Arizona Commission Form

What is the Arizona Commission Form

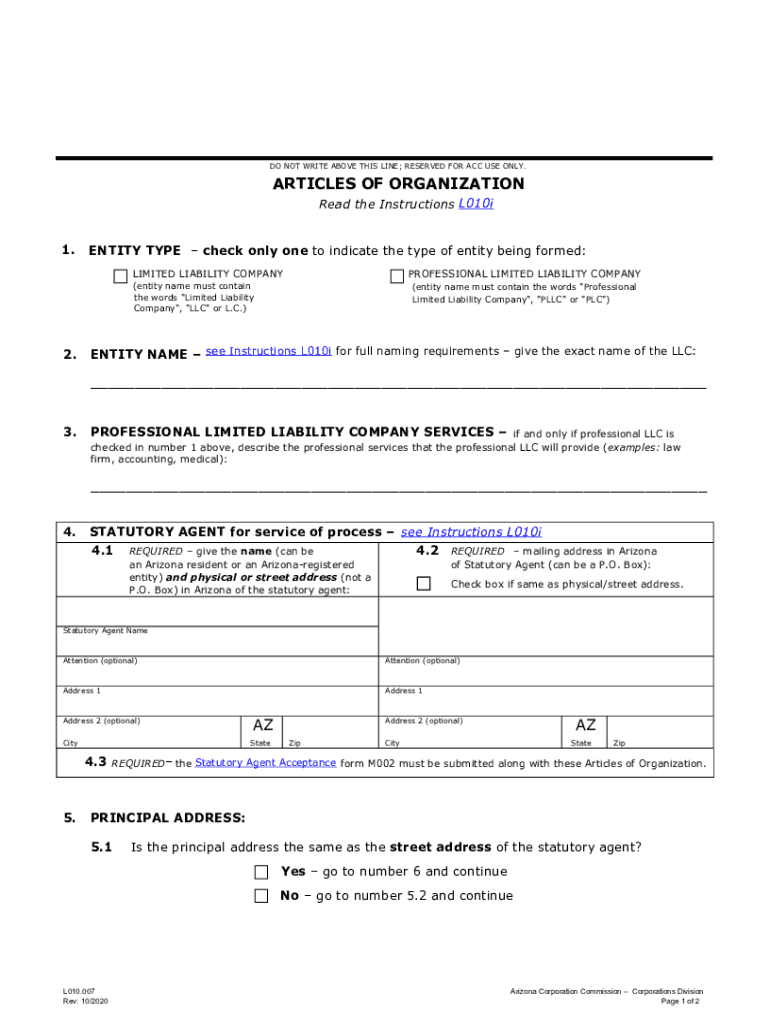

The Arizona Commission Form, often referred to as the Arizona 007 articles, is a crucial document for businesses operating in Arizona. This form is required for various types of organizations, including corporations and limited liability companies (LLCs). It serves as a foundational legal document that outlines essential information about the organization, such as its name, purpose, and structure. The form is submitted to the Arizona Corporation Commission, which oversees the registration and compliance of businesses within the state.

How to use the Arizona Commission Form

Using the Arizona Commission Form involves several key steps. First, ensure that you have all necessary information about your organization, including its legal name, principal address, and the names of the members or directors. Once you have gathered this information, you can fill out the form either online or in a paper format. After completing the form, it must be submitted to the Arizona Corporation Commission along with any required fees. It is essential to review the form for accuracy to avoid delays in processing.

Steps to complete the Arizona Commission Form

Completing the Arizona Commission Form requires careful attention to detail. Follow these steps for successful submission:

- Gather all necessary information about your organization.

- Access the Arizona Commission Form through the Arizona Corporation Commission website.

- Fill in the required fields, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the form online or print it for mailing, along with any applicable fees.

Legal use of the Arizona Commission Form

The Arizona Commission Form is legally binding when filled out and submitted correctly. It must comply with state regulations to ensure that the organization is recognized as a legal entity. This includes adhering to the stipulations set forth by the Arizona Corporation Commission, such as the need for signatures from authorized individuals. Proper completion of the form ensures that the organization can operate legally within Arizona.

