Customer Identification Program Federal Deposit Insurance Form

What is the Customer Identification Program Federal Deposit Insurance

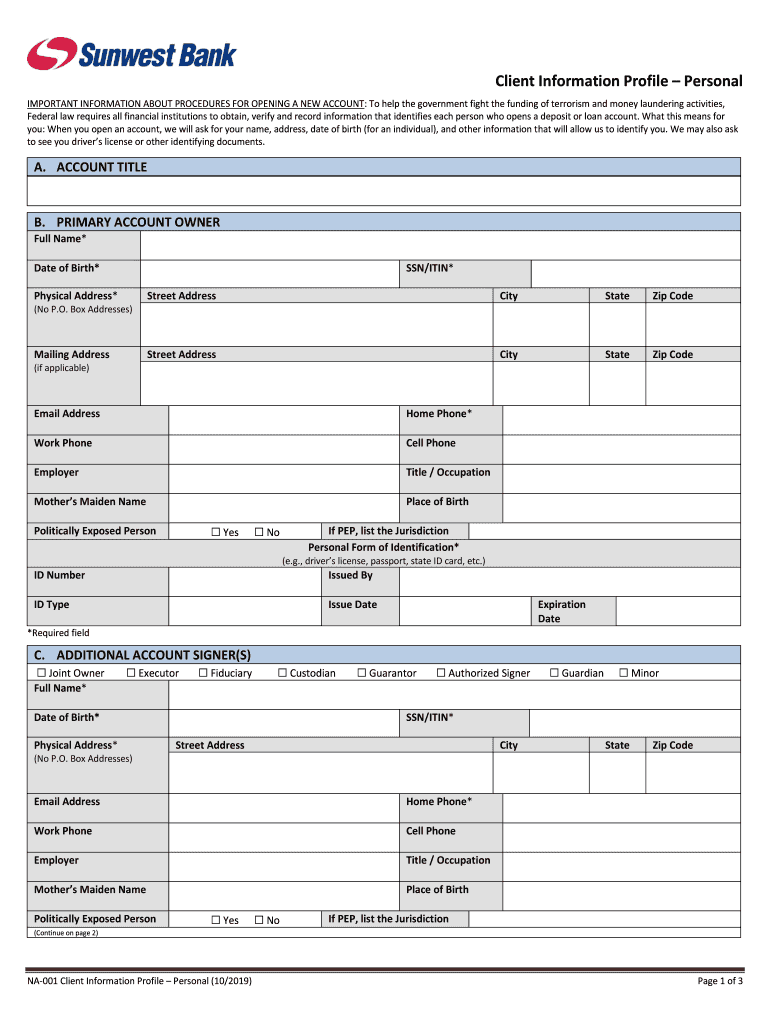

The Customer Identification Program (CIP) under the Federal Deposit Insurance Corporation (FDIC) is a regulatory requirement that financial institutions must adhere to in order to verify the identities of their customers. This program is designed to prevent fraud and money laundering by ensuring that banks and credit unions know who they are doing business with. The CIP mandates that institutions collect specific information from customers, such as name, address, date of birth, and Social Security number, before opening an account or providing services.

Steps to complete the Customer Identification Program Federal Deposit Insurance

Completing the Customer Identification Program involves several key steps to ensure compliance and proper identification of customers. First, financial institutions must gather the required information from the customer. This includes personal details like name, address, and identification numbers. Next, institutions must verify this information using reliable sources, such as government-issued identification or credit reports. Once verified, the institution must maintain a record of the information and the verification process for future reference. This documentation is crucial for audits and regulatory compliance.

Legal use of the Customer Identification Program Federal Deposit Insurance

The legal framework governing the Customer Identification Program is primarily established by the USA PATRIOT Act, which requires financial institutions to implement procedures for verifying customer identities. Compliance with this program not only helps to prevent illegal activities but also protects the institution from potential legal repercussions. Institutions must ensure that their CIP procedures align with federal regulations and are regularly updated to reflect any changes in the law.

Required Documents for the Customer Identification Program Federal Deposit Insurance

To successfully complete the Customer Identification Program, certain documents are required. These typically include:

- Government-issued photo identification, such as a driver's license or passport.

- Proof of address, which can be a utility bill or bank statement.

- Social Security number or taxpayer identification number.

These documents help verify the identity of the customer and ensure compliance with regulatory requirements.

How to obtain the Customer Identification Program Federal Deposit Insurance

Obtaining the necessary forms and information for the Customer Identification Program is typically straightforward. Customers can visit their financial institution's website or contact their local branch to request the required forms. Institutions often provide guidance on completing the forms and submitting the necessary documentation. It is important for customers to ensure they have all required information before starting the process to avoid delays.

Examples of using the Customer Identification Program Federal Deposit Insurance

Examples of the Customer Identification Program in action include scenarios where a new customer wishes to open a bank account. In this case, the bank will request the necessary identification documents and verify the customer's identity before account opening. Another example is when a customer applies for a loan; the institution will utilize the CIP to ensure they are lending to a verified individual. These examples illustrate the program's role in maintaining security and trust within the financial system.

Quick guide on how to complete customer identification program federal deposit insurance

Complete Customer Identification Program Federal Deposit Insurance effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to draft, modify, and eSign your documents rapidly without delays. Handle Customer Identification Program Federal Deposit Insurance on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Customer Identification Program Federal Deposit Insurance without hassle

- Locate Customer Identification Program Federal Deposit Insurance and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, either by email, SMS, invitation link, or download it onto your computer.

Leave behind the worry of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Customer Identification Program Federal Deposit Insurance and ensure outstanding communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Customer Identification Program Federal Deposit Insurance?

The Customer Identification Program Federal Deposit Insurance (CIP FDIC) is a regulation that requires financial institutions to verify the identity of individuals who open accounts. This program is critical for preventing fraud and money laundering, ensuring both safety and compliance in banking.

-

How does airSlate SignNow support the Customer Identification Program Federal Deposit Insurance?

airSlate SignNow provides an efficient way to send and eSign documents required by the Customer Identification Program Federal Deposit Insurance. With its secure platform, businesses can easily gather necessary identification documents and maintain compliance with regulatory standards.

-

What are the benefits of using airSlate SignNow for the Customer Identification Program Federal Deposit Insurance?

Using airSlate SignNow for the Customer Identification Program Federal Deposit Insurance streamlines the process, saving time and reducing paperwork. The platform's robust security features ensure sensitive information is protected, helping businesses comply with federal regulations efficiently.

-

Is airSlate SignNow cost-effective for implementing the Customer Identification Program Federal Deposit Insurance?

Yes, airSlate SignNow offers a cost-effective solution for the Customer Identification Program Federal Deposit Insurance. The competitive pricing structure allows businesses of all sizes to access essential features without incurring high costs, making compliance manageable.

-

What features does airSlate SignNow offer for the Customer Identification Program Federal Deposit Insurance?

airSlate SignNow includes features like electronic signatures, document templates, and detailed audit trails that facilitate the Customer Identification Program Federal Deposit Insurance. These features help organizations easily manage verification processes and maintain compliance.

-

Can airSlate SignNow integrate with other systems for the Customer Identification Program Federal Deposit Insurance?

Absolutely! airSlate SignNow seamlessly integrates with various CRM and compliance management systems, enhancing your ability to implement the Customer Identification Program Federal Deposit Insurance. This helps streamline all related processes for better efficiency.

-

How can I ensure compliance with the Customer Identification Program Federal Deposit Insurance using airSlate SignNow?

To ensure compliance with the Customer Identification Program Federal Deposit Insurance using airSlate SignNow, utilize the platform's retention features and private document sharing. You can also maintain thorough records and audit trails to meet regulatory requirements and verify compliance.

Get more for Customer Identification Program Federal Deposit Insurance

- Letter tenant notice 497321308 form

- New york law form

- Letter tenant landlord 497321310 form

- Tenant notice increase 497321311 form

- Notice rent increase lease form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase new york form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant new york form

- Letter tenant increase sample form

Find out other Customer Identification Program Federal Deposit Insurance

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later