Form 990 or 990 EZ Schedule L Transactions with Interested Persons Irs

What is the Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

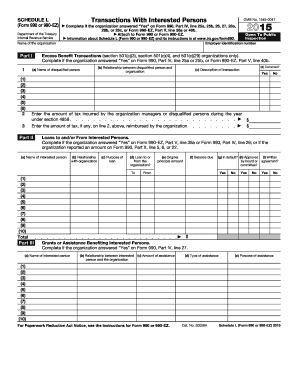

The Form 990 or 990 EZ Schedule L is a critical document required by the IRS for certain tax-exempt organizations. This form specifically addresses transactions between the organization and interested persons, which include board members, key employees, and their family members. It aims to ensure transparency and accountability in financial dealings, providing detailed information about any transactions that could potentially benefit these individuals. Understanding this form is essential for compliance with IRS regulations, as it helps maintain the integrity of nonprofit organizations.

How to use the Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

Using the Form 990 or 990 EZ Schedule L involves several steps to ensure accurate reporting of transactions with interested persons. Organizations must first identify all transactions that meet the IRS criteria, including loans, leases, and sales of goods or services. Once identified, the organization must report these transactions in the appropriate sections of the form, providing details such as the nature of the transaction, the amount involved, and the relationship of the interested person to the organization. Proper use of this form not only aids in compliance but also enhances the organization’s credibility.

Steps to complete the Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

Completing the Form 990 or 990 EZ Schedule L requires a systematic approach. Begin by gathering all necessary financial records related to transactions with interested persons. Follow these steps:

- Identify all interested persons associated with the organization.

- Document each transaction involving these individuals, noting the type and amount.

- Fill out the form accurately, ensuring all required information is included.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form by the designated deadline to avoid penalties.

Key elements of the Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

The key elements of the Form 990 or 990 EZ Schedule L include detailed sections that require information about each transaction with interested persons. These elements typically consist of:

- The name and relationship of the interested person.

- A description of the transaction, including its purpose.

- The amount of the transaction and any terms associated with it.

- Disclosure of any conflicts of interest that may arise from the transaction.

Providing comprehensive and accurate information in these sections is vital for compliance and transparency.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990 or 990 EZ Schedule L. These guidelines emphasize the importance of full disclosure of transactions with interested persons to prevent conflicts of interest and ensure accountability. Organizations must adhere to the definitions and requirements set forth by the IRS, including the types of transactions that must be reported and the necessary documentation to support these transactions. Familiarity with these guidelines is essential for proper compliance.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of the Form 990 or 990 EZ Schedule L can result in significant penalties. The IRS may impose fines for incomplete or inaccurate reporting, which can affect the organization’s tax-exempt status. Additionally, organizations may face reputational damage, as stakeholders expect transparency and accountability in financial dealings. It is crucial for organizations to understand these risks and take necessary steps to ensure compliance.

Quick guide on how to complete 2015 form 990 or 990 ez schedule l transactions with interested persons irs

Complete Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs without stress

- Locate Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a standard wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs?

Form 990 and 990 EZ Schedule L relate to transactions that nonprofit organizations engage in with interested persons. These forms report financial dealings and ensure transparency, helping organizations maintain compliance with IRS regulations regarding related-party transactions. It's crucial for nonprofits to accurately complete these forms to avoid penalties and maintain public trust.

-

How can airSlate SignNow help with Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs?

airSlate SignNow simplifies the process of managing documents related to Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs. By using our eSignature solution, organizations can ensure that all necessary forms are completed, signed, and stored securely. This streamlines your compliance process and helps you maintain accurate records.

-

What pricing options does airSlate SignNow offer for nonprofits needing Form 990 Or 990 EZ Schedule L support?

airSlate SignNow provides various pricing tiers to accommodate nonprofits looking for assistance with Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs. Our plans are designed to be cost-effective, ensuring that organizations of all sizes can access the necessary tools for efficient document management and eSigning. You can easily select a plan that fits your budget and needs.

-

Are there features specifically designed for Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs?

Yes, airSlate SignNow includes features tailored specifically for handling Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs. These features include customizable templates, audit trails, and secure cloud storage, ensuring all your transactions are properly documented and compliant. This makes managing your nonprofit's financial dealings simple and efficient.

-

Is airSlate SignNow compliant with IRS requirements for Form 990 Or 990 EZ Schedule L?

Absolutely! airSlate SignNow is designed with compliance in mind, including features that ensure you meet IRS requirements for Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs. Our platform helps you navigate legal stipulations while providing a user-friendly experience for your eSigning and document management needs.

-

Can airSlate SignNow integrate with other software for handling Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs?

Yes, airSlate SignNow integrates seamlessly with various accounting and finance software that can assist with Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs. This integration allows for a more streamlined workflow, enabling you to manage documents and financial data all in one place. Such connectivity enhances overall efficiency in your reporting processes.

-

What are the benefits of using airSlate SignNow for Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs?

Using airSlate SignNow for Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs offers numerous benefits. You gain a signNow amount of time through automating document workflows and eSigning, which decreases the risk of errors in your transactions. Additionally, secure storage and easy access to your documents facilitate compliance and transparency.

Get more for Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

- New jersey waiver form

- Notice pay rent 497319262 form

- Notice to pay rent or lease terminates for nonresidential or commercial property days of advance notice variable new jersey form

- 3 day form

- Notice termination lease form

- Nj assignment mortgage form

- Assignment of mortgage by corporate mortgage holder new jersey form

- New jersey assignment form

Find out other Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation