Tax Preparation Worksheets Excel and Tax Return Form

What is the Tax Preparation Worksheets Excel and Tax Return

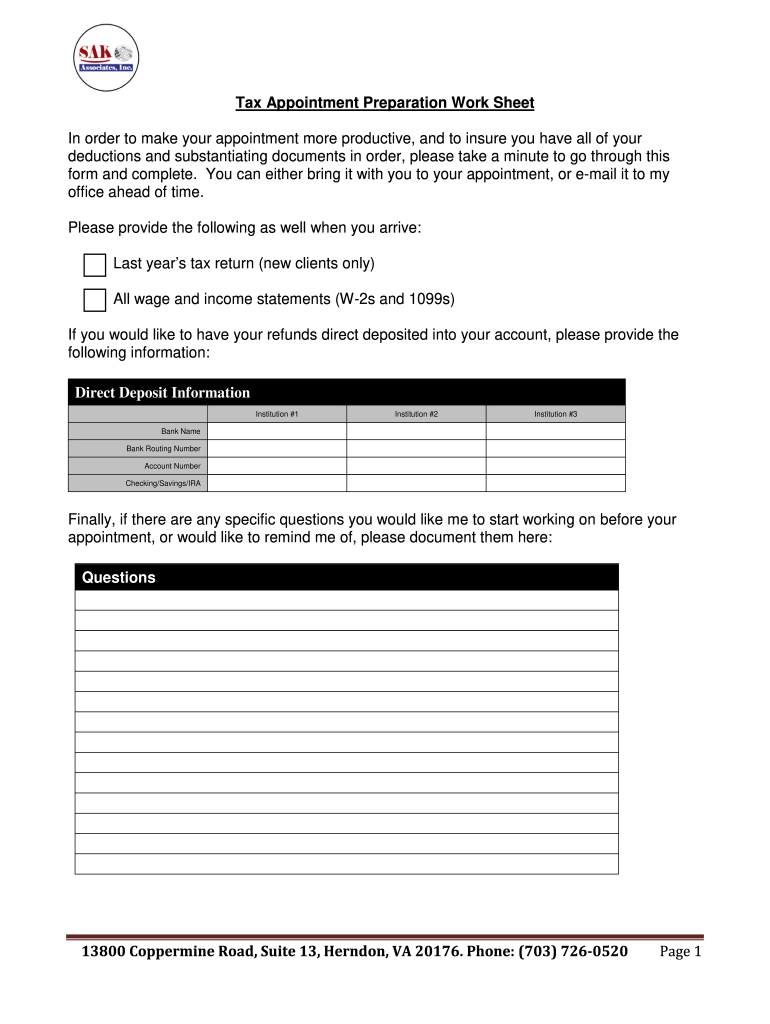

The Tax Preparation Worksheets Excel and Tax Return is a comprehensive tool designed to assist individuals and businesses in organizing their financial information for tax filing purposes. This form typically includes various worksheets that help taxpayers calculate their income, deductions, and credits, ensuring that all relevant data is accurately captured. By using Excel for these worksheets, users can easily manipulate data, perform calculations, and maintain an organized record of their tax-related information.

How to use the Tax Preparation Worksheets Excel and Tax Return

To effectively use the Tax Preparation Worksheets Excel and Tax Return, begin by downloading the appropriate Excel template. Once you have the template, follow these steps:

- Input your personal information, including your name, address, and Social Security number.

- Enter your income details, such as wages, interest, and dividends, in the designated sections.

- Document all eligible deductions, including mortgage interest, medical expenses, and charitable contributions.

- Utilize built-in formulas to calculate your total income, deductions, and tax liability.

- Review your entries for accuracy and completeness before finalizing your tax return.

Steps to complete the Tax Preparation Worksheets Excel and Tax Return

Completing the Tax Preparation Worksheets Excel and Tax Return involves several methodical steps:

- Gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions.

- Open the Excel worksheet and input your personal and financial information in the appropriate fields.

- Follow the prompts to fill out each section, ensuring that you include all relevant income and deductions.

- Use the Excel functions to verify calculations and ensure accuracy.

- Save your completed worksheet and prepare it for submission, either electronically or by mail.

Legal use of the Tax Preparation Worksheets Excel and Tax Return

The legal use of the Tax Preparation Worksheets Excel and Tax Return hinges on compliance with IRS regulations and guidelines. To ensure that your completed forms are legally valid:

- Make sure to use the most current version of the worksheets as provided by the IRS.

- Sign and date your tax return, as required by law.

- Retain copies of your completed worksheets and supporting documents for at least three years in case of an audit.

- Utilize a secure method for submitting your tax return, whether electronically or by mail, to protect your personal information.

Required Documents

When preparing the Tax Preparation Worksheets Excel and Tax Return, it is essential to gather all required documents to ensure accuracy and completeness. Commonly needed documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements showing interest income

- Documentation for any tax credits claimed

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for timely submission of your Tax Preparation Worksheets Excel and Tax Return. Key dates to remember include:

- April 15: The standard deadline for individual tax returns.

- October 15: The extended deadline for those who filed for an extension.

- January 31: Deadline for employers to issue W-2 forms to employees.

- March 15: Deadline for partnerships and S corporations to file their returns.

Quick guide on how to complete tax preparation worksheets excel and tax return

Complete Tax Preparation Worksheets Excel And Tax Return seamlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to access the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without any delays. Manage Tax Preparation Worksheets Excel And Tax Return on any gadget using airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

The easiest way to modify and eSign Tax Preparation Worksheets Excel And Tax Return effortlessly

- Locate Tax Preparation Worksheets Excel And Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Preparation Worksheets Excel And Tax Return to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Tax Preparation Worksheets Excel And Tax Return used for?

Tax Preparation Worksheets Excel And Tax Return are designed to help individuals and businesses organize their financial information efficiently. These worksheets facilitate the process of accurately completing tax returns by providing structured formats to input necessary data, ensuring a smoother filing experience.

-

How can airSlate SignNow assist with Tax Preparation Worksheets Excel And Tax Return?

With airSlate SignNow, you can easily upload, sign, and send Tax Preparation Worksheets Excel And Tax Return securely. Our platform streamlines document management and eSigning, allowing you to focus on gathering and preparing your tax information with confidence.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and cloud storage for your Tax Preparation Worksheets Excel And Tax Return. These features simplify the process of preparing and signing tax documents, ensuring you stay organized and compliant.

-

Is there a cost associated with using airSlate SignNow for tax preparation?

Yes, using airSlate SignNow involves a subscription plan, but it is designed to be cost-effective for businesses of all sizes. The investment provides access to powerful tools for managing Tax Preparation Worksheets Excel And Tax Return efficiently, potentially saving you time and reducing filing errors.

-

Can I integrate airSlate SignNow with other accounting software for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to seamlessly manage your Tax Preparation Worksheets Excel And Tax Return alongside your financial records. This integration helps ensure that all your data is synchronized and accessible.

-

What are the benefits of using airSlate SignNow for my tax preparation needs?

Using airSlate SignNow for your tax preparation needs provides increased efficiency, enhanced security, and easy collaboration. By utilizing our platform for your Tax Preparation Worksheets Excel And Tax Return, you can streamline the entire process and ensure timely submission of your tax documents.

-

How secure is my information when using airSlate SignNow for tax documents?

Your information is secure with airSlate SignNow as we utilize advanced encryption and security measures. When working with Tax Preparation Worksheets Excel And Tax Return, you can rest assured that your sensitive data is protected throughout the document signing and storage processes.

Get more for Tax Preparation Worksheets Excel And Tax Return

Find out other Tax Preparation Worksheets Excel And Tax Return

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple