See Instructions Page 45 Form

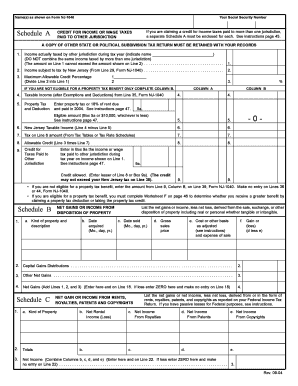

Understanding the nj 1040 Schedule B

The nj 1040 Schedule B is a crucial document for taxpayers in New Jersey, specifically designed to report interest and dividend income. This form is part of the New Jersey income tax return process, allowing individuals to detail their earnings from various sources. Understanding its purpose and requirements is essential for accurate tax reporting and compliance.

Steps to Complete the nj 1040 Schedule B

Completing the nj 1040 Schedule B involves several steps to ensure accuracy and compliance. Begin by gathering all relevant financial documents, such as bank statements and investment records. Follow these steps:

- List all sources of interest and dividend income.

- Enter the total amounts in the appropriate sections of the form.

- Ensure all calculations are correct and reflect your financial records.

- Review the completed form for any errors before submission.

Required Documents for nj 1040 Schedule B

To complete the nj 1040 Schedule B accurately, you will need specific documents. These include:

- Form 1099-INT for interest income.

- Form 1099-DIV for dividend income.

- Bank statements detailing interest earnings.

- Investment statements showing dividend distributions.

Filing Deadlines for the nj 1040 Schedule B

It is important to be aware of the filing deadlines associated with the nj 1040 Schedule B. Typically, the deadline for submitting your New Jersey income tax return, including Schedule B, aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Form Submission Methods for the nj 1040 Schedule B

Taxpayers have several options for submitting the nj 1040 Schedule B. These methods include:

- Online submission through the New Jersey Division of Taxation website.

- Mailing a paper copy to the appropriate tax office.

- In-person submission at designated tax offices.

IRS Guidelines Related to the nj 1040 Schedule B

While the nj 1040 Schedule B is specific to New Jersey, it is important to follow IRS guidelines for reporting interest and dividend income. Ensure that all income reported on Schedule B aligns with federal tax requirements to avoid discrepancies. This includes accurately reporting amounts from Forms 1099 and adhering to any applicable IRS regulations.

Penalties for Non-Compliance with the nj 1040 Schedule B

Failure to accurately complete and submit the nj 1040 Schedule B can result in penalties. These may include:

- Fines for late filing or underreporting income.

- Interest on unpaid taxes.

- Potential audits by the New Jersey Division of Taxation.

Quick guide on how to complete see instructions page 45

Complete See Instructions Page 45 effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage See Instructions Page 45 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign See Instructions Page 45 with ease

- Locate See Instructions Page 45 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign See Instructions Page 45 while ensuring superior communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the NJ 1040 Schedule B?

The NJ 1040 Schedule B is a supplementary form that individuals use to report interest and dividends for state tax purposes in New Jersey. This form helps ensure you accurately disclose your income sources, which can affect your overall tax liability. Understanding how to fill out the NJ 1040 Schedule B properly is crucial for compliance and to avoid potential penalties.

-

How can airSlate SignNow assist in preparing my NJ 1040 Schedule B?

AirSlate SignNow streamlines the process of electronically signing and sending your NJ 1040 Schedule B documents. With our platform, you can quickly format and share your tax forms without the hassle of paper. This efficiency helps ensure you meet filing deadlines while keeping your important documents organized.

-

Are there any costs associated with using airSlate SignNow for NJ 1040 Schedule B submissions?

AirSlate SignNow offers a cost-effective solution for handling your NJ 1040 Schedule B documents with a variety of pricing plans tailored to your needs. We provide flexible subscription options, enabling you to choose the one that fits your budget. Plus, our service can save you time and resources, making it a worthy investment.

-

What features does airSlate SignNow provide for NJ 1040 Schedule B handling?

AirSlate SignNow offers a range of features to simplify your NJ 1040 Schedule B handling, including eSignature capabilities, document templates, and secure cloud storage. These features ensure that your forms are completed accurately and quickly. Additionally, our user-friendly interface makes it easy for anyone to adopt this solution.

-

Can I integrate airSlate SignNow with other software for NJ 1040 Schedule B preparation?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax preparation software to facilitate your NJ 1040 Schedule B submissions. This integration allows you to import necessary data directly into your documents, reducing the chance for errors. By utilizing these integrations, you can streamline your overall tax filing process.

-

Is airSlate SignNow secure for submitting my NJ 1040 Schedule B information?

Absolutely, airSlate SignNow prioritizes the security of your documents, employing advanced encryption technologies to protect your NJ 1040 Schedule B information. We comply with industry standards to ensure your data remains confidential throughout the signing process. This commitment to security gives you peace of mind when submitting sensitive tax information.

-

How does using airSlate SignNow benefit me when filing the NJ 1040 Schedule B?

Utilizing airSlate SignNow provides numerous benefits when filing your NJ 1040 Schedule B, including enhanced efficiency and reduced paperwork. Our eSignature capabilities allow for faster approvals and turnaround times. Additionally, the ease of access to your documents will enable you to focus on other important tasks while ensuring compliance.

Get more for See Instructions Page 45

Find out other See Instructions Page 45

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now