Individual Income Tax FormsNebraska Department of RevenueAbout Form 2210, Underpayment of Estimated Tax ByEstimated TaxesInterna

Understanding Form 2210 and Underpayment Penalties

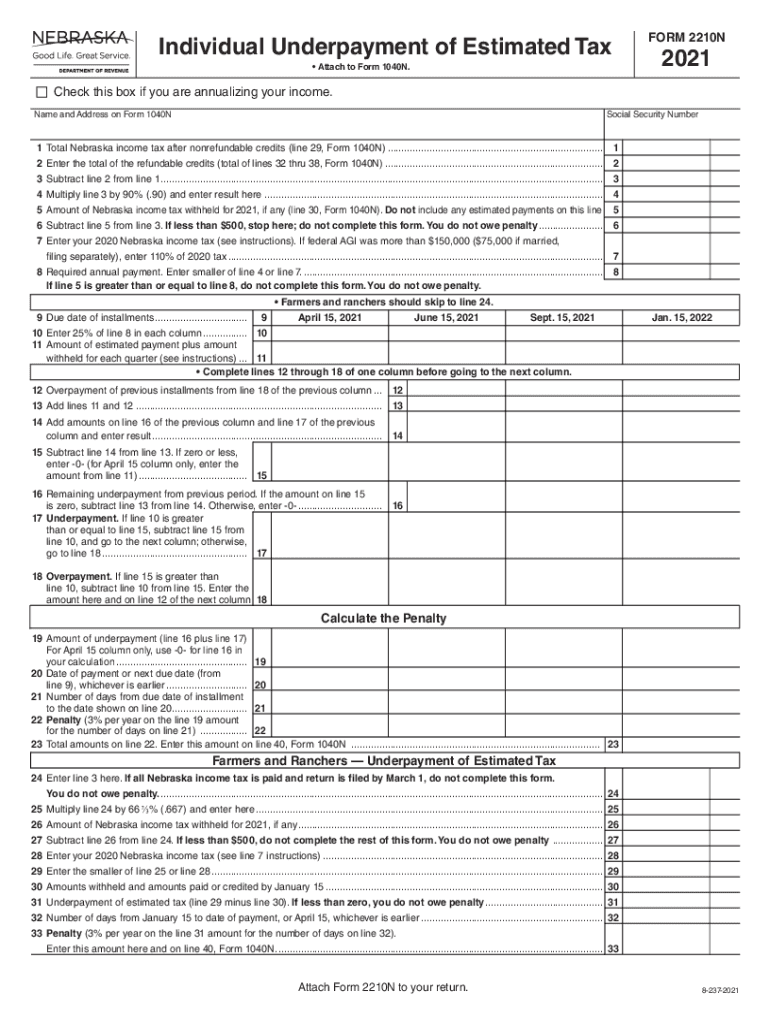

Form 2210 is used by taxpayers to determine if they owe a penalty for underpayment of estimated tax. This form is crucial for individuals who do not have enough tax withheld from their income throughout the year. The IRS requires taxpayers to pay a certain amount of their tax liability as they earn income, and failing to do so can result in penalties. The form helps assess whether the taxpayer qualifies for an exception or if they owe a penalty based on their specific tax situation.

Key Elements of Form 2210

Form 2210 consists of several key sections that guide taxpayers through the process of determining their underpayment status. These include:

- Part I: This section assesses whether you owe a penalty based on your total tax liability and the amount of tax you have paid throughout the year.

- Part II: This part allows taxpayers to calculate the penalty amount, if applicable, based on the underpayment amount and the number of days it was unpaid.

- Part III: Here, taxpayers can claim exceptions to the penalty, such as if they had no tax liability in the previous year or if their total tax owed is below a certain threshold.

Filing Deadlines for Form 2210

Timely filing of Form 2210 is essential to avoid additional penalties. The form should generally be submitted along with your annual tax return, typically due on April fifteenth. If you file for an extension, the deadline may be extended to October fifteenth, but it is important to ensure that you still meet the estimated tax payment requirements to avoid penalties.

Penalties for Non-Compliance

If you fail to file Form 2210 when required, or if you do not pay the appropriate amount of estimated tax, the IRS may impose penalties. These penalties can accumulate quickly, leading to significant financial consequences. The penalty is calculated based on the amount of underpayment and the number of days the payment is overdue. Understanding these penalties can help taxpayers manage their tax obligations more effectively.

State-Specific Rules for Form 2210

While Form 2210 is a federal form, some states have their own versions or additional requirements regarding underpayment of estimated taxes. For example, Nebraska has its own underpayment form, the Nebraska 2210N, which may have different rules or thresholds for penalties. Taxpayers should familiarize themselves with both federal and state requirements to ensure compliance and avoid unnecessary penalties.

Eligibility Criteria for Using Form 2210

To use Form 2210, taxpayers must meet specific eligibility criteria. Generally, you may need to file this form if you owe a penalty for underpayment of estimated tax. Additionally, if your total tax owed exceeds a certain amount, or if you did not have sufficient withholding, you may be required to complete this form. Understanding these criteria can help taxpayers determine if they need to file Form 2210.

Quick guide on how to complete individual income tax formsnebraska department of revenueabout form 2210 underpayment of estimated tax byestimated

Conveniently Prepare Individual Income Tax FormsNebraska Department Of RevenueAbout Form 2210, Underpayment Of Estimated Tax ByEstimated TaxesInterna on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed materials, allowing you to obtain the required forms and securely store them online. airSlate SignNow equips you with all the tools necessary to produce, modify, and eSign your documents quickly without any hold-ups. Manage Individual Income Tax FormsNebraska Department Of RevenueAbout Form 2210, Underpayment Of Estimated Tax ByEstimated TaxesInterna seamlessly on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and eSign Individual Income Tax FormsNebraska Department Of RevenueAbout Form 2210, Underpayment Of Estimated Tax ByEstimated TaxesInterna Effortlessly

- Obtain Individual Income Tax FormsNebraska Department Of RevenueAbout Form 2210, Underpayment Of Estimated Tax ByEstimated TaxesInterna and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or cover sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, text (SMS), invitation link, or download to your computer.

Eliminate the hassle of lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Edit and eSign Individual Income Tax FormsNebraska Department Of RevenueAbout Form 2210, Underpayment Of Estimated Tax ByEstimated TaxesInterna to ensure effective communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual income tax formsnebraska department of revenueabout form 2210 underpayment of estimated tax byestimated

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is Form 2210 and why is it important?

What is Form 2210? It is a tax form used by individuals to calculate penalties for underpayment of estimated tax. This form helps taxpayers understand whether they owe penalties for not paying enough tax during the year.

-

How can airSlate SignNow assist with submitting Form 2210?

Using airSlate SignNow, businesses can easily prepare and eSign Form 2210, making the submission process straightforward. This digital solution ensures that your forms are filled out correctly and submitted on time, avoiding potential penalties.

-

Is there a cost associated with eSigning Form 2210 using airSlate SignNow?

Yes, airSlate SignNow offers various plans that include eSigning features for documents like Form 2210. Pricing is competitive and provides businesses with a cost-effective solution for all their electronic signing needs.

-

What features does airSlate SignNow offer for completing Form 2210?

airSlate SignNow offers customizable templates and intuitive editing tools for completing Form 2210. Additionally, you can track the status of your forms and manage workflows to enhance efficiency.

-

Can I integrate airSlate SignNow with other software for Form 2210 management?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, enhancing how you manage Form 2210 and other documents. This integration allows for streamlined data flow and improved document handling.

-

What are the advantages of using airSlate SignNow for tax forms like Form 2210?

The main advantages of using airSlate SignNow include ease of use, cost savings, and enhanced security for your documents. You can quickly complete and eSign Form 2210 without the hassle of traditional paper processes.

-

How does airSlate SignNow ensure the security of Form 2210 submissions?

airSlate SignNow prioritizes security by employing advanced encryption methods and secure cloud storage for all documents, including Form 2210. This protects sensitive information during the signing and submission process.

Get more for Individual Income Tax FormsNebraska Department Of RevenueAbout Form 2210, Underpayment Of Estimated Tax ByEstimated TaxesInterna

- Excavation contractor package new jersey form

- Renovation contractor package new jersey form

- Concrete mason contractor package new jersey form

- Demolition contractor package new jersey form

- Security contractor package new jersey form

- Insulation contractor package new jersey form

- Paving contractor package new jersey form

- Site work contractor package new jersey form

Find out other Individual Income Tax FormsNebraska Department Of RevenueAbout Form 2210, Underpayment Of Estimated Tax ByEstimated TaxesInterna

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement