing delays and potential penalties associated with incorrect filings.

Required Documents for the Individual Filing Status Montana Department Of Revenue

To complete the Individual Filing Status form, specific documents are required. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Social Security numbers for yourself and any dependents.

- Income statements, such as W-2 forms or 1099s.

- Documentation of any deductions or credits you plan to claim.

Having these documents ready will streamline the filing process and help ensure that all necessary information is accurately reported.

Legal Use of the Individual Filing Status Montana Department Of Revenue

The legal use of the Individual Filing Status form is governed by Montana state tax laws. It is essential for taxpayers to accurately report their filing status to comply with state regulations. Misrepresentation or errors in filing status can lead to penalties, including fines or additional taxes owed. Therefore, understanding the legal implications of your filing status is vital for maintaining compliance and avoiding legal issues with the Montana Department of Revenue.

State-Specific Rules for the Individual Filing Status Montana Department Of Revenue

Montana has specific rules that govern the Individual Filing Status, which may differ from federal guidelines. For instance, the state recognizes various filing statuses, including single, married filing jointly, married filing separately, and head of household. Each status has distinct tax rates and deductions. Additionally, Montana may have unique credits and exemptions that apply based on your filing status, making it essential to review state-specific regulations when preparing your tax return.

Form Submission Methods for the Individual Filing Status Montana Department Of Revenue

Taxpayers in Montana have several options for submitting the Individual Filing Status form. The form can be filed online through the Montana Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, individuals can mail their completed forms to the appropriate state office or submit them in person at designated locations. Each method has its advantages, and choosing the right one can depend on personal preference and the urgency of the filing.

Quick guide on how to complete individual filing status montana department of revenue

Finalize [SKS] effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest method to alter and electronically sign [SKS] without stress

- Obtain [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically provides for that aim.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Alter and electronically sign [SKS] and maintain excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Filing Status Montana Department Of Revenue

Create this form in 5 minutes!

People also ask

-

What is Individual Filing Status at the Montana Department Of Revenue?

Individual Filing Status at the Montana Department Of Revenue refers to how taxpayers report their income and taxes based on their specific criteria, such as marital status or dependent status. Understanding your filing status is essential for determining your tax liability accurately. This status can influence deductions and tax credits, ultimately affecting your tax return.

-

How can I check my Individual Filing Status with the Montana Department Of Revenue?

To check your Individual Filing Status with the Montana Department Of Revenue, you can visit their official website and use their online resources. You may also need to provide personal information, including your Social Security number, to access your filing status. Accurate information is crucial for ensuring compliance with state tax regulations.

-

What are the benefits of knowing my Individual Filing Status in Montana?

Knowing your Individual Filing Status in Montana helps you make informed decisions regarding your tax returns. It can affect your eligibility for certain credits and deductions, which can result in more signNow savings. Moreover, understanding your status ensures that you file correctly and avoid potential penalties.

-

Are there specific requirements for different Individual Filing Statuses in Montana?

Yes, different Individual Filing Statuses in Montana have unique requirements. For example, single filers must have no dependents, while married couples may choose to file jointly or separately. It's essential to review the Montana Department Of Revenue guidelines to determine the best filing status for your situation to maximize tax benefits.

-

Does airSlate SignNow support filing for Individual Filing Status in Montana?

Yes, airSlate SignNow supports the documentation process for filing your Individual Filing Status in Montana. Our platform allows you to electronically sign and send necessary documents seamlessly. This makes it easier to manage your tax filings and collaborate with tax professionals when needed.

-

What features does airSlate SignNow offer for tax filing documents related to Individual Filing Status in Montana?

airSlate SignNow offers robust features such as electronic signatures, document templates, and secure cloud storage for managing tax filing documents. These features streamline the process of filing your taxes under the Individual Filing Status at the Montana Department Of Revenue, ensuring accuracy and compliance. Additionally, our user-friendly interface makes it easy to navigate the entire process.

-

Is there a cost associated with using airSlate SignNow for tax filing?

Yes, while airSlate SignNow provides a cost-effective solution for electronic signature needs, there are subscription plans available that vary in pricing based on features. Each plan includes access to all essential tools to assist with your Individual Filing Status documents for the Montana Department Of Revenue. You can choose a plan that best fits your needs and budget.

Get more for Individual Filing Status Montana Department Of Revenue

- Hysa membership form

- Nhics form 260 individual resident evacuation

- Snf nf formpdffillercom

- Long term care facility evacuation resident assessment form for

- Affidavit of registered agent glassboro online form

- Centrex insurance form

- Usli trust supplemental questionnaire form

- Rent receipt month fill form

Find out other Individual Filing Status Montana Department Of Revenue

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word