503 B 9 Form

What is the 503 B 9 Form

The 503 B 9 form is a specific document used in the United States, primarily for regulatory compliance and reporting purposes. It is often associated with various legal and financial processes, ensuring that organizations adhere to applicable laws and regulations. This form plays a crucial role in maintaining transparency and accountability within businesses, particularly in industries that are heavily regulated.

How to use the 503 B 9 Form

Using the 503 B 9 form involves several straightforward steps. First, ensure that you have the correct version of the form, as updates may occur periodically. Next, fill out the required fields accurately, providing all necessary information as requested. After completing the form, review it for any errors or omissions before submitting it. Depending on the requirements, you may need to submit the form electronically or via traditional mail.

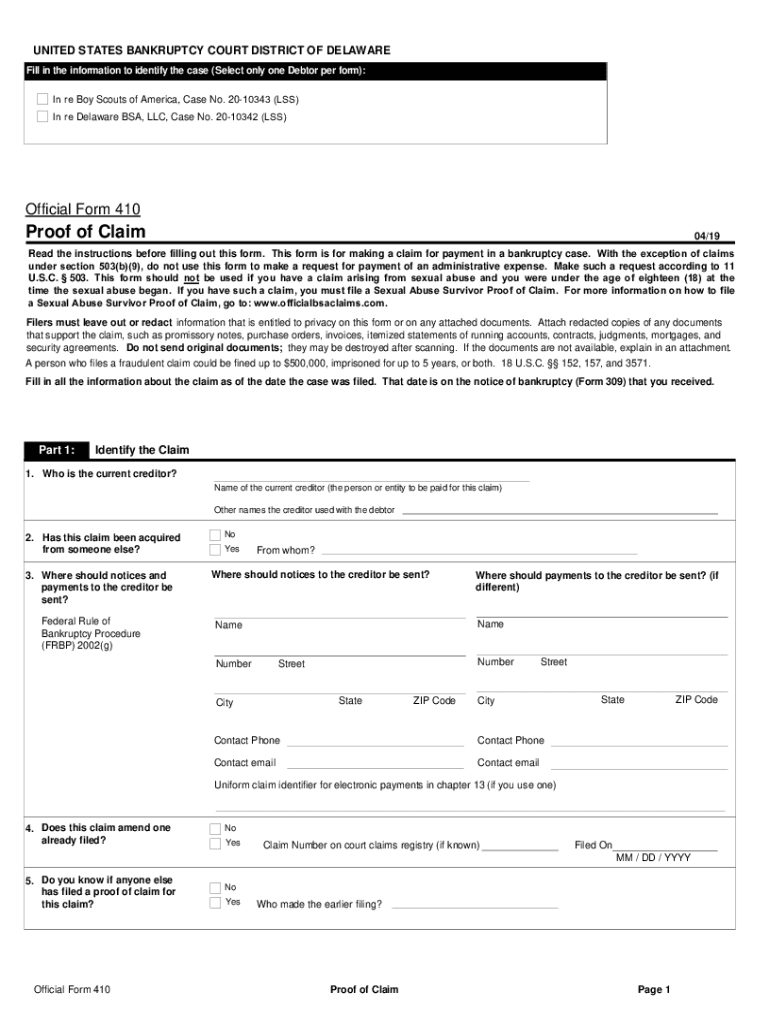

Steps to complete the 503 B 9 Form

Completing the 503 B 9 form requires careful attention to detail. Here are the essential steps:

- Gather all necessary information, including identification details and any relevant financial data.

- Access the latest version of the 503 B 9 form from a reliable source.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check for any errors or missing information.

- Submit the form according to the specified submission guidelines.

Legal use of the 503 B 9 Form

The legal use of the 503 B 9 form is paramount for compliance with federal and state regulations. To be considered valid, the form must be filled out correctly and submitted within the designated timeframes. Additionally, it is essential to retain copies of submitted forms for record-keeping and potential audits. Adhering to legal requirements ensures that the form serves its intended purpose without complications.

Key elements of the 503 B 9 Form

The 503 B 9 form contains several key elements that are critical for its validity. These include:

- Identification information of the individual or entity submitting the form.

- Details relevant to the specific regulatory requirements being addressed.

- Signature of the authorized representative, which may be required to validate the submission.

- Date of completion and submission to establish a timeline for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 503 B 9 form can vary based on the specific regulatory context in which it is used. It is crucial to be aware of these deadlines to avoid penalties or non-compliance issues. Typically, deadlines will be outlined in the instructions accompanying the form or in relevant regulatory guidelines. Keeping a calendar of important dates can help ensure timely submissions.

Quick guide on how to complete 503 b 9 form

Complete 503 B 9 Form seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage 503 B 9 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign 503 B 9 Form with ease

- Find 503 B 9 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors needing the reprinting of new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from a device of your choice. Edit and electronically sign 503 B 9 Form to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 503 b 9 form?

The 503 b 9 form is a specific document used in various organizations to provide necessary details regarding certain transactions or processes. This form helps ensure compliance with regulatory requirements and captures essential information for record-keeping.

-

How can airSlate SignNow help with the 503 b 9 form?

AirSlate SignNow provides a seamless platform to create, send, and eSign your 503 b 9 form efficiently. With its intuitive interface, you can easily customize the form, ensuring that all required fields are captured, enhancing the user experience and reducing turnaround time.

-

Is there a cost associated with using airSlate SignNow for the 503 b 9 form?

Yes, airSlate SignNow offers a range of pricing plans suitable for businesses of all sizes. Each plan provides access to essential features for managing the 503 b 9 form, and you can choose one that fits your budget and specific needs.

-

What features does airSlate SignNow offer for the 503 b 9 form?

AirSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and tracking tools for your 503 b 9 form. These features streamline the signing process and ensure your documents are processed without delays.

-

Are there integrations available with airSlate SignNow for the 503 b 9 form?

Yes, airSlate SignNow supports integrations with various software tools that can enhance the use of the 503 b 9 form. This includes CRMs, document management systems, and cloud storage solutions, making it easy to manage your documents in one place.

-

What are the benefits of using airSlate SignNow for the 503 b 9 form?

Using airSlate SignNow for your 503 b 9 form provides several benefits, including enhanced workflow efficiency, reduced paper usage, and faster processing times. The platform's user-friendly design ensures that your team can adapt quickly, increasing productivity.

-

Can I track the status of my 503 b 9 form using airSlate SignNow?

Absolutely! AirSlate SignNow offers real-time tracking features that allow you to monitor the status of your 503 b 9 form. You will receive notifications on when the form has been sent, viewed, and signed, ensuring you remain informed throughout the process.

Get more for 503 B 9 Form

- New york prenuptial premarital agreement with financial statements new york form

- Ny financial form

- Amendment to prenuptial or premarital agreement new york form

- Financial statements only in connection with prenuptial premarital agreement new york form

- Revocation of premarital or prenuptial agreement new york form

- New york divorce 497321124 form

- Uncontested divorce package for dissolution of marriage with no children with or without property and debts property and or form

- New york business corporation form

Find out other 503 B 9 Form

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement