Form 8829 Expenses for Business Use of Your Home Irs

What is the Form 8829 Expenses For Business Use Of Your Home IRS

The Form 8829 is a tax form used by individuals who claim expenses for business use of their home. It allows taxpayers to calculate the allowable deductions for home office expenses, which can include mortgage interest, utilities, repairs, and depreciation. This form is particularly relevant for self-employed individuals or those who run a business from their residence. By detailing the expenses associated with the portion of the home used for business, taxpayers can potentially reduce their taxable income significantly.

How to use the Form 8829 Expenses For Business Use Of Your Home IRS

Using Form 8829 involves several steps to ensure accurate reporting of home office expenses. First, determine the portion of your home that is used for business purposes. This can be calculated based on the square footage of the office area compared to the total square footage of the home. Next, gather all relevant financial documents, including utility bills, mortgage statements, and receipts for repairs. Complete the form by entering these expenses in the appropriate sections, ensuring that calculations are accurate. Finally, attach the completed form to your tax return when filing.

Steps to complete the Form 8829 Expenses For Business Use Of Your Home IRS

Completing Form 8829 requires careful attention to detail. Follow these steps:

- Determine the percentage of your home used for business by dividing the square footage of your office by the total square footage of your home.

- List all eligible expenses, including direct and indirect costs. Direct expenses are those that apply only to the business area, while indirect expenses benefit the entire home.

- Calculate the total expenses and apply the business-use percentage to find the deductible amount.

- Complete the form sections accurately, ensuring all entries reflect the gathered documentation.

- Review the form for accuracy before submitting it with your tax return.

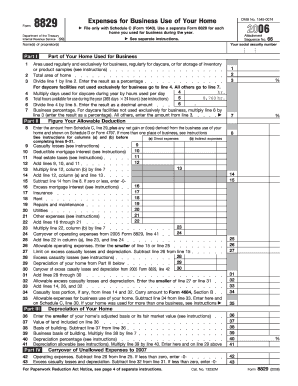

Key elements of the Form 8829 Expenses For Business Use Of Your Home IRS

Form 8829 consists of several key elements that taxpayers must understand. These include:

- Part I: This section requires information about the business use of the home, including the square footage used for business.

- Part II: Here, taxpayers report direct and indirect expenses related to the home office.

- Part III: This part focuses on the calculation of the home office deduction, including depreciation and other relevant expenses.

- Part IV: This section summarizes the total deduction claimed for the business use of the home.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8829. Taxpayers must ensure that their home office meets the "exclusive use" requirement, meaning the space must be used solely for business activities. Additionally, the IRS stipulates that the home office must be the principal place of business or a place where clients meet. It's essential to keep detailed records and receipts for all claimed expenses, as the IRS may require substantiation during an audit.

Eligibility Criteria

To be eligible to use Form 8829, taxpayers must meet certain criteria. The individual must be self-employed or a business owner using their home for business purposes. The space claimed must be used exclusively for business activities, and it should be the principal place of business or a location where clients are regularly met. Additionally, the taxpayer must maintain accurate records of all expenses related to the home office to substantiate the deductions claimed on the form.

Quick guide on how to complete 2006 form 8829 expenses for business use of your home irs

Complete Form 8829 Expenses For Business Use Of Your Home Irs seamlessly on any device

Online document administration has become increasingly popular with businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage Form 8829 Expenses For Business Use Of Your Home Irs on any device with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Form 8829 Expenses For Business Use Of Your Home Irs effortlessly

- Locate Form 8829 Expenses For Business Use Of Your Home Irs and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 8829 Expenses For Business Use Of Your Home Irs and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Form 8829 Expenses For Business Use Of Your Home Irs?

Form 8829 is a tax form used to calculate expenses for business use of your home, as outlined by the IRS. This form enables business owners to deduct specific costs associated with using part of their home as a workspace, which can signNowly reduce taxable income.

-

How can airSlate SignNow help with Form 8829 documentation?

airSlate SignNow simplifies the process of managing the documentation needed for filing Form 8829 Expenses For Business Use Of Your Home Irs. With its easy-to-use electronic signature features, you can sign and send your documents securely, ensuring that all necessary paperwork is completed efficiently.

-

Is there a cost to use airSlate SignNow for Form 8829 submissions?

airSlate SignNow offers a cost-effective solution for businesses that need to manage Form 8829 Expenses For Business Use Of Your Home Irs effectively. Pricing plans are competitive, and you can choose a tier that suits your business's needs without straining your budget.

-

What features does airSlate SignNow provide for managing IRS forms?

airSlate SignNow includes a variety of features that cater specifically to managing IRS forms like Form 8829. These features include customizable templates, secure e-signatures, cloud storage, and the ability to collect necessary data from clients or team members seamlessly.

-

Can I integrate airSlate SignNow with other accounting software for filing Form 8829?

Yes, airSlate SignNow integrates with various accounting software systems, making it easier to manage Form 8829 Expenses For Business Use Of Your Home Irs alongside your financial data. This integration helps streamline the process, ensuring accuracy and efficiency in filing tax documents.

-

What are the benefits of using airSlate SignNow for Form 8829?

Using airSlate SignNow for Form 8829 provides several benefits, including improved efficiency in document management and easier compliance with IRS regulations. By allowing users to eSign and send documents quickly, it ensures that all necessary forms are submitted on time and without hassle.

-

Is airSlate SignNow suitable for small businesses dealing with Form 8829?

Definitely! airSlate SignNow is particularly suitable for small businesses that need to manage Form 8829 Expenses For Business Use Of Your Home Irs effectively. Its user-friendly interface and cost-effective pricing make it accessible for small business owners who may not have extensive resources for document management.

Get more for Form 8829 Expenses For Business Use Of Your Home Irs

- Llc notices resolutions and other operations forms package new jersey

- Nj disclosure statement form

- Notice of dishonored check civil keywords bad check bounced check new jersey form

- Notice check bounced form

- Mutual wills containing last will and testaments for unmarried persons living together with no children new jersey form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children new jersey form

- Mutual wills or last will and testaments for unmarried persons living together with minor children new jersey form

- Nj cohabitation form

Find out other Form 8829 Expenses For Business Use Of Your Home Irs

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe