November 1040X Your First Name and Initial Form Department of the Treasury Internal Revenue Service Amended U

What is the November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U

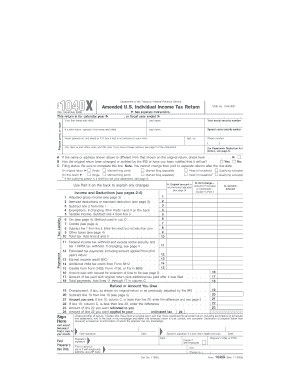

The November 2X form, officially known as the Amended U.S. Individual Income Tax Return, is used by taxpayers to amend their previously filed federal income tax returns. This form allows individuals to correct errors, claim additional deductions or credits, or adjust their filing status. It is important to note that the 1040X cannot be used to amend a return for a year that has been closed by the statute of limitations, which is generally three years from the original filing date.

How to use the November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U

To use the November 2X form, start by obtaining the correct version from the IRS website or through authorized tax preparation software. Fill out the form by providing your personal information, including your name, address, and Social Security number. Clearly indicate the tax year you are amending and explain the reasons for the amendment in the designated section. Be sure to include any necessary supporting documentation, such as W-2 forms or additional schedules, to substantiate your claims.

Steps to complete the November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U

Completing the November 2X involves several key steps:

- Gather your original tax return and any relevant documents.

- Obtain the 1040X form from the IRS website or tax software.

- Fill out your personal information at the top of the form.

- Indicate the tax year you are amending.

- Complete the sections detailing the changes you are making, including the reasons for each change.

- Calculate the new amounts and ensure they are accurately reflected in the form.

- Sign and date the form before submitting it.

Legal use of the November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U

The November 2X form is legally recognized as a valid document for amending tax returns in the United States. To ensure its legal standing, it must be filled out completely and accurately. Compliance with IRS guidelines is critical, as any discrepancies or errors can lead to delays in processing or potential penalties. Additionally, electronic signatures are accepted when using e-filing methods, provided they meet the necessary legal standards.

Filing Deadlines / Important Dates

When filing the November 2X, it is essential to be aware of the deadlines. Generally, the form must be submitted within three years of the original return's due date, including any extensions. For example, if you filed your 2020 tax return on April 15, 2021, you would have until April 15, 2024, to submit the 1040X for that year. If you are claiming a refund, it is advisable to file the amended return as soon as possible to avoid missing the deadline.

Form Submission Methods (Online / Mail / In-Person)

The November 2X can be submitted in various ways, depending on your preference and the method that best suits your situation:

- Online: If you are using tax preparation software, you may have the option to e-file your 1040X directly with the IRS.

- Mail: You can print the completed form and mail it to the address specified in the form instructions, based on your state of residence.

- In-Person: While less common, you may also be able to submit the form in person at certain IRS offices.

Quick guide on how to complete november 2004 1040x your first name and initial form department of the treasury internal revenue service amended u

Complete November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documentation, allowing you to easily find the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U on any platform using airSlate SignNow apps for Android or iOS and enhance any document-focused workflow today.

How to modify and eSign November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U with ease

- Find November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional written signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pricing structure for airSlate SignNow 2004 x?

The pricing for airSlate SignNow 2004 x is designed to be affordable and flexible, catering to businesses of all sizes. We offer various plans, including monthly and annual subscriptions, with the goal of providing you the best value for your electronic signature needs. It’s easy to compare the different features for each plan to find the one that suits your needs best.

-

What features does airSlate SignNow 2004 x offer?

airSlate SignNow 2004 x comes with a range of powerful features that make document management a breeze. Key features include customizable templates, in-person signing, and advanced security options like audit trails. With these features, you can streamline your document workflows and ensure your signatures are always compliant.

-

How can airSlate SignNow 2004 x benefit my business?

By using airSlate SignNow 2004 x, your business can enhance productivity by reducing the time spent on document processing. It allows for faster approvals and eliminates the need for physical paperwork, which means you save time and resources. Furthermore, it improves customer satisfaction as clients can sign documents from anywhere, anytime.

-

Is airSlate SignNow 2004 x easy to integrate with other tools?

Yes, airSlate SignNow 2004 x offers seamless integrations with a wide variety of applications, including CRMs, document management systems, and more. This flexibility allows businesses to enhance their existing workflows without disruption. With API access, you can easily connect with your preferred tools and customize your electronic signature process.

-

What types of documents can I sign using airSlate SignNow 2004 x?

With airSlate SignNow 2004 x, you can sign various document types, including contracts, agreements, and forms. Whether you need to handle legal documents, HR forms, or sales contracts, SignNow accommodates all of them securely and efficiently. You can also create templates for frequently used documents to streamline your signing process.

-

Does airSlate SignNow 2004 x offer mobile compatibility?

Absolutely! airSlate SignNow 2004 x is fully mobile-responsive, giving you the power to send and sign documents on any device. Whether you're in the office or on the go, you can manage your documents efficiently from your smartphone or tablet. This mobile compatibility ensures that you never miss a signature, no matter where you are.

-

Is onboarding support available for airSlate SignNow 2004 x users?

Yes, when you choose airSlate SignNow 2004 x, you gain access to comprehensive onboarding support. Our team is dedicated to helping you set up your account and guiding you through all the features and functionalities. We want you to get the most out of your experience and ensure a smooth transition to digital document signing.

Get more for November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U

- New jersey rent control form

- Letter tenant landlord 497319236 form

- Landlord rent during form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase new jersey form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant new jersey form

- Tenant rent increase form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services new jersey form

- Temporary lease agreement to prospective buyer of residence prior to closing new jersey form

Find out other November 1040X Your First Name And Initial Form Department Of The Treasury Internal Revenue Service Amended U

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer