Employed Income Statement 2000

What is the employed income statement

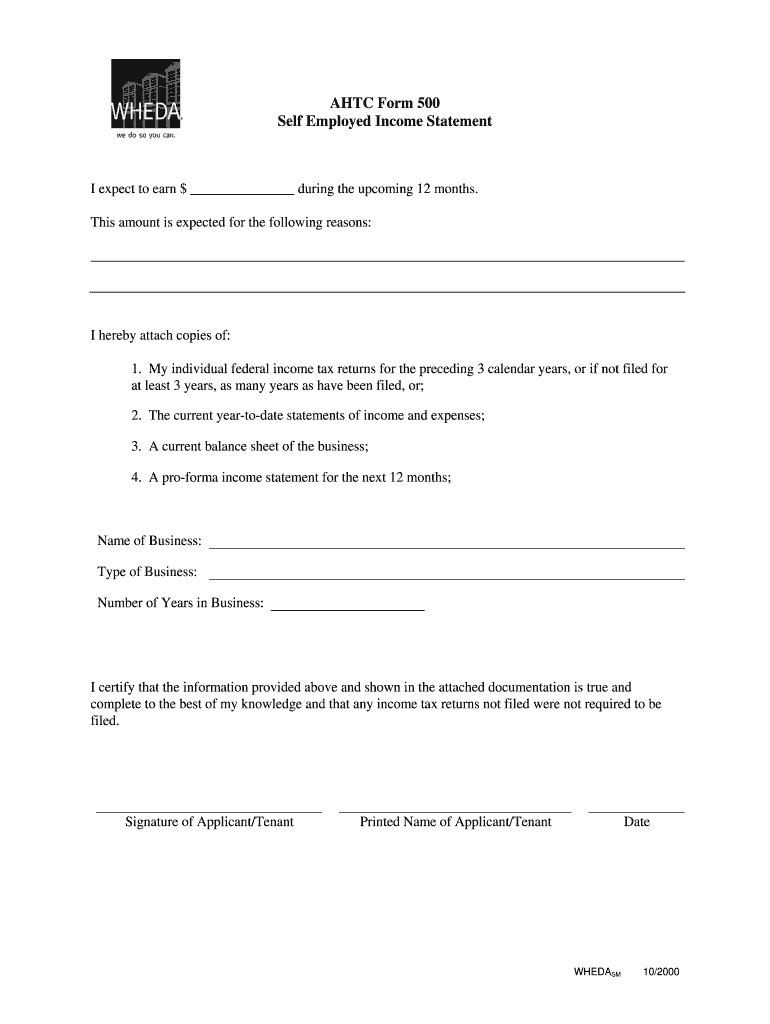

The employed income statement is a financial document that outlines an individual's income sources, expenses, and net earnings over a specified period. This statement is particularly relevant for self-employed individuals, as it provides a clear picture of their financial situation, which is essential for tax reporting and loan applications. The employed income statement serves as proof of income, helping to demonstrate financial stability to lenders, landlords, and other entities requiring verification of earnings.

How to use the employed income statement

Using the employed income statement involves compiling financial data to create a comprehensive overview of income and expenses. Begin by gathering all relevant documentation, including invoices, receipts, and bank statements. Next, categorize your income sources, such as freelance work, consulting fees, or business earnings. List all expenses related to your self-employment, including operational costs, supplies, and taxes. Once the data is organized, calculate your net income by subtracting total expenses from total income. This statement can then be used for various purposes, including tax filings and securing loans.

Steps to complete the employed income statement

Completing the employed income statement requires careful attention to detail. Follow these steps:

- Gather all income-related documents, such as pay stubs, invoices, and bank statements.

- List all sources of income, including self-employment earnings and any additional income streams.

- Document all business-related expenses, ensuring to keep receipts for verification.

- Calculate the total income and total expenses.

- Determine the net income by subtracting total expenses from total income.

- Review the statement for accuracy and completeness before using it for official purposes.

Legal use of the employed income statement

The employed income statement is legally recognized as a valid document for proving income. It must be accurately completed and reflect true financial information. When used for applications such as loans, leases, or government assistance, it is essential to ensure that the statement complies with relevant regulations. Digital signatures and secure storage of the document can enhance its legal standing, providing a reliable way to verify the authenticity of the information presented.

Key elements of the employed income statement

Several key elements must be included in the employed income statement to ensure it serves its purpose effectively. These elements typically include:

- Income Sources: A detailed list of all income sources, including wages, freelance work, and any other earnings.

- Expenses: A comprehensive account of all business-related expenses incurred during the reporting period.

- Net Income: The difference between total income and total expenses, representing the actual earnings.

- Time Period: The specific period for which the statement is being prepared, such as monthly or annually.

- Signature: A signature or digital signature to validate the document.

Examples of using the employed income statement

The employed income statement can be utilized in various scenarios. For instance, self-employed individuals may need to provide this document when applying for a mortgage to demonstrate their ability to repay the loan. Landlords often request proof of income, making the employed income statement an essential part of rental applications. Additionally, small business owners may use this statement to track their financial performance over time, aiding in budgeting and financial planning.

Quick guide on how to complete self employed income statement form

The simplest method to acquire and sign Employed Income Statement

Across the entirety of your business, ineffective procedures regarding document approval can consume a signNow amount of labor hours. Signing documents like Employed Income Statement is an inherent aspect of operations in any organization, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, endorsing your Employed Income Statement is as straightforward and quick as possible. This platform provides you access to the latest version of nearly any form. Even better, you can sign it instantly without needing to install external applications on your computer or printing anything as paper copies.

Steps to obtain and sign your Employed Income Statement

- Browse our library by category or utilize the search field to locate the form you require.

- Examine the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to initiate editing immediately.

