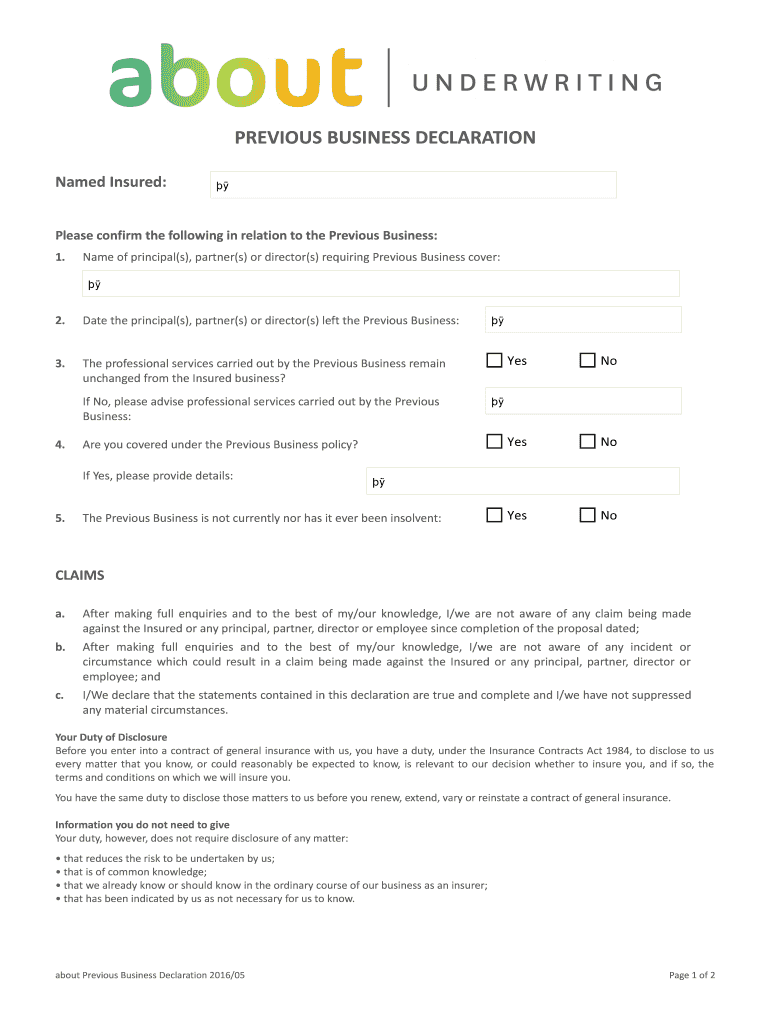

PREVIOUS BUSINESS DECLARATION Form

What is the Previous Business Declaration

The Previous Business Declaration is a formal document used by businesses to disclose prior business activities, including ownership, management, and operational history. This declaration is often required for various legal and regulatory purposes, including tax filings and compliance with state and federal regulations. It serves to provide transparency and ensure that all relevant information about a business's history is available to authorities and stakeholders.

Steps to Complete the Previous Business Declaration

Completing the Previous Business Declaration involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding your previous business activities, including business names, addresses, and the nature of operations. Next, fill out the form with precise details, ensuring that all entries are truthful and complete. After completing the form, review it for any errors or omissions. Finally, sign the document electronically or by hand, depending on the submission method required.

Legal Use of the Previous Business Declaration

The Previous Business Declaration is legally binding when completed accurately and submitted in compliance with applicable laws. It is essential to understand the legal implications of the information provided, as inaccuracies can lead to penalties or legal repercussions. By utilizing a reliable electronic signature solution, businesses can ensure that their declarations meet legal standards and are protected under laws such as the ESIGN Act and UETA.

Required Documents

When preparing to submit the Previous Business Declaration, certain documents may be required to support the information provided. Commonly required documents include:

- Proof of previous business registration or incorporation

- Financial statements from previous business operations

- Tax returns related to the previous business

- Any relevant licenses or permits

Gathering these documents in advance can streamline the completion process and ensure that your declaration is comprehensive.

