Denver Sales Tax Return Quarterly Form

What is the Denver Sales Tax Return Quarterly

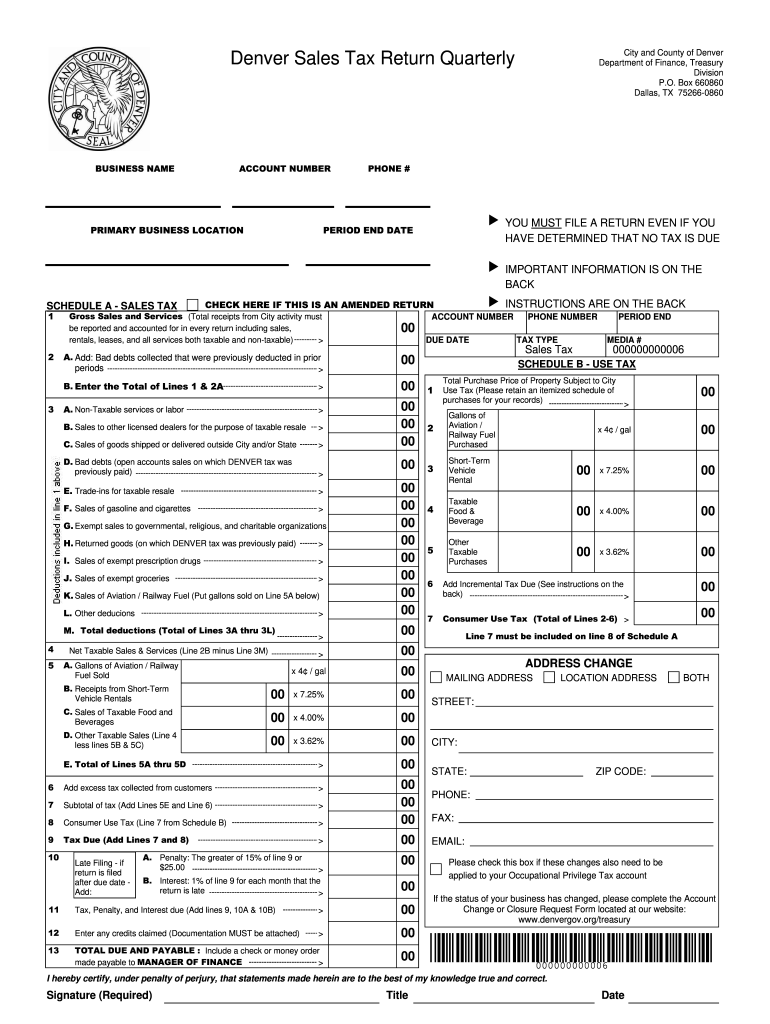

The Denver Sales Tax Return Quarterly is a tax form used by businesses operating within the city and county of Denver to report and remit sales tax collected from customers. This form is essential for maintaining compliance with local tax regulations and ensuring that the appropriate sales tax is submitted to the city. The quarterly filing period allows businesses to consolidate their sales tax obligations and report them every three months, streamlining the tax process.

How to use the Denver Sales Tax Return Quarterly

Using the Denver Sales Tax Return Quarterly involves several steps. First, businesses must accurately calculate the total sales made during the quarter and the corresponding sales tax collected. Next, they should complete the form by entering the required information, including gross sales, taxable sales, and the total sales tax due. Once the form is filled out, it must be submitted to the city’s finance department either online or via mail, along with the payment for any taxes owed.

Steps to complete the Denver Sales Tax Return Quarterly

Completing the Denver Sales Tax Return Quarterly involves the following steps:

- Gather sales records for the quarter, including invoices and receipts.

- Calculate total sales and the amount of sales tax collected.

- Obtain the Denver Sales Tax Return Quarterly form from the city’s finance website.

- Fill out the form with accurate sales data and tax amounts.

- Review the completed form for accuracy.

- Submit the form online or mail it to the appropriate city office, along with any payment due.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines for the Denver Sales Tax Return Quarterly. Typically, the form is due on the last day of the month following the end of each quarter. For example, the deadlines are usually April 30, July 31, October 31, and January 31. Missing these deadlines can result in penalties and interest on unpaid taxes, so timely filing is essential.

Required Documents

When completing the Denver Sales Tax Return Quarterly, businesses should have the following documents ready:

- Sales records for the reporting period, including receipts and invoices.

- Previous sales tax returns for reference.

- Any correspondence from the city regarding tax obligations.

Penalties for Non-Compliance

Failure to file the Denver Sales Tax Return Quarterly on time can result in penalties. The city may impose fines based on the amount of tax owed and the length of time the tax remains unpaid. Additionally, interest may accrue on the outstanding balance, further increasing the total amount due. To avoid these penalties, businesses should ensure they meet all filing requirements and deadlines.

Quick guide on how to complete denver sales tax return quarterly department of finance denvergov

Your assistance manual on how to prepare your Denver Sales Tax Return Quarterly

If you’re interested in understanding how to finalize and send your Denver Sales Tax Return Quarterly, here are some straightforward instructions on how to simplify tax submissions.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to modify, create, and complete your income tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and revisit to amend details as necessary. Streamline your tax oversight with enhanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Denver Sales Tax Return Quarterly in minutes:

- Establish your account and commence working on PDFs in just a few moments.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Denver Sales Tax Return Quarterly in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to apply your legally-recognized eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can lead to increased return errors and delays in refunds. Of course, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How can a person be able to earn the most out of their tax returns when forming a startup?

Save ALL receipts for items you purchased for the business as well as other expenses incurred. You won’t file them with your tax return but you will always be able to prove your deductions if audited.And you need to know that the IRS can audit a return many years later.

-

How do you use Quickbooks for dropshipping to keep your finances in check? How do I record all the sales and payments, keeping track of the finances and be ready to submit tax forms and all?

Hi Ricky,Drop shipping product affects how you would track inventory. Typically, one would invoice after the shipment is made. Do you produce inventory or just buy/sell/rep for products? If you produce the inventory yourself, you would want to capture the materials purchased, the assembly, the increase in inventory when built. Then when you ship, you can invoice and it decreases your inventory value and increases your Cost of Goods Sold.QuickBooks is a powerful tool to track all of the transactions that occur. From prepaying your vendor, customer deposits, receiving a vendor bill, invoicing your customer, receiving payments and making deposits. Can you tell I love my accounting software?

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the denver sales tax return quarterly department of finance denvergov

How to create an electronic signature for the Denver Sales Tax Return Quarterly Department Of Finance Denvergov online

How to create an eSignature for the Denver Sales Tax Return Quarterly Department Of Finance Denvergov in Google Chrome

How to generate an electronic signature for putting it on the Denver Sales Tax Return Quarterly Department Of Finance Denvergov in Gmail

How to make an eSignature for the Denver Sales Tax Return Quarterly Department Of Finance Denvergov from your smart phone

How to create an eSignature for the Denver Sales Tax Return Quarterly Department Of Finance Denvergov on iOS

How to make an eSignature for the Denver Sales Tax Return Quarterly Department Of Finance Denvergov on Android devices

People also ask

-

What is a Denver Sales Tax Return Quarterly and why is it important?

A Denver Sales Tax Return Quarterly is a tax form that businesses in Denver must file every quarter to report their sales tax collected. It is crucial for compliance with local tax laws and helps avoid penalties. Filing this return accurately ensures that your business remains in good standing with the city and can continue its operations without interruptions.

-

How can airSlate SignNow help with filing a Denver Sales Tax Return Quarterly?

airSlate SignNow simplifies the process of preparing and filing your Denver Sales Tax Return Quarterly by providing a user-friendly platform to eSign and manage documents. With our digital signatures, you can expedite the filing process and ensure that your returns are submitted on time. This efficiency can save you valuable time and reduce stress during tax season.

-

What are the costs associated with using airSlate SignNow for my Denver Sales Tax Return Quarterly?

airSlate SignNow offers a cost-effective solution for managing your Denver Sales Tax Return Quarterly, with pricing plans that cater to businesses of all sizes. Our plans are designed to be budget-friendly, allowing you to choose the one that best fits your needs. Additionally, the time and resources saved by using our platform can lead to signNow cost reductions in the long run.

-

What features does airSlate SignNow offer for managing taxes like the Denver Sales Tax Return Quarterly?

airSlate SignNow provides various features to assist with your Denver Sales Tax Return Quarterly, including customizable templates, secure eSignature capabilities, and document tracking. Our platform ensures that you can easily edit and store tax documents while maintaining compliance. The intuitive interface makes it easy for users to navigate and complete their tax filings efficiently.

-

Are there any integrations available for airSlate SignNow to help with my Denver Sales Tax Return Quarterly?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to manage your Denver Sales Tax Return Quarterly. These integrations enable you to import data directly from your accounting systems, reducing manual entry and potential errors. This streamlined process ensures that your financial records and tax filings are always up-to-date.

-

Can I access airSlate SignNow on mobile devices for my Denver Sales Tax Return Quarterly?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage your Denver Sales Tax Return Quarterly from anywhere. Whether you are in the office or on the go, you can quickly access your documents, eSign them, and ensure timely submissions. Our mobile-friendly platform enhances your productivity and flexibility.

-

What security measures does airSlate SignNow implement for tax documents like the Denver Sales Tax Return Quarterly?

airSlate SignNow prioritizes the security of your tax documents, including the Denver Sales Tax Return Quarterly, by using advanced encryption protocols and secure data storage. We ensure that sensitive information is protected at all times, giving you peace of mind when handling your tax filings. Our commitment to security helps you focus on your business without worrying about data bsignNowes.

Get more for Denver Sales Tax Return Quarterly

Find out other Denver Sales Tax Return Quarterly

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed