Quarterly Yearly Income Self Employment Rempate 2019-2026

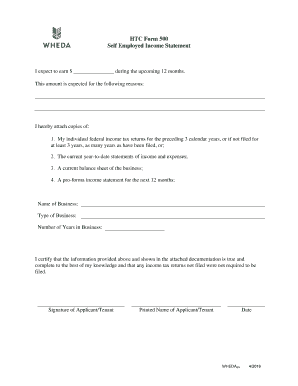

What is a self employment statement?

A self employment statement is a document that outlines the income and expenses of an individual who operates their own business. It serves as a crucial financial record for self-employed individuals, helping them track their earnings and expenditures over a specific period. This statement is often required for various purposes, including tax filings, loan applications, and financial assessments. It typically includes details such as gross income, business expenses, and net profit, providing a comprehensive overview of the individual’s financial situation.

Key elements of a self employment statement

When preparing a self employment statement, several key elements should be included to ensure accuracy and completeness:

- Gross Income: Total earnings before any deductions are made.

- Business Expenses: Costs incurred in the course of running the business, such as supplies, utilities, and travel expenses.

- Net Profit: The amount remaining after subtracting total expenses from gross income.

- Time Period: The specific timeframe the statement covers, typically on a quarterly or yearly basis.

- Documentation: Supporting documents such as receipts and invoices to validate reported income and expenses.

Steps to complete a self employment statement

Completing a self employment statement involves several steps to ensure accuracy:

- Gather financial records, including income sources and expense receipts.

- Calculate total gross income from all business activities.

- List all business expenses, categorizing them for clarity.

- Subtract total expenses from gross income to determine net profit.

- Review the statement for accuracy and completeness before submission.

Legal use of a self employment statement

A self employment statement is legally recognized and can serve various purposes, including tax reporting and loan applications. To ensure its legal validity, it should be prepared accurately and include all necessary information. Additionally, it is important to maintain records that support the figures reported in the statement, as these may be required for verification by tax authorities or financial institutions.

Filing deadlines and important dates

Self-employed individuals must adhere to specific filing deadlines for their income statements. Generally, the IRS requires self-employed individuals to file their tax returns by April fifteenth of each year. However, if additional time is needed, an extension can be requested, allowing for an extended deadline. It is essential to keep track of these dates to avoid penalties and ensure compliance with tax regulations.

IRS guidelines for self employment statements

The IRS provides clear guidelines for self employed individuals regarding the reporting of income and expenses. According to IRS regulations, self-employed individuals must report all income received during the tax year, regardless of whether it was received in cash or through other means. Additionally, they can deduct legitimate business expenses to reduce their taxable income. Familiarity with these guidelines is crucial for accurate reporting and compliance.

Quick guide on how to complete quarterly yearly income self employment rempate

Prepare Quarterly Yearly Income Self Employment Rempate seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Quarterly Yearly Income Self Employment Rempate on any platform with airSlate SignNow Android or iOS applications and streamline any document-based process today.

How to modify and electronically sign Quarterly Yearly Income Self Employment Rempate effortlessly

- Find Quarterly Yearly Income Self Employment Rempate and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Quarterly Yearly Income Self Employment Rempate and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quarterly yearly income self employment rempate

Create this form in 5 minutes!

How to create an eSignature for the quarterly yearly income self employment rempate

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a self employed statement of income?

A self employed statement of income is a document that outlines the earnings and expenses of a self-employed individual. It provides a clear picture of your financial health, which is essential for tax preparation and loan applications. Using airSlate SignNow, you can easily create and sign this statement with a professional touch.

-

How can airSlate SignNow help with my self employed statement of income?

airSlate SignNow streamlines the creation and signing of your self employed statement of income. Our user-friendly platform allows you to customize your documents and securely send them for signatures. This saves you time and ensures your income statement is professional and reliable.

-

What features does airSlate SignNow offer for self employed individuals?

airSlate SignNow offers features tailored for self employed individuals, including easy document templates for a self employed statement of income, electronic signatures, and cloud storage. These tools allow you to manage your finances effectively and keep your important documents organized, all in one place.

-

Is airSlate SignNow cost-effective for self-employed individuals?

Yes, airSlate SignNow provides a cost-effective solution for self-employed individuals. With various pricing plans available, you can choose one that fits your budget while still gaining access to all essential features for managing your self employed statement of income efficiently.

-

Can I integrate airSlate SignNow with other applications I use?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect it with accounting software, CRM systems, and more, making it easier to manage your self employed statement of income and other essential documents in one ecosystem.

-

What types of documents can I create with airSlate SignNow?

With airSlate SignNow, you can create a wide range of documents, including contracts, agreements, and your self employed statement of income. Our customizable templates make it easy to generate professional documents tailored to your specific needs as a self-employed individual.

-

How secure is my self employed statement of income with airSlate SignNow?

Security is a top priority for us at airSlate SignNow. Your self employed statement of income and other documents are protected with advanced encryption technology. This ensures that your sensitive financial information remains confidential and secure during the document signing process.

Get more for Quarterly Yearly Income Self Employment Rempate

- Notice of abandonment of assumed name brazoria county clerk form

- Pill mill finder form

- Ahip request for proposal form 2014 2015 vancouver island

- Cnic full form filled

- Sace application form

- Sports bursaries at uj form

- Watertown job application town of watertown ct watertownct form

- 11 plus cem non verbal reasoning question booklet form

Find out other Quarterly Yearly Income Self Employment Rempate

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors