Form 712

What is the Form 712

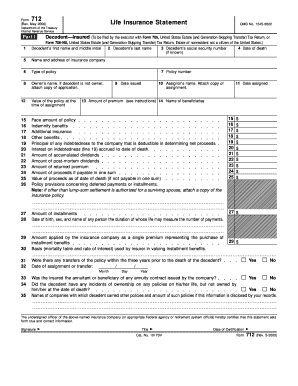

The Form 712 is a crucial document used in the United States for reporting certain tax-related information. Specifically, it is often associated with the reporting of life insurance policies and their cash value. This form is essential for both individuals and businesses that need to disclose the value of life insurance policies for tax purposes. Understanding the details of Form 712 is important for ensuring compliance with IRS regulations and accurately reporting financial information.

How to use the Form 712

Using Form 712 involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary information regarding the life insurance policy, including the policyholder's details, the insurer's information, and the policy's cash value. Next, fill out the form with this information, ensuring that all fields are completed correctly. Once the form is filled out, it can be submitted to the appropriate tax authority, either electronically or by mail, depending on the specific requirements for your situation.

Steps to complete the Form 712

Completing Form 712 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documents related to the life insurance policy.

- Enter the policyholder's name and address in the designated fields.

- Provide the insurer's name and contact information.

- Fill in the policy number and the cash value of the policy.

- Review the completed form for accuracy.

- Submit the form according to IRS guidelines, either electronically or via mail.

Legal use of the Form 712

The legal use of Form 712 is governed by IRS regulations, which stipulate that the form must be completed accurately to be considered valid. It serves as an official record of the value of life insurance policies, which can impact tax liabilities. Failure to use the form correctly may lead to penalties or issues with tax compliance. Therefore, it is essential to understand the legal implications of submitting Form 712 and to ensure that all information is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for Form 712 can vary depending on individual circumstances and the specific tax year. Generally, it is advisable to submit the form by the tax filing deadline, which is typically April fifteenth for most taxpayers. However, if you are filing for an estate or trust, different deadlines may apply. Keeping track of these important dates is crucial to avoid penalties and ensure that all tax obligations are met in a timely manner.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 712. These guidelines include instructions on how to fill out each section of the form, what information is required, and how to submit the form. It is important to refer to the latest IRS publications or the official IRS website for the most current information and any updates regarding Form 712. Adhering to these guidelines helps ensure compliance with tax laws and regulations.

Quick guide on how to complete form 712 10004037

Effortlessly Prepare Form 712 on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Handle Form 712 on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Form 712 seamlessly

- Locate Form 712 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click the Done button to save your alterations.

- Select how you want to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 712 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are xxwxx 2015 tax forms 2023 online?

xxwxx 2015 tax forms 2023 online refer to the specific tax forms that businesses and individuals need to complete for the 2023 tax year, based on 2015 regulations. These forms are essential for accurate tax reporting and compliance, and can be easily accessed and completed using airSlate SignNow.

-

How can airSlate SignNow assist with xxwxx 2015 tax forms 2023 online?

airSlate SignNow simplifies the process of filling out and signing xxwxx 2015 tax forms 2023 online by providing an intuitive platform. Users can effortlessly input their information, eSign documents, and securely share them with relevant parties, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for completing yywxx 2015 tax forms 2023 online?

The platform includes features such as customizable templates, eSignature capabilities, document storage, and integrations with popular software. Additionally, airSlate SignNow ensures that your xxwxx 2015 tax forms 2023 online are always up-to-date and compliant with the latest regulations.

-

Is there a cost to use airSlate SignNow for access to xxwxx 2015 tax forms 2023 online?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Depending on the plan you choose, users can access features for efficiently managing xxwxx 2015 tax forms 2023 online without breaking the budget.

-

Can I save my xxwxx 2015 tax forms 2023 online within airSlate SignNow?

Absolutely! airSlate SignNow provides a secure storage solution for all your xxwxx 2015 tax forms 2023 online. You can easily save, retrieve, and manage your documents within the platform, ensuring that you always have access to your important tax forms.

-

What integrations does airSlate SignNow support for handling xxwxx 2015 tax forms 2023 online?

airSlate SignNow supports a variety of integrations with popular accounting, CRM, and productivity tools. This ensures that you can seamlessly manage your workflow while handling xxwxx 2015 tax forms 2023 online, making the process more efficient and streamlined.

-

Is it easy to eSign xxwxx 2015 tax forms 2023 online using airSlate SignNow?

Yes, eSigning xxwxx 2015 tax forms 2023 online is incredibly easy with airSlate SignNow. The user-friendly interface allows you to quickly eSign documents, adding a layer of convenience and efficiency to your tax filing process.

Get more for Form 712

- Quitclaim deed from individual to individual north carolina form

- Nc deed 497316818 form

- North carolina deed form

- Warranty deed husband and wife to three individuals north carolina form

- Nc special warranty form

- Interrogatories sample form

- Discovery interrogatories from defendant to plaintiff with production requests north carolina form

- Nc interrogatories form

Find out other Form 712

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later