Form 886 L

What is the Form 886 L

The Form 886 L is a document used by taxpayers to report specific information related to their tax obligations. This form is primarily utilized for compliance with IRS regulations, ensuring that individuals and businesses accurately disclose their financial activities. Understanding the purpose of Form 886 L is essential for maintaining proper tax records and meeting legal requirements.

How to use the Form 886 L

Using Form 886 L involves several steps to ensure accurate completion. First, gather all necessary financial documents that pertain to your tax situation. Next, fill out the form with the required information, ensuring that all entries are correct and complete. Once filled, review the form for any errors before submitting it to the IRS. Proper usage of Form 886 L can help prevent delays in processing and potential penalties.

Steps to complete the Form 886 L

Completing Form 886 L requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Fill in your personal information, such as name, address, and Social Security number.

- Provide details regarding your financial activities as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

By following these steps, you can ensure that your Form 886 L is correctly completed and ready for submission.

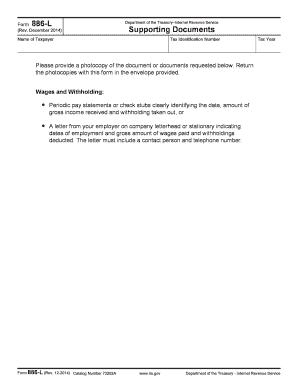

Required Documents

When preparing to complete Form 886 L, certain documents are necessary to provide accurate information. These may include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Any supporting documentation that pertains to deductions or credits claimed.

Having these documents on hand will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Legal use of the Form 886 L

The legal use of Form 886 L is governed by IRS guidelines, which stipulate that the form must be filled out accurately and submitted within designated time frames. Failure to comply with these regulations can result in penalties or audits. It is crucial to understand the legal implications of the information provided on this form, as it serves as an official record of your tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for Form 886 L are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth for most taxpayers. However, extensions may be available under certain circumstances. Keeping track of these important dates ensures compliance and helps maintain good standing with the IRS.

Quick guide on how to complete form 886 l

Complete Form 886 L seamlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Form 886 L on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Form 886 L effortlessly

- Locate Form 886 L and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 886 L and ensure clear communication at any point of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 886 l?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents digitally. The reference to '886 l' highlights its advanced features and efficiency, making document management seamless and effective for organizations of all sizes.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business needs. With options designed for small teams to enterprises, you can choose a plan that provides the best value while utilizing the features associated with '886 l.'

-

What key features does airSlate SignNow offer?

airSlate SignNow includes features like customizable templates, automated workflows, and secure document storage. These features enhance productivity and align with the standard practices of using '886 l' in document management.

-

How can airSlate SignNow benefit my business?

By implementing airSlate SignNow, businesses can streamline their document signing processes, save time, and reduce costs. The easy-to-use interface and robust features associated with '886 l' empower teams to focus on what matters most—growing the business.

-

Is airSlate SignNow suitable for small businesses?

Yes, airSlate SignNow is incredibly suitable for small businesses looking to optimize their document signing process. With its affordable plans and features tailored for efficiency, businesses can leverage the advantages of '886 l' without a hefty investment.

-

What integrations does airSlate SignNow support?

airSlate SignNow supports a wide range of integrations with popular business applications like Google Drive, Salesforce, and others. These integrations enhance functionality and provide a seamless experience, especially for those utilizing '886 l' in their workflows.

-

Is airSlate SignNow secure for signing confidential documents?

Absolutely! airSlate SignNow employs industry-standard security measures to protect your data and documents. By using end-to-end encryption and compliance with regulations, it ensures that the signing of confidential documents using '886 l' remains secure.

Get more for Form 886 L

- Minnesota amended form

- Notice of prehearing efforts to reach settlement minnesota form

- Notice of default on residential lease minnesota form

- Model affidavit requesting unspecified relief template minnesota form

- Amended judgment decree form

- Mn template form

- Minnesota dissolution form

- Minnesota landlord tenant 497312324 form

Find out other Form 886 L

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form