Form Submission Methods

The Previous Business Declaration can typically be submitted through various methods, including online platforms, mail, or in-person at designated offices. Online submission is often the most efficient, allowing for quicker processing and confirmation. When submitting by mail, ensure that you use a secure method and retain proof of mailing. In-person submissions may be required in certain jurisdictions, so it is important to check local regulations.

Examples of Using the Previous Business Declaration

Businesses may need to use the Previous Business Declaration in various scenarios, including:

- Applying for new business licenses or permits

- Filing taxes for a new entity that has taken over previous operations

- Responding to inquiries from regulatory bodies regarding business history

- Participating in mergers or acquisitions where prior business activities must be disclosed

Understanding these use cases can help businesses prepare for situations where the declaration is necessary.

Quick guide on how to complete previous business declaration

Prepare PREVIOUS BUSINESS DECLARATION seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage PREVIOUS BUSINESS DECLARATION on any system with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign PREVIOUS BUSINESS DECLARATION effortlessly

- Find PREVIOUS BUSINESS DECLARATION and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign PREVIOUS BUSINESS DECLARATION and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a PREVIOUS BUSINESS DECLARATION and why is it important?

A PREVIOUS BUSINESS DECLARATION is a formal statement that outlines key information about a business's past operations and financial activities. This document is essential for various processes such as securing loans, applying for licenses, or participating in contracts. Understanding how to properly create and manage a PREVIOUS BUSINESS DECLARATION can signNowly impact your business's credibility and trustworthiness.

-

How can airSlate SignNow help with creating a PREVIOUS BUSINESS DECLARATION?

airSlate SignNow provides a streamlined process for drafting and eSigning your PREVIOUS BUSINESS DECLARATION. With our user-friendly interface, you can easily customize templates, add necessary fields, and collaborate with your team in real-time. This eliminates the time-consuming paper trail, ensuring your document is ready quickly and efficiently.

-

What features does airSlate SignNow offer for managing a PREVIOUS BUSINESS DECLARATION?

airSlate SignNow includes features such as document templates, secure eSignature collection, automated workflows, and detailed tracking. These features enable you to manage your PREVIOUS BUSINESS DECLARATION effortlessly, ensuring it meets legal standards while maintaining ease of use. Plus, you can store and retrieve your documents securely anytime, anywhere.

-

Is there a cost associated with using airSlate SignNow for a PREVIOUS BUSINESS DECLARATION?

While airSlate SignNow offers several pricing plans, the cost will depend on your specific usage and feature requirements. We provide flexible subscription options that cater to small businesses and enterprises alike. Investing in a reliable eSigning solution can save you time and resources in managing your PREVIOUS BUSINESS DECLARATION efficiently.

-

Can I integrate airSlate SignNow with other tools for handling a PREVIOUS BUSINESS DECLARATION?

Yes, airSlate SignNow supports integration with popular business tools like Google Workspace, Salesforce, and Microsoft 365. These integrations allow you to automatically import data and collaborate seamlessly, enhancing the management process of your PREVIOUS BUSINESS DECLARATION. This connectivity simplifies workflow and boosts productivity for your team.

-

What are the benefits of using airSlate SignNow for my PREVIOUS BUSINESS DECLARATION?

Using airSlate SignNow for your PREVIOUS BUSINESS DECLARATION offers numerous benefits, including fast document turnaround, enhanced security, and improved compliance. Our platform ensures your documents are protected with encryption and complies with industry standards. This efficiency leads to better business operations and a stronger reputation in your field.

-

How can I ensure my PREVIOUS BUSINESS DECLARATION is legally compliant using airSlate SignNow?

airSlate SignNow includes compliance features that adhere to various legal standards, helping ensure that your PREVIOUS BUSINESS DECLARATION is valid and enforceable. We offer features like timestamping and detailed audit trails to document the signing process accurately. This helps you maintain compliance and legal integrity for your critical business documents.

Get more for PREVIOUS BUSINESS DECLARATION

- Warranty deed from limited partnership or llc is the grantor or grantee new mexico form

- Nm warranty form

- Warranty deed form nm

- Deed personal form

- New mexico quitclaim deed 497320384 form

- Warranty deed for co trustees to husband and wife as tenants in common or as community property new mexico form

- New mexico warranty deed form

- New mexico form 497320387

Find out other PREVIOUS BUSINESS DECLARATION

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF