H 3 Model Disclosure Form

What is the H 3 Model Disclosure

The H 3 Model Disclosure is a standardized form used primarily in the context of residential mortgage lending. It provides essential information about the terms and conditions of a loan, including interest rates, payment schedules, and potential fees. This disclosure is designed to ensure transparency between lenders and borrowers, allowing individuals to make informed decisions regarding their financial commitments. The H 3 Model Disclosure is particularly important for understanding the total cost of a loan and the implications of various financing options.

How to Use the H 3 Model Disclosure

Utilizing the H 3 Model Disclosure involves a few straightforward steps. First, borrowers should carefully review the document to understand the loan's key terms. This includes the annual percentage rate (APR), monthly payment amounts, and any applicable fees. Next, it is advisable to compare this disclosure with other loan offers to assess which option aligns best with financial goals. Borrowers should also consult with financial advisors or real estate professionals if they have questions about specific terms or conditions outlined in the disclosure.

Steps to Complete the H 3 Model Disclosure

Completing the H 3 Model Disclosure requires careful attention to detail. Here are the steps involved:

- Gather necessary financial documents, including income statements and credit reports.

- Fill out the form with accurate information regarding the loan amount, interest rate, and term length.

- Include any additional fees or costs associated with the loan.

- Review the completed disclosure for accuracy and completeness.

- Submit the disclosure to the lender as part of the loan application process.

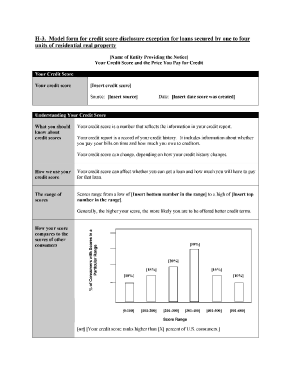

Key Elements of the H 3 Model Disclosure

The H 3 Model Disclosure consists of several critical components that borrowers should understand:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Monthly Payments: The amount due each month for the duration of the loan.

- Fees: Any additional costs that may apply, such as closing costs or origination fees.

- Loan Term: The length of time over which the loan will be repaid.

Legal Use of the H 3 Model Disclosure

The H 3 Model Disclosure is legally binding and must comply with federal regulations set forth by the Consumer Financial Protection Bureau (CFPB). Lenders are required to provide this disclosure to borrowers in a timely manner, typically within three business days of receiving a loan application. Failure to provide the disclosure or inaccuracies within the document can lead to penalties for the lender and may impact the borrower's ability to secure financing.

Examples of Using the H 3 Model Disclosure

Examples of scenarios where the H 3 Model Disclosure is utilized include:

- A first-time homebuyer seeking a mortgage for a new property.

- A homeowner refinancing an existing mortgage to secure a lower interest rate.

- A borrower considering various loan options to finance a home renovation project.

In each case, the H 3 Model Disclosure serves as a critical tool for understanding the financial implications of the loan agreement.

Quick guide on how to complete h 3 model disclosure

Effortlessly Prepare H 3 Model Disclosure on Any Device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage H 3 Model Disclosure on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign H 3 Model Disclosure with Ease

- Find H 3 Model Disclosure and click Get Form to commence.

- Use the tools we offer to fill out your form.

- Mark pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and hit the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign H 3 Model Disclosure while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the h 3 model disclosure and how does it work?

The h 3 model disclosure outlines the transparency and functionalities of airSlate SignNow's eSigning services. It provides users with a clear understanding of compliance, security features, and the overall process involved in sending and signing documents electronically. This model ensures that all parties are informed and protected throughout the eSigning process.

-

How can businesses benefit from the h 3 model disclosure?

The h 3 model disclosure helps businesses by providing a comprehensive framework that guarantees compliance with legal standards. By understanding these disclosures, companies can make informed choices about their eSigning solutions and enhance their practice of document management. This transparency fosters trust and promotes smoother transactions with clients.

-

Does airSlate SignNow's pricing include features related to the h 3 model disclosure?

Yes, airSlate SignNow's pricing is designed to include crucial features aligned with the h 3 model disclosure. This includes easy access to compliance documents, security measures, and personalized support services. By subscribing to our various plans, businesses receive valuable resources that enhance their eSigning experience.

-

What integrations does airSlate SignNow offer to support the h 3 model disclosure?

airSlate SignNow integrates seamlessly with various third-party applications to enhance the h 3 model disclosure experience. Popular integrations include CRM software, document management systems, and cloud storage solutions, allowing businesses to streamline their workflows and maintain organized records of eSigned documents. These integrations facilitate a more efficient document handling process.

-

Is airSlate SignNow secure in relation to the h 3 model disclosure?

Absolutely, airSlate SignNow prioritizes security in alignment with the h 3 model disclosure. Our platform uses advanced encryption methods and adheres to stringent compliance standards to protect sensitive data. This ensures that all signed documents are secure and that businesses can confidently use our eSigning service without concerns about data integrity.

-

What are the unique features of airSlate SignNow related to the h 3 model disclosure?

Key features of airSlate SignNow in relation to the h 3 model disclosure include customizable templates, audit trails, and the ability to track document progress. These advantages not only simplify the eSigning process but also provide essential documentation and accountability. By leveraging these features, users can ensure compliance and enhance their document management practices.

-

How can I ensure compliance with the h 3 model disclosure when using airSlate SignNow?

To ensure compliance with the h 3 model disclosure while using airSlate SignNow, users should familiarize themselves with the provided documentation and compliance resources. Our platform offers guidance on how to use features that promote legal adherence, such as securing eSignatures and maintaining detailed records. Regular training and updates on compliance practices further enhance understanding.

Get more for H 3 Model Disclosure

- Answers to interrogatories mississippi form

- Order administrative judge form

- Petition for review of decision mississippi form

- Ms compensation commission form

- Notice of controversion mississippi form

- Claimants first set of interrogatories to employer and carrier mississippi form

- Claimants first set of request for production mississippi form

- Request for production of documents to carrier mississippi form

Find out other H 3 Model Disclosure

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free