1042 S Form

What is the 1042 S Form

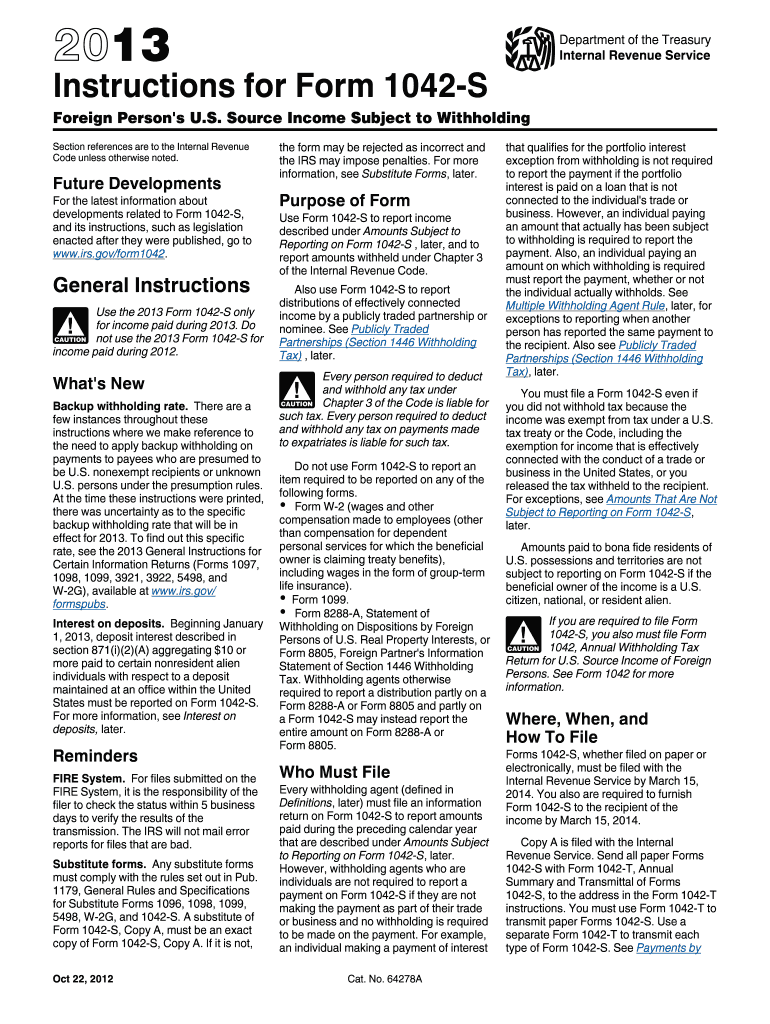

The 1042 S Form is a tax document used by the Internal Revenue Service (IRS) in the United States. It is primarily utilized to report income paid to foreign persons, including non-resident aliens and foreign entities. This form is essential for withholding agents who are responsible for withholding income tax on certain types of payments made to non-U.S. residents. The 1042 S Form provides detailed information about the income paid, the amount withheld, and the recipient's tax identification number, if applicable.

How to use the 1042 S Form

Using the 1042 S Form involves several key steps. First, the withholding agent must determine if the payment made to a foreign person is subject to withholding tax. If so, the agent must complete the form accurately, ensuring that all necessary information is included. This includes the recipient's name, address, and the type of income being reported. After completing the form, it must be submitted to the IRS along with any required tax payments. The recipient of the income should also receive a copy of the 1042 S Form for their records, as it is crucial for their own tax reporting purposes.

Steps to complete the 1042 S Form

Completing the 1042 S Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information about the foreign recipient, including their name, address, and tax identification number.

- Identify the type of income being reported, such as interest, dividends, or royalties.

- Calculate the total amount of income paid and the amount of tax withheld.

- Fill out the form, ensuring that all fields are completed accurately.

- Submit the completed form to the IRS by the specified deadline.

- Provide a copy of the form to the recipient for their records.

Filing Deadlines / Important Dates

Filing deadlines for the 1042 S Form are crucial for compliance. The form must be filed with the IRS by March 15 of the year following the calendar year in which the income was paid. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, withholding agents must provide copies of the 1042 S Form to recipients by the same date. It is important to stay informed about any changes to these deadlines to avoid penalties.

Legal use of the 1042 S Form

The legal use of the 1042 S Form is governed by IRS regulations. This form must be used to report payments made to foreign persons that are subject to U.S. withholding tax. Proper completion and timely submission of the form are essential to ensure compliance with U.S. tax laws. Failure to file the 1042 S Form or inaccuracies in the information reported can lead to penalties for the withholding agent. Therefore, understanding the legal implications and requirements associated with this form is vital for all parties involved.

Who Issues the Form

The 1042 S Form is issued by the Internal Revenue Service (IRS). Withholding agents, such as businesses or financial institutions making payments to foreign individuals or entities, are responsible for completing and submitting the form. The IRS provides guidelines and instructions for filling out the form correctly, ensuring that all necessary information is reported accurately. It is essential for withholding agents to stay updated on any changes in IRS regulations regarding the issuance and use of the 1042 S Form.

Quick guide on how to complete 1042 s 2012 form

Effortlessly Prepare 1042 S Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage 1042 S Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign 1042 S Form without stress

- Find 1042 S Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the paperwork or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1042 S Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 1042 S Form and who needs it?

The 1042 S Form is a tax form used to report income paid to non-resident aliens in the United States. If your business pays such income, you are required to file this form to ensure compliance with IRS regulations.

-

How does airSlate SignNow simplify the completion of the 1042 S Form?

airSlate SignNow provides an intuitive platform for completing the 1042 S Form electronically. With features like eSignature capabilities and document templates, businesses can efficiently prepare, send, and sign the form without hassle.

-

What are the pricing options for using airSlate SignNow for the 1042 S Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan based on your document volume and features needed, ensuring you get the best value when managing the 1042 S Form.

-

Can I integrate airSlate SignNow with other software for the 1042 S Form?

Yes, airSlate SignNow supports various integrations with popular business applications. This enables you to streamline your document workflows, including the management and submission of the 1042 S Form, enhancing efficiency.

-

What security measures does airSlate SignNow implement for the 1042 S Form?

airSlate SignNow employs robust security protocols to protect sensitive information contained in the 1042 S Form. This includes encryption, secure cloud storage, and access controls to ensure that your data remains confidential and secure.

-

Is there customer support available for questions related to the 1042 S Form?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions regarding the 1042 S Form. You can signNow out via chat, email, or phone for timely assistance.

-

What benefits does using airSlate SignNow provide for eSigning the 1042 S Form?

Using airSlate SignNow to eSign the 1042 S Form offers several benefits, including faster processing times and enhanced legal validity. You can obtain signatures from multiple parties quickly, of which speeds up your compliance process.

Get more for 1042 S Form

- Wedding planning or consultant package ohio form

- Oh power attorney form

- Hunting forms package ohio

- Identity theft recovery package ohio form

- Durable power of attorney for health care ohio form

- Revocation of statutory durable power of attorney for health care ohio form

- Aging parent package ohio form

- Sale of a business package ohio form

Find out other 1042 S Form

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free