27 0032 Form

What is the 27 0032?

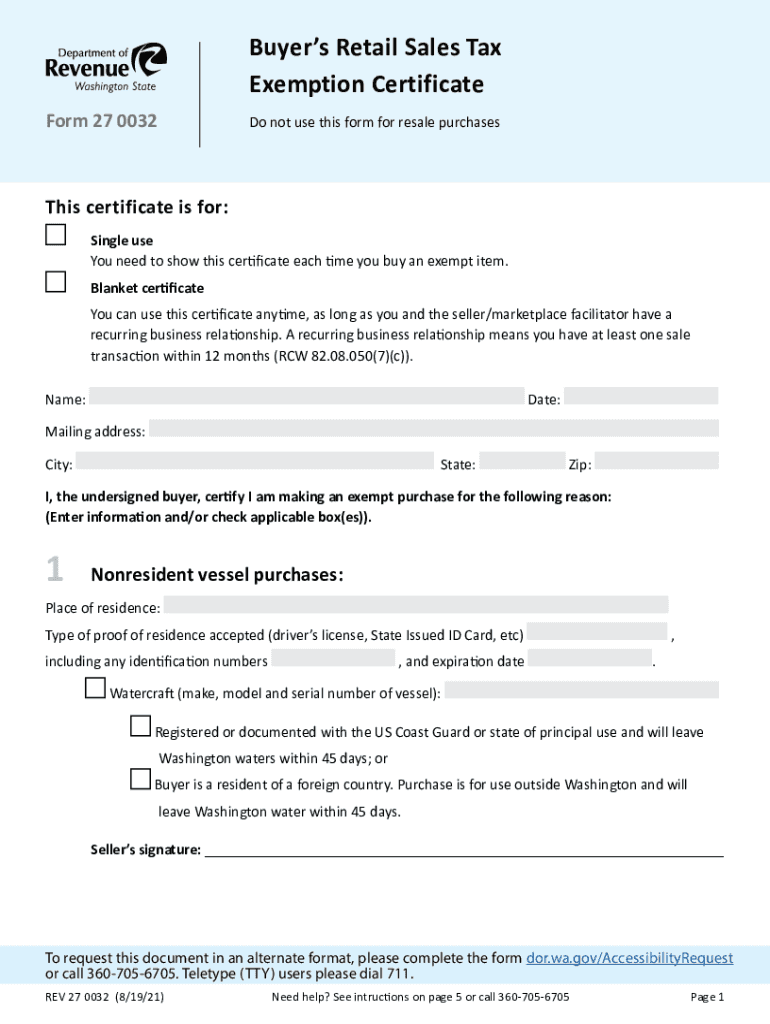

The 27 0032 form, also known as the buyers exemption certificate, is a crucial document used in the United States for sales tax purposes. This form allows eligible buyers to claim exemption from sales tax on purchases of tangible personal property or services. It is primarily utilized by businesses and organizations that qualify for tax-exempt status, enabling them to avoid paying sales tax on items that will be resold or used in their operations.

How to Use the 27 0032

Using the 27 0032 form involves several straightforward steps. First, ensure that you are eligible for a sales tax exemption. Next, fill out the form accurately, providing necessary details such as your business name, address, and the nature of your purchases. Once completed, present the signed form to the seller at the time of purchase. This process ensures that the seller recognizes your tax-exempt status and does not charge sales tax on the transaction.

Steps to Complete the 27 0032

Completing the 27 0032 form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the Department of Revenue or your state’s tax authority.

- Fill in your business information, including the name, address, and tax identification number.

- Specify the reason for the exemption, such as resale or use in manufacturing.

- Sign and date the form to confirm its accuracy and authenticity.

- Submit the completed form to the seller before making your purchase.

Legal Use of the 27 0032

The legal use of the 27 0032 form is governed by state tax laws. It is essential to understand that misuse of this form can lead to penalties. To ensure compliance, businesses must only use the form for legitimate tax-exempt purchases. Additionally, sellers must retain a copy of the completed form for their records, demonstrating that they have followed the appropriate procedures for sales tax exemption.

Eligibility Criteria

Eligibility for using the 27 0032 form is primarily determined by the nature of the