Key elements of the Arizona Commission Form

The Arizona Commission Form includes several key elements that are vital for its validity. These elements typically include:

- Organization Name: The legal name of the business as it will appear in official records.

- Principal Address: The primary location where the business operates.

- Type of Entity: Indication of whether the organization is a corporation, LLC, or another type.

- Member or Director Information: Names and addresses of individuals involved in the organization.

Form Submission Methods

The Arizona Commission Form can be submitted through various methods to accommodate different preferences. Businesses can choose to submit the form online via the Arizona Corporation Commission's website, which is often the quickest option. Alternatively, the form can be printed and mailed to the commission or delivered in person. Each submission method may have different processing times, so it is advisable to consider the urgency of your filing when choosing a method.

Quick guide on how to complete arizona commission form

Complete Arizona Commission Form effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, since you can easily find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Arizona Commission Form on any gadget with airSlate SignNow Android or iOS apps and simplify any document-related task today.

The easiest way to modify and electronically sign Arizona Commission Form without effort

- Find Arizona Commission Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Alter and electronically sign Arizona Commission Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit an AZ organization?

airSlate SignNow is an eSignature solution that allows AZ organizations to efficiently send, sign, and manage documents. It streamlines processes, reduces turnaround time, and minimizes paperwork, which ultimately saves both time and resources. With its user-friendly interface, AZ organizations of any size can easily adopt this tool.

-

How much does airSlate SignNow cost for AZ organizations?

airSlate SignNow offers various pricing plans tailored to the needs of AZ organizations. The pricing is flexible, starting from a basic plan suitable for small teams to comprehensive packages designed for larger enterprises. This makes it a cost-effective solution for any AZ organization looking to enhance their document management processes.

-

What features does airSlate SignNow offer for AZ organizations?

airSlate SignNow includes features such as customizable templates, document workflows, multi-party signing, and real-time tracking. These features empower AZ organizations to manage their documents more effectively, ensuring that all signatures are collected promptly and securely. The platform also provides mobile access, enabling users to handle documents on the go.

-

Can airSlate SignNow integrate with other tools used by AZ organizations?

Yes, airSlate SignNow offers seamless integration with a variety of popular business tools and software that AZ organizations commonly use. This includes CRM systems, cloud storage services, and project management applications. These integrations help streamline workflows and enhance productivity for AZ organizations.

-

Is airSlate SignNow compliant with legal and security standards for AZ organizations?

Absolutely! airSlate SignNow adheres to strict legal and security standards, such as GDPR and HIPAA compliance, ensuring that AZ organizations can handle sensitive documents with confidence. The platform uses encryption and secure authentication methods to safeguard all data processed, making it a reliable choice for secure document transactions.

-

How easy is it to get started with airSlate SignNow for an AZ organization?

Getting started with airSlate SignNow is quick and easy for any AZ organization. The intuitive setup process allows users to create an account, upload documents, and send them for signing within minutes. Additionally, airSlate provides comprehensive support resources and customer service to assist organizations throughout their onboarding process.

-

What benefits can AZ organizations expect from using airSlate SignNow?

AZ organizations can expect enhanced efficiency, improved collaboration, and signNow cost savings by utilizing airSlate SignNow. The ability to digitize and automate processes reduces the need for physical paperwork and minimizes delays. Furthermore, the ease of use encourages quicker adoption across teams, fostering a more productive work environment.

Get more for Arizona Commission Form

- Sc husband wife 497325625 form

- Warranty deed from husband and wife to corporation south carolina form

- Unconditional waiver and release of claim of lien upon progress payment south carolina form

- Quitclaim deed from husband and wife to llc south carolina form

- Warranty deed from husband and wife to llc south carolina form

- Sc judgment form

- Conditional waiver and release of claim of lien upon final payment south carolina form

- Landlord notice premises form

Find out other Arizona Commission Form

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile