Sa 700 Form 2020

What is the Sa 700 Form

The Sa 700 Form is a crucial document utilized primarily for tax purposes in the United States. It is designed for specific reporting requirements, often related to income or deductions. Understanding the purpose of this form is essential for compliance with tax regulations. The Sa 700 Form allows taxpayers to accurately report their financial activities, ensuring that they meet their legal obligations while potentially minimizing their tax liabilities.

How to use the Sa 700 Form

Using the Sa 700 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts related to deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is advisable to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS.

Steps to complete the Sa 700 Form

Completing the Sa 700 Form requires attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents.

- Fill in personal identification information accurately.

- Report income and deductions as required.

- Double-check all entries for accuracy.

- Submit the form by the deadline, either electronically or by mail.

By adhering to these steps, you can ensure that your Sa 700 Form is completed correctly and submitted on time.

Legal use of the Sa 700 Form

The Sa 700 Form is legally binding when completed and submitted according to IRS guidelines. It is essential to understand that any false information or omissions can lead to penalties. The form must be signed and dated by the taxpayer, affirming that the information provided is true and accurate. Compliance with all legal requirements ensures that the form serves its intended purpose without issues.

Examples of using the Sa 700 Form

There are various scenarios in which the Sa 700 Form may be used. For instance, self-employed individuals may use this form to report their income and claim deductions for business expenses. Similarly, retirees might use it to report pension income. Understanding these examples can help taxpayers identify when and how to utilize the Sa 700 Form effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Sa 700 Form are critical to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, it is advisable to check for any specific changes or extensions that may apply. Marking these important dates on your calendar can help ensure timely submission.

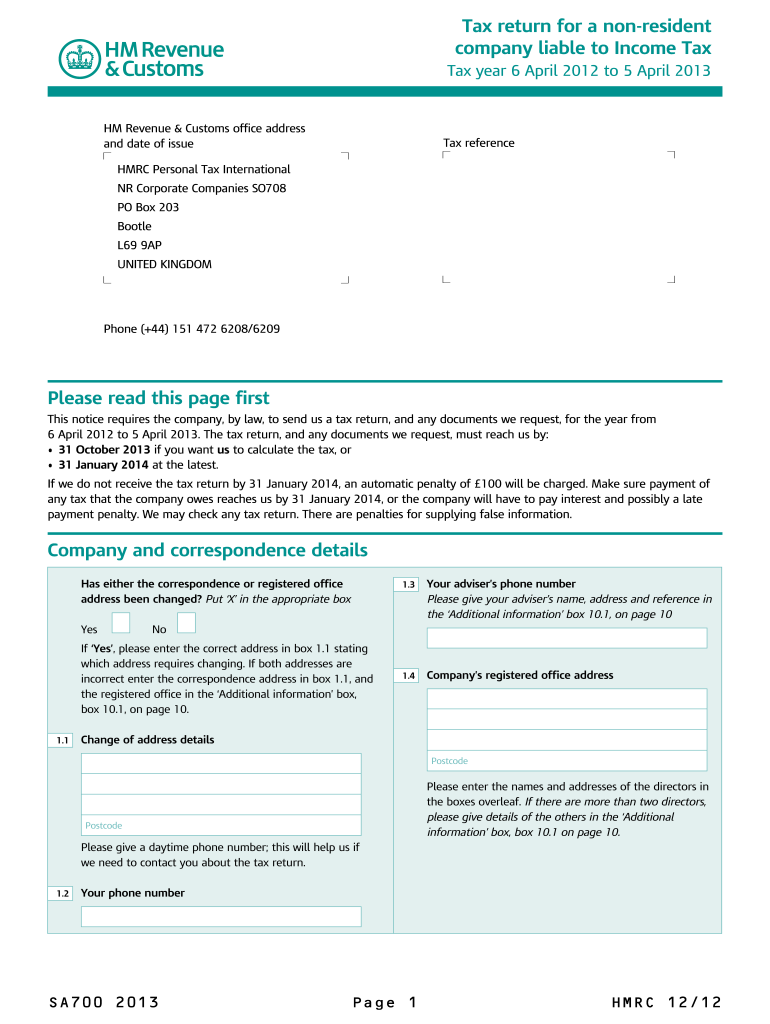

Quick guide on how to complete 2013 sa 700 form

Prepare Sa 700 Form effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without hindrance. Manage Sa 700 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Sa 700 Form seamlessly

- Find Sa 700 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, cumbersome form navigation, or errors that require printing new document versions. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your choice. Modify and eSign Sa 700 Form and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 sa 700 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 sa 700 form

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Sa 700 Form and why is it important?

The Sa 700 Form is a signNow document used for tax purposes, primarily for individuals and businesses in the UK. It helps in reporting income and expenses accurately to HM Revenue and Customs. Using airSlate SignNow to eSign the Sa 700 Form ensures a secure and efficient submission process.

-

How does airSlate SignNow simplify the process of signing the Sa 700 Form?

airSlate SignNow simplifies the signing process for the Sa 700 Form by providing an intuitive interface that allows users to eSign documents quickly. The platform enables document sharing and collaboration in real-time, making it easier for multiple parties to review and sign. This saves time and eliminates the hassle of printing and faxing.

-

Is airSlate SignNow cost-effective for signing documents like the Sa 700 Form?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to sign important documents like the Sa 700 Form. With competitive pricing plans tailored for different business needs, you can save on paper costs and streamline your document management process. Efficiencies gained can lead to substantial cost savings over time.

-

Can I integrate airSlate SignNow with other software to manage the Sa 700 Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing for better management of the Sa 700 Form. Whether you use CRM, cloud storage, or accounting tools, these integrations help centralize workflow and minimize the need for manual data entry.

-

What features does airSlate SignNow offer for handling the Sa 700 Form?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage for documents like the Sa 700 Form. Additionally, it offers tracking and notification options so you can stay updated on the status of your signed documents. These features enhance the overall efficiency of your document management.

-

How secure is the process of signing the Sa 700 Form with airSlate SignNow?

The security of your documents is a top priority for airSlate SignNow when signing the Sa 700 Form. The platform employs advanced encryption and complies with industry standards to ensure your data remains secure. You can eSign documents with confidence, knowing that unauthorized access is minimal.

-

What are the benefits of using airSlate SignNow for the Sa 700 Form?

Using airSlate SignNow for the Sa 700 Form has numerous benefits, including increased efficiency and reduced turnaround times for document signing. The ease of electronic signatures reduces the likelihood of errors and delays. Moreover, you can track the status of your submissions, enhancing accountability.

Get more for Sa 700 Form

Find out other Sa 700 Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF