Wilmington DE 19899 8750 2013

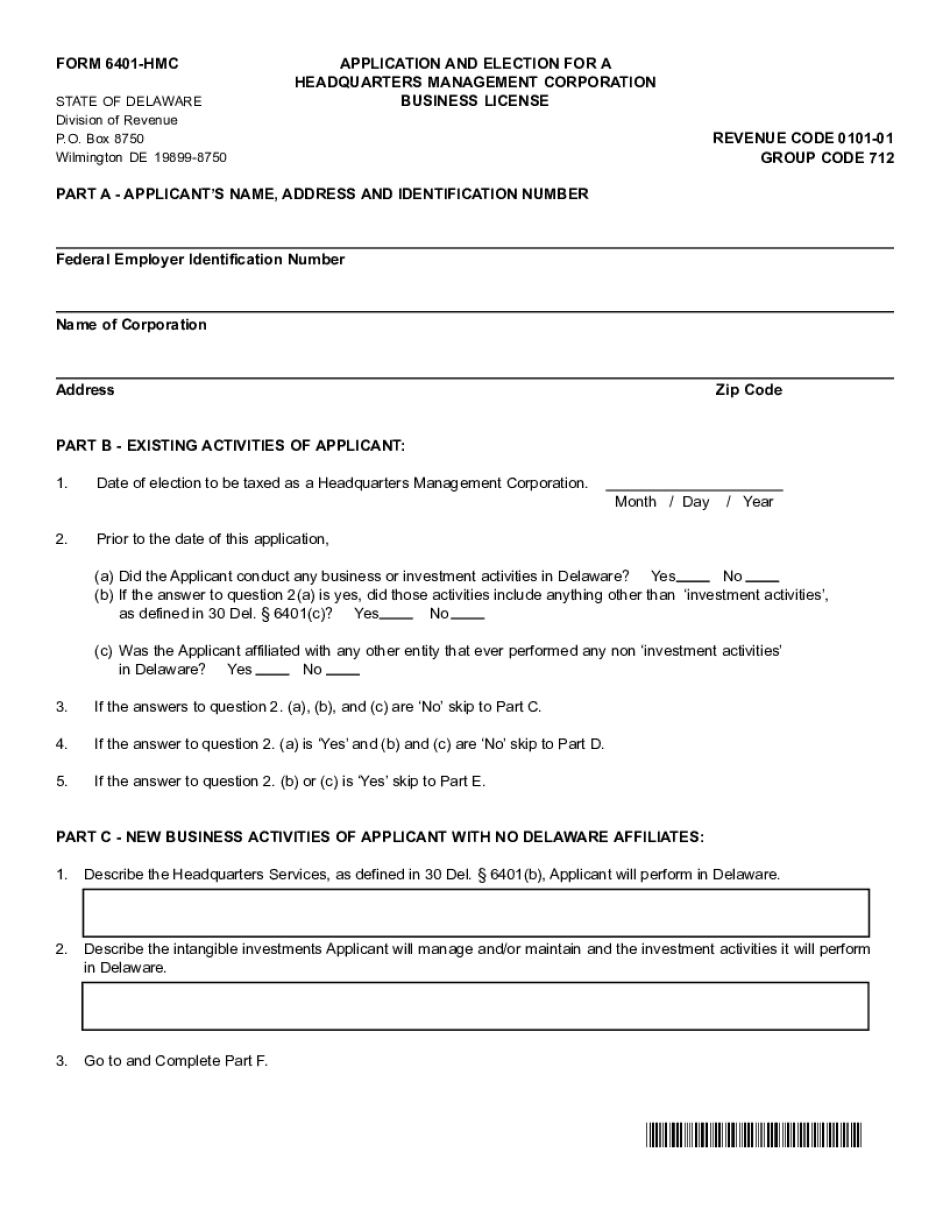

What is Form 6401?

Form 6401 is a document used primarily for tax purposes in the United States. It is often associated with specific tax reporting requirements that individuals or businesses must fulfill. Understanding the purpose of Form 6401 is crucial for ensuring compliance with IRS regulations. This form may be required for various financial transactions or reporting obligations, depending on the taxpayer's situation.

Steps to Complete Form 6401

Completing Form 6401 involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents and information relevant to the form. This may include income statements, expense records, and any other pertinent data. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, whether electronically or by mail.

Legal Use of Form 6401

Form 6401 must be used in accordance with IRS regulations to maintain its legal standing. This includes ensuring that the information provided is truthful and accurate. Misrepresentation or errors on the form can lead to penalties or legal issues. It is important to understand the legal implications of submitting this form and to keep records of the submission for future reference.

Filing Deadlines / Important Dates

Being aware of the filing deadlines for Form 6401 is essential for compliance. The IRS typically sets specific dates by which the form must be submitted, which may vary based on the type of taxpayer or the nature of the form. Missing these deadlines can result in penalties or additional interest on any taxes owed. Always check the IRS website or consult a tax professional for the most current deadlines related to Form 6401.

Who Issues Form 6401?

Form 6401 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations. It is important to refer to the official IRS documentation when working with Form 6401 to ensure compliance with all regulations.

Required Documents

To complete Form 6401, certain documents are typically required. These may include proof of income, expense records, and any other financial documentation relevant to the information being reported. Having these documents on hand will facilitate a smoother completion process and help ensure that the form is filled out accurately. Always verify the specific requirements for your situation based on IRS guidelines.

Quick guide on how to complete wilmington de 19899 8750

Complete Wilmington DE 19899 8750 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Wilmington DE 19899 8750 on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric workflow today.

How to adjust and eSign Wilmington DE 19899 8750 with ease

- Obtain Wilmington DE 19899 8750 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for such tasks.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Adjust and eSign Wilmington DE 19899 8750 while ensuring effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wilmington de 19899 8750

Create this form in 5 minutes!

How to create an eSignature for the wilmington de 19899 8750

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the form 6401 used for?

The form 6401 is primarily used for requesting a tax refund or credit. By utilizing the form 6401, businesses can efficiently handle their tax-related documentation, ensuring compliance and reducing delays in processing.

-

How can airSlate SignNow help with form 6401?

airSlate SignNow allows users to easily upload, sign, and send the form 6401 electronically. This not only saves time but also enhances accuracy by minimizing the chances of errors commonly associated with manual submissions.

-

What are the pricing options for using airSlate SignNow with form 6401?

airSlate SignNow offers various pricing plans tailored to different business needs. Depending on the features you choose, the plans are designed to be cost-effective, providing you with the tools necessary to manage documents like the form 6401 efficiently.

-

Does airSlate SignNow support integrations for submitting form 6401?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easier to submit the form 6401 alongside other documentation. These integrations enhance workflow efficiency, facilitating smooth data transfer and management.

-

What features does airSlate SignNow offer for managing form 6401?

Key features of airSlate SignNow include document templates, tracking, and secure signing options specifically for form 6401. These tools streamline the workflow, allowing you to manage your documents with ease while maintaining compliance.

-

Is airSlate SignNow compliant with legal standards for form 6401?

Absolutely! airSlate SignNow is fully compliant with legal standards for electronic signatures and document management, ensuring that your form 6401 is processed in accordance with regulations. This compliance gives you peace of mind as you handle sensitive documents.

-

Can I track the status of my form 6401 submissions with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your form 6401 submissions. This feature allows you to monitor who has signed and manage document statuses, which enhances accountability and transparency in your processes.

Get more for Wilmington DE 19899 8750

Find out other Wilmington DE 19899 8750

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF