Unless the Insured Designated Otherwise, You Have Four Options Option a Alliance Account This is an Account Opened for You by Th Form

Understanding the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account

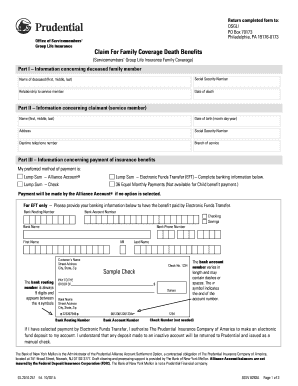

The Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account is a financial account established by the Prudential Insurance Company of America for eligible individuals. This account serves as a means for beneficiaries to manage their claims and access funds associated with their insurance policies. It is essential for claimants to understand the purpose and benefits of this account, as it simplifies the process of receiving and managing funds from insurance claims.

Steps to Complete the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account

Completing the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account involves several straightforward steps. First, gather all necessary documentation, including identification and any relevant insurance policy details. Next, fill out the required forms accurately, ensuring that all information is complete and correct. After completing the forms, submit them to Prudential through the specified channels, which may include online submission or mailing. It is crucial to keep a copy of all submitted documents for your records.

Legal Use of the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account

The legal use of the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account is governed by various regulations and guidelines. This account is recognized as a legitimate financial tool for managing insurance benefits. To ensure legal compliance, it is important to follow all instructions provided by Prudential and adhere to applicable laws regarding financial transactions and beneficiary claims. Utilizing secure methods for submitting forms and accessing account information further enhances the legal standing of your transactions.

How to Obtain the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account

To obtain the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account, individuals must first verify their eligibility based on the criteria set by Prudential. Once eligibility is confirmed, applicants can request the necessary forms through Prudential's official channels. It may involve contacting customer service or accessing the forms online. After completing the forms, submit them as instructed to initiate the account setup process.

Key Elements of the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account

Several key elements define the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account. These include the account holder's personal information, policy details, and the specific benefits associated with the account. Additionally, terms and conditions governing the use of the account, including withdrawal limits and fees, are crucial components. Understanding these elements ensures that account holders can effectively manage their funds and comply with Prudential's requirements.

Examples of Using the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account

Examples of using the Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account can vary based on individual circumstances. For instance, a beneficiary may use the account to receive funds from a life insurance policy, allowing for immediate access to financial support during a difficult time. Another example includes using the account to manage ongoing medical expenses covered by an insurance policy. These scenarios illustrate the practical applications of the account in real-life situations.

Quick guide on how to complete unless the insured designated otherwise you have four options option a alliance account this is an account opened for you by

Finish Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account This Is An Account Opened For You By Th effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the required form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account This Is An Account Opened For You By Th on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The easiest method to modify and eSign Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account This Is An Account Opened For You By Th with minimal effort

- Find Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account This Is An Account Opened For You By Th and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account This Is An Account Opened For You By Th and maintain outstanding communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the SGLV 8283A form and why do I need it?

The SGLV 8283A form is a crucial document for Service members and their beneficiaries, allowing for the election of coverage under the Servicemembers' Group Life Insurance program. Completing this form ensures that your insurance coverage is properly set up and managed, providing peace of mind during your service.

-

How can I fill out the SGLV 8283A form using airSlate SignNow?

With airSlate SignNow, you can easily fill out the SGLV 8283A form online. Our user-friendly platform allows you to enter information, add signatures, and send the document electronically, streamlining the process and eliminating paperwork hassle.

-

Is airSlate SignNow secure for submitting the SGLV 8283A form?

Yes, airSlate SignNow prioritizes your security. We use advanced encryption protocols to protect your data when submitting the SGLV 8283A form, ensuring that your sensitive information remains confidential and secure.

-

What features does airSlate SignNow offer for the SGLV 8283A form?

AirSlate SignNow offers a range of features for the SGLV 8283A form, including eSignature capabilities, document templates, and seamless document sharing. These tools enhance efficiency and make the signing process straightforward.

-

Are there costs associated with using airSlate SignNow for the SGLV 8283A form?

AirSlate SignNow provides a cost-effective solution for processing the SGLV 8283A form. Our pricing plans are designed to fit various budgets while offering features that enhance the signing experience without breaking the bank.

-

Can I track the status of my SGLV 8283A form submission with airSlate SignNow?

Absolutely! AirSlate SignNow includes real-time tracking for your SGLV 8283A form submission. You will receive notifications when the document is viewed, signed, and finalized, keeping you informed at every step.

-

What integrations does airSlate SignNow offer for the SGLV 8283A form?

AirSlate SignNow integrates with various applications, enhancing your workflow when filling out the SGLV 8283A form. Popular integrations include CRM systems, cloud storage providers, and productivity tools, making document management seamless.

Get more for Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account This Is An Account Opened For You By Th

- Oklahoma probate form

- Order income child support form

- Instructions to complete order notice to withhold income for child support oklahoma form

- Oklahoma contractors release and waiver of lien form

- Oklahoma state lien law summary levyvon beck form

- Quitclaim deed from individual to corporation oklahoma form

- Warranty deed from individual to corporation oklahoma form

- Summary administration oklahoma form

Find out other Unless The Insured Designated Otherwise, You Have Four Options Option A Alliance Account This Is An Account Opened For You By Th

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document