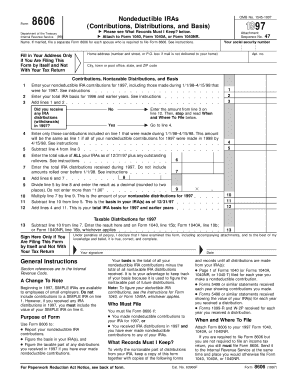

Nondeductible IRAs Contributions, Distributions, and Basis Irs Form

What is the Nondeductible IRAs Contributions, Distributions, And Basis IRS?

The Nondeductible IRAs Contributions, Distributions, and Basis IRS refers to specific tax regulations governing contributions made to Individual Retirement Accounts (IRAs) that are not tax-deductible. These contributions are typically made by individuals whose income exceeds certain limits or who are covered by a retirement plan at work. Understanding this form is crucial for accurately reporting contributions and distributions to the IRS, ensuring compliance with tax regulations, and managing tax liabilities effectively.

Steps to Complete the Nondeductible IRAs Contributions, Distributions, And Basis IRS

Completing the Nondeductible IRAs Contributions, Distributions, and Basis IRS form involves several steps:

- Gather necessary documents, including previous tax returns and records of contributions.

- Determine the total amount of nondeductible contributions made during the tax year.

- Calculate the basis of your IRA, which is the total of nondeductible contributions.

- Fill out the appropriate IRS form, typically Form 8606, to report these contributions.

- Review the completed form for accuracy before submission.

Legal Use of the Nondeductible IRAs Contributions, Distributions, And Basis IRS

The legal use of the Nondeductible IRAs Contributions, Distributions, and Basis IRS form is essential for taxpayers who wish to report their nondeductible contributions accurately. This form helps in tracking the basis in an IRA, which is necessary for determining tax implications when distributions are taken. Proper use of this form ensures compliance with IRS regulations and helps avoid penalties associated with incorrect reporting.

IRS Guidelines

The IRS provides guidelines for reporting nondeductible IRA contributions, which include specific instructions on how to fill out Form 8606. Key points include the requirement to file this form if you make nondeductible contributions, how to calculate your basis, and the implications of distributions taken from the IRA. Familiarity with these guidelines is crucial for taxpayers to avoid errors and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Nondeductible IRAs Contributions, Distributions, and Basis IRS form typically align with the annual tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following year. If you file for an extension, ensure that the form is submitted by the extended deadline to avoid penalties.

Examples of Using the Nondeductible IRAs Contributions, Distributions, And Basis IRS

Examples of using the Nondeductible IRAs Contributions, Distributions, and Basis IRS form include situations where individuals contribute to an IRA but do not qualify for a tax deduction due to income limits. For instance, a high-income earner may make nondeductible contributions to an IRA and later withdraw funds during retirement. Accurate reporting using this form is necessary to track the basis and ensure that only the earnings portion is taxed upon withdrawal.

Quick guide on how to complete nondeductible iras contributions distributions and basis irs

Effortlessly prepare Nondeductible IRAs Contributions, Distributions, And Basis Irs on any device

The management of documents online has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly without delays. Manage Nondeductible IRAs Contributions, Distributions, And Basis Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Nondeductible IRAs Contributions, Distributions, And Basis Irs seamlessly

- Locate Nondeductible IRAs Contributions, Distributions, And Basis Irs and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your modifications.

- Choose your preferred method to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you select. Edit and electronically sign Nondeductible IRAs Contributions, Distributions, And Basis Irs and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are nondeductible IRA contributions?

Nondeductible IRA contributions are those made to an individual retirement account that are not tax-deductible. This means that when you contribute to your IRA, you cannot lower your taxable income for the year. Understanding the implications of nondeductible IRAs contributions, distributions, and basis IRS is crucial for effective tax planning.

-

How do nondeductible IRA distributions work?

Nondeductible IRA distributions refer to withdrawals made from your IRA account that include both your contributions and earnings. When you take a distribution, only the earnings portion may be subject to taxes, while the contributions are tax-free. This differentiation is essential for managing nondeductible IRAs contributions, distributions, and basis IRS to avoid unnecessary tax liabilities.

-

What is the basis of a nondeductible IRA?

The basis of a nondeductible IRA is the total amount of nondeductible contributions you’ve made to the account over the years. This basis is important because it determines the portion of your distributions that will be tax-free. Properly tracking your basis is vital when dealing with nondeductible IRAs contributions, distributions, and basis IRS to ensure compliance with taxation rules.

-

Can I convert a nondeductible IRA to a Roth IRA?

Yes, you can convert a nondeductible IRA to a Roth IRA. This can be an effective strategy to avoid taxes on future earnings if managed correctly. It’s important to understand the implications of nondeductible IRAs contributions, distributions, and basis IRS in this process to fully benefit from the conversion.

-

Are there any income limits for making nondeductible IRA contributions?

There are no income limits for making nondeductible IRA contributions, unlike Roth IRA contributions, which have specific income thresholds. However, it's crucial to be aware of the contribution limits and to properly report nondeductible IRAs contributions, distributions, and basis IRS when filing your taxes to avoid any penalties.

-

What are the benefits of making nondeductible IRA contributions?

Making nondeductible IRA contributions allows you to save for retirement even if you exceed the income limits for deductible contributions. It can also provide a source of tax-free income in retirement, as the contributions can be taken out without tax. Understanding these benefits can help you make informed decisions about nondeductible IRAs contributions, distributions, and basis IRS.

-

How can I keep track of my nondeductible IRA contributions?

To keep track of your nondeductible IRA contributions, you should maintain accurate records, including Form 8606, which reports nondeductible contributions and calculates the taxable portion of distributions. Utilizing financial tracking tools and software can help simplify this process. Proper management ensures compliance with nondeductible IRAs contributions, distributions, and basis IRS requirements.

Get more for Nondeductible IRAs Contributions, Distributions, And Basis Irs

- Letter tenant landlord repair 497319211 form

- New jersey tenant landlord form

- Tenant landlord demand form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles new jersey form

- Letter from tenant to landlord about landlords failure to make repairs new jersey form

- Nj letter rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession new jersey form

- Letter from tenant to landlord about illegal entry by landlord new jersey form

Find out other Nondeductible IRAs Contributions, Distributions, And Basis Irs

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online