Form 8960 Internal Revenue Service Irs

What is the Form 8960 Internal Revenue Service IRS

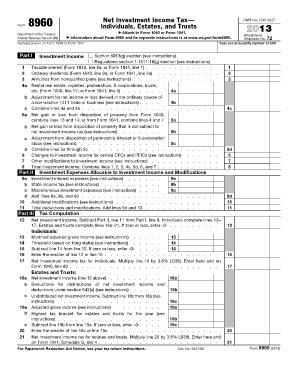

The Form 8960 is a tax form used by the Internal Revenue Service (IRS) to calculate the Net Investment Income Tax (NIIT). This tax applies to individuals, estates, and trusts that have net investment income and modified adjusted gross income above certain thresholds. The form is essential for taxpayers who may be subject to this additional tax, ensuring compliance with federal tax regulations.

How to use the Form 8960 Internal Revenue Service IRS

To effectively use Form 8960, taxpayers must first determine if their income exceeds the specified thresholds. The form requires detailed information about net investment income, which includes interest, dividends, capital gains, rental income, and other investment-related earnings. After gathering the necessary financial data, individuals can complete the form by following the provided instructions, ensuring that all relevant income is accurately reported.

Steps to complete the Form 8960 Internal Revenue Service IRS

Completing Form 8960 involves several key steps:

- Gather all relevant financial documents that detail your net investment income.

- Calculate your modified adjusted gross income (MAGI) to determine if you meet the income thresholds.

- Fill out the form by entering your total net investment income and MAGI in the appropriate sections.

- Follow the instructions to calculate any tax owed based on your reported figures.

- Review the completed form for accuracy before submission.

Legal use of the Form 8960 Internal Revenue Service IRS

The legal use of Form 8960 is governed by IRS regulations, which outline the requirements for reporting net investment income. It is crucial for taxpayers to file this form accurately to avoid penalties. Compliance with tax laws ensures that individuals meet their obligations while also taking advantage of any applicable deductions or exemptions related to their investment income.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form 8960. Typically, the form is due on the same date as the individual income tax return, which is usually April 15 of the following tax year. If additional time is needed, taxpayers may file for an extension, but they must still pay any taxes owed by the original deadline to avoid interest and penalties.

Required Documents

To complete Form 8960, several documents are required, including:

- Tax returns from previous years for reference.

- Statements detailing all sources of net investment income.

- Documentation of any deductions related to investment income.

- Records of any capital gains or losses incurred during the tax year.

Penalties for Non-Compliance

Failing to file Form 8960 or inaccurately reporting information can result in significant penalties. The IRS may impose fines for late filing or underpayment of taxes owed. Additionally, taxpayers may face interest charges on any unpaid tax amounts. It is essential to ensure that the form is completed correctly and submitted on time to avoid these consequences.

Quick guide on how to complete form 8960 internal revenue service irs

Effortlessly prepare Form 8960 Internal Revenue Service Irs on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and store it safely online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Form 8960 Internal Revenue Service Irs on any platform using the airSlate SignNow applications available for Android or iOS and simplify your document-centered tasks today.

How to modify and electronically sign Form 8960 Internal Revenue Service Irs with ease

- Obtain Form 8960 Internal Revenue Service Irs and click on Get Form to initiate the process.

- Utilize the features we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiresome document searches, or errors that require the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Update and eSign Form 8960 Internal Revenue Service Irs to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2013 net pricing for airSlate SignNow?

The 2013 net pricing for airSlate SignNow offers a range of plans that cater to different business needs. Pricing starts at a competitive rate, ensuring that you get a cost-effective solution for your eSigning needs. Each plan provides access to essential features, making it suitable for teams of any size.

-

How does airSlate SignNow benefit businesses in 2013 net?

AirSlate SignNow enhances business operations by simplifying the document signing process within the 2013 net framework. It allows teams to send, receive, and sign documents with ease, which can signNowly increase efficiency. By adopting airSlate SignNow, businesses can reduce turnaround times and improve customer satisfaction.

-

What features does airSlate SignNow offer related to 2013 net?

AirSlate SignNow includes features like document templates, real-time tracking, and secure cloud storage, all optimized for the 2013 net. These tools enable users to streamline their workflows and maintain oversight throughout the signing process. With features customized for various industries, it supports a wide range of business use cases.

-

Can airSlate SignNow integrate with other software in the 2013 net ecosystem?

Yes, airSlate SignNow integrates seamlessly with various applications within the 2013 net ecosystem. This includes popular tools like CRM systems and cloud storage platforms, allowing for smooth data transfer and enhanced productivity. Integrations help users maintain their work processes without disruption.

-

Is airSlate SignNow secure for signing documents in 2013 net?

Absolutely! AirSlate SignNow prioritizes security, compliant with industry standards, ensuring that your documents signed in the 2013 net are protected. With features like encryption and secure access controls, users can trust that their sensitive information remains confidential. Your business can sign documents confidently, knowing security is a top priority.

-

What types of documents can I send for eSigning with airSlate SignNow in 2013 net?

AirSlate SignNow supports a variety of document types for eSigning within the 2013 net, including contracts, invoices, and agreements. This versatility allows businesses to handle all necessary paperwork electronically. The user-friendly interface ensures that sending these documents for signature is straightforward and efficient.

-

How can airSlate SignNow improve my workflow in 2013 net?

By using airSlate SignNow, businesses can automate their document workflows in the 2013 net, reducing manual tasks and errors. Features like bulk sending and automated reminders streamline processes, allowing teams to focus on more strategic activities. This enhancement leads to signNow time savings and improved productivity.

Get more for Form 8960 Internal Revenue Service Irs

- General warranty deed from husband and wife to a trust north carolina form

- General warranty deed nc 497316801 form

- Quitclaim deed from husband to himself and wife north carolina form

- Quitclaim deed from husband and wife to husband and wife north carolina form

- General warranty deed from husband and wife to husband and wife north carolina form

- North carolina postnuptial agreement form

- Nc postnuptial form

- Nc postnuptial 497316807 form

Find out other Form 8960 Internal Revenue Service Irs

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast