Form 6401 2011

What is the Form 6401

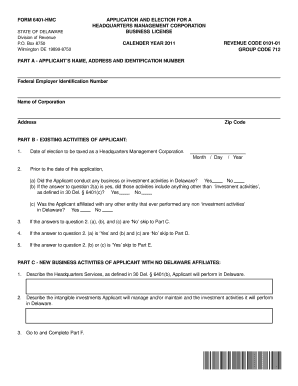

The Form 6401 is a tax-related document used in the United States, primarily for reporting certain types of income or expenses. It serves as a means for individuals and businesses to communicate specific financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for accurate tax reporting and compliance with federal regulations.

How to use the Form 6401

Using the Form 6401 involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary documentation that supports the entries on the form, such as receipts, income statements, or other relevant financial records. Next, carefully fill out each section of the form, ensuring that all required fields are completed. It is important to double-check the accuracy of the information before submission to avoid potential issues with the IRS.

Steps to complete the Form 6401

Completing the Form 6401 requires a systematic approach. Follow these steps:

- Review the form's instructions thoroughly to understand each section.

- Collect all supporting documents that relate to the information you need to report.

- Fill out the form carefully, entering data in the appropriate fields.

- Verify that all calculations are correct and that no information is missing.

- Sign and date the form as required before submission.

Legal use of the Form 6401

The legal use of the Form 6401 is governed by IRS regulations. To ensure that the form is considered valid, it must be completed accurately and submitted within the specified deadlines. Additionally, using a reliable method for eSigning the form can enhance its legal standing. Compliance with relevant laws, such as the ESIGN Act, ensures that electronically signed documents are legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Form 6401 vary depending on the specific type of income or expense being reported. Generally, it is advisable to submit the form by the annual tax deadline, which is typically April 15 for individual taxpayers. Businesses may have different deadlines based on their fiscal year. Staying informed about these dates is essential to avoid penalties and ensure timely compliance.

Required Documents

When completing the Form 6401, certain documents are required to substantiate the information reported. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Any additional documentation that supports claims made on the form.

Having these documents readily available will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete form 6401

Effortlessly Prepare Form 6401 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent green alternative to traditional printed and signed documents, allowing you to locate the required form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Form 6401 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Method to Edit and Electronically Sign Form 6401 Seamlessly

- Locate Form 6401 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a standard handwritten signature.

- Review the information thoroughly and click on the Done button to save your adjustments.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form 6401 while ensuring remarkable communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6401

Create this form in 5 minutes!

People also ask

-

What is form 6401 and how is it used in airSlate SignNow?

Form 6401 is a specific document often used in various business applications, and airSlate SignNow facilitates its electronic signature process. By using airSlate SignNow, you can easily send, receive, and eSign form 6401, streamlining your workflow and ensuring compliance. This makes the entire process quicker and more efficient for your business.

-

How does airSlate SignNow ensure the security of form 6401?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your form 6401 and other sensitive documents. By ensuring that your data is safe, you can confidently eSign and manage form 6401, minimizing risks associated with data bsignNowes. Our commitment to security gives businesses peace of mind while handling sensitive information.

-

What are the pricing options for airSlate SignNow when using form 6401?

airSlate SignNow offers flexible pricing plans designed to meet varying business needs while using form 6401. Whether you are a small business or a large enterprise, you'll find a plan that fits your budget. Explore our plans to see how you can save time and money when managing form 6401 through our platform.

-

Can multiple users collaborate on form 6401 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 6401 effectively. This feature supports team collaboration, where different team members can review, comment, and eSign the document in a secure and organized manner. This greatly enhances productivity and keeps your projects moving forward seamlessly.

-

What features of airSlate SignNow enhance the eSigning process for form 6401?

airSlate SignNow provides a range of features that enhance the eSigning process for form 6401, including template creation, automated reminders, and real-time tracking. These features help you manage your document signing workflows efficiently, reducing turnaround times and improving customer satisfaction. With airSlate SignNow, signing form 6401 is not only easy but also highly effective.

-

Is it easy to integrate airSlate SignNow with other applications when handling form 6401?

Absolutely! airSlate SignNow offers seamless integrations with hundreds of popular applications, allowing you to manage form 6401 within your existing workflows. Whether you use CRMs like Salesforce or document management tools like Google Drive, integrating airSlate SignNow simplifies your processes and saves time. This way, you can focus more on your business rather than managing paperwork.

-

How can airSlate SignNow improve the efficiency of processing form 6401?

Using airSlate SignNow can signNowly improve the efficiency of processing form 6401 by automating the signing and submission steps. This reduces the time spent on manual paperwork, facilitating faster approvals and turnaround. As a result, your business can operate more smoothly and focus on core activities, ultimately driving growth.

Get more for Form 6401

- Form 11 application for consent ordersdoc

- Publication 15 internal revenue service form

- Fillable online mass superior court department docket no form

- Computer loan program irs tax forms

- Tax and estimated withholding irsgov form

- 6292 fill out and sign printable pdf templatesignnow form

- Irs publication 6292 a 2020 2021 fill and sign printable form

- Jis code lgm form

Find out other Form 6401

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online