- Fill out your form and incorporate any necessary information using the toolbar.

- Once finished, click the Sign tool to endorse your Employed Income Statement.

- Choose the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as required.

With airSlate SignNow, you have everything necessary to manage your documents efficiently. You can find, fill out, edit, and even dispatch your Employed Income Statement in a single tab without any difficulties. Enhance your processes with one smart eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct self employed income statement form

FAQs

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

What form should I fill out if I am a UK self-employed resident invoicing the EU company?

You question is unclear. Do you mean another company in the EU, or administration of the EU like the Parliament or the Commission.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

Is it easy to get a Chinese tourist visa?

Generally, yes as long as you submit a complete list of documents to the nearest Chinese Embassy from where you are based.The basic requirements are:1) Original passport that is valid for at least another 6 months with at least one blank visa page, a photocopy of the passport's information/photo page and emergency contact page;2) Visa Application Form of the People's Republic of China which should be legibly and truthfully filled out. (Must be filled up in capital letters. Do not leave anything blank. Write N/A if the item is not applicable to you);3) 2 colored ID photos which must comply with the required photo specifications; and4) Bank Certificate of Deposit Balance (including the past 6 months bank statement) and the receipt for payment of this certificate.You may also want to submit supporting documents:Supporting documents are those which prove your financial capacity to travel and to stay at the People’s Republic of China and those which show your intent to go back to your country.1) For employees- Income Tax Return Form and Certificate of Employment (detailing the salary and the length of employment)2) For self-employed/digital nomads- BIR-stamped Income Tax Return Form3) For businessmen- Business Registration Certificate4) For students- School ID and Enrollment Form/Receipt5) For those who have obtained a Chinese visa before- Submit a photocopy of the visa, and if the visa is on your old passport, you should also submit the old passportNOTE: Bring other relevant documents proving your economic condition/employment/study such as land/condominium title, car registration, etc., other documents supporting your travel to China, or those explaining the travel purpose (if applicable).See this article for more details: How To Apply For A Chinese Tourist Visa

-

For a Canadian visitor visa application, do we need to have a booked flight ticket?

Booked flight ticket isn’t one of the requirements when applying for a Visitor Visa for Canada but it is highly encouraged to submit one to prove your purpose of travel. You basically need the following documents:1) Valid passport. With a remaining one year validity. Scan the bio-page;2) Duly accomplished Form IMM5257. This is the Application for Visitor Visa Form. Fill it out digitally and truthfully. (This works on Internet Explorer and the latest signNow version);3) Duly accomplished Form 5645. This requires your Family Information which shall also be filled out digitally;4) 2 passport size photos (35mm x 45mm). Must be photographed within the last six months. See complete photo specifications here;5) Proof of income/financial capability. This shall include Bank Certificate/Bank Statement within the last 4 months, Certificate of Employment and Income Tax Return (for employees, self-employed and digital nomads), School Records such as Enrollment Receipt/Certificate (For Students), Business Permits (for business owners), as well as Condominium/Car/Land Titles (if any).6) Affidavit of Support. This only applies if somebody else is paying for your trip. Also, attach his/her proof of financial capability;7) Travel history. Scanned copy of your visas (whether valid or expired) as well as entry/exit stamps. Make sure just to put everything in 1 file; AND8) Purpose of Travel. Your flight and hotel reservations and day-to-day itinerary.Check out this article to know more: How To Apply For A Canadian Tourist Visa

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the self employed income statement form

How to generate an electronic signature for your Self Employed Income Statement Form online

How to create an eSignature for the Self Employed Income Statement Form in Google Chrome

How to generate an eSignature for putting it on the Self Employed Income Statement Form in Gmail

How to create an electronic signature for the Self Employed Income Statement Form straight from your mobile device

How to make an eSignature for the Self Employed Income Statement Form on iOS

How to make an eSignature for the Self Employed Income Statement Form on Android devices

People also ask

-

What is an employed income statement?

An employed income statement is a financial document that outlines an individual's earnings from employment. This statement is crucial for applications related to loans, mortgages, or any financial assessments that require proof of income.

-

How can airSlate SignNow help with my employed income statement?

airSlate SignNow streamlines the process of signing and sending your employed income statement electronically. Our solution allows for quick eSigning of your documents, ensuring that you have a secure and seamless experience.

-

Is there a cost associated with using airSlate SignNow for my employed income statement?

Yes, airSlate SignNow offers various pricing plans to cater to your business needs. We provide a range of cost-effective solutions that allow you to efficiently manage your employed income statement and other documents.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities, specifically designed for managing important documents like your employed income statement. This ensures you can handle all your document needs in one platform.

-

Can I integrate airSlate SignNow with other applications for my employed income statement?

Absolutely! airSlate SignNow supports integration with various applications, helping you link your employed income statement with accounting, CRM, and other essential tools. This integration simplifies the workflow and enhances productivity.

-

How secure is my employed income statement when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your employed income statement and other documents are protected with encryption and secure access controls, ensuring that all your sensitive information remains confidential.

-

What are the benefits of using airSlate SignNow for my employed income statement?

Using airSlate SignNow for your employed income statement can save you time and reduce paperwork hassles. Our easy-to-use platform enhances efficiency, making it simple to sign, send, and track your documents seamlessly.

Get more for Employed Income Statement

- Pharmaceutical care services and quality management in form

- Cancer family history questionnaire st charles health system form

- Tca metlife com form

- Mri and ct head and mri spine imaging request m evicorecom form

- Acaria health rheumatology iv route referral form rheumatology iv route referral form

- Acaria heatlh dermatology referral form dermatology referral form

- Nurse anesthesia shadowing experience form case

- Fpl template joint bill form

Find out other Employed Income Statement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online