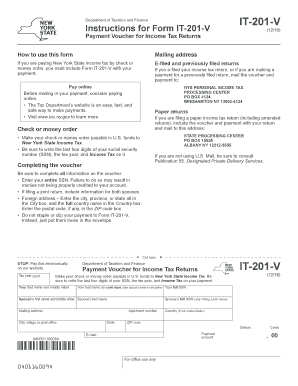

It 201 V Form

What is the IT-201-V?

The IT-201-V is a payment voucher used by New York State taxpayers when submitting their personal income tax returns. This form allows individuals to make payments electronically or via mail, ensuring that their tax obligations are met in a timely manner. It is specifically designed for those who owe taxes and need to submit a payment along with their tax return.

How to Use the IT-201-V

To use the IT-201-V, taxpayers must first determine the amount they owe based on their completed tax return. After calculating the owed amount, they should fill out the IT-201-V form, providing necessary details such as their name, Social Security number, and the payment amount. This form can be submitted electronically through the New York State Department of Taxation and Finance website or printed and mailed with a check or money order.

Steps to Complete the IT-201-V

Completing the IT-201-V involves several key steps:

- Gather necessary documents, including your completed IT-201 tax return.

- Calculate the total amount owed in taxes.

- Fill out the IT-201-V form, ensuring all required fields are completed accurately.

- Choose your payment method: electronic payment through the state’s website or mailing a check.

- Submit the form along with your payment by the due date to avoid penalties.

Legal Use of the IT-201-V

The IT-201-V is legally recognized as a valid method for submitting tax payments in New York State. When filled out and submitted correctly, it ensures compliance with state tax laws. Taxpayers must adhere to the filing deadlines and payment requirements outlined by the New York State Department of Taxation and Finance to avoid any legal repercussions.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the IT-201-V. Typically, the due date for submitting the IT-201-V coincides with the personal income tax return deadline, which is usually April fifteenth. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Timely submission is essential to avoid penalties and interest on unpaid taxes.

Required Documents

When completing the IT-201-V, taxpayers need to have specific documents on hand to ensure accurate reporting. These documents include:

- Completed IT-201 tax return.

- Any supporting documents related to income, deductions, and credits.

- Previous year’s tax return for reference, if necessary.

Form Submission Methods

Taxpayers have multiple options for submitting the IT-201-V. They can choose to file electronically through the New York State Department of Taxation and Finance website, which offers a secure and efficient way to make payments. Alternatively, taxpayers can print the form and mail it along with their payment to the appropriate address. It is important to select a method that aligns with personal preferences and ensures timely processing.

Quick guide on how to complete it 201 v

Complete It 201 V effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delays. Handle It 201 V on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The most efficient way to modify and electronically sign It 201 V without hassle

- Locate It 201 V and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form navigation, or errors that require creating new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and electronically sign It 201 V and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form it 201 v and how does it work?

Form it 201 v is an advanced digital document solution provided by airSlate SignNow. It allows users to create, send, and eSign documents effortlessly. The platform optimizes the document workflow ensuring that all necessary parties can review and sign efficiently.

-

What pricing options are available for form it 201 v?

airSlate SignNow offers flexible pricing plans for form it 201 v, catering to businesses of all sizes. You can choose from monthly or annual subscriptions which come with various features tailored to meet your specific needs. Additionally, there’s a free trial option to explore the capabilities of form it 201 v before committing.

-

What features are included with form it 201 v?

Form it 201 v includes features such as customizable templates, real-time tracking of document statuses, and comprehensive eSignature capabilities. Other notable features include team collaboration tools and secure storage options for all your documents. This makes form it 201 v an all-in-one solution for managing your business documentation.

-

How can form it 201 v benefit my business?

Using form it 201 v can signNowly enhance your business operations by streamlining the document signing process. It reduces turnaround times, improves workflow efficiency, and enhances collaboration among team members. Overall, form it 201 v can lead to greater productivity and lower operational costs.

-

Can form it 201 v integrate with other software?

Yes, form it 201 v offers seamless integrations with popular business applications such as Google Workspace, Salesforce, and Microsoft Office. This allows users to automate workflows and enhance productivity by connecting different tools effectively. Integrating form it 201 v into your existing processes is quick and straightforward.

-

Is form it 201 v secure for sensitive documents?

Absolutely. Form it 201 v employs industry-standard security protocols to ensure that your documents are protected. With encryption, secure access controls, and compliance with regulations, you can trust that sensitive information is safe when using form it 201 v.

-

What types of businesses can benefit from form it 201 v?

Form it 201 v is suitable for a wide range of businesses, from startups to large enterprises, across various industries. Any organization that relies on document signing and management can leverage the benefits of form it 201 v to improve efficiency. Its user-friendly interface makes it accessible to teams with varying levels of technical expertise.

Get more for It 201 V

- Bill of sale of automobile and odometer statement oregon form

- Bill of sale for automobile or vehicle including odometer statement and promissory note oregon form

- Promissory note in connection with sale of vehicle or automobile oregon form

- Bill of sale for watercraft or boat oregon form

- Bill of sale of automobile and odometer statement for as is sale oregon form

- Construction contract cost plus or fixed fee oregon form

- Painting contract for contractor oregon form

- Trim carpenter 497323478 form

Find out other It 201 V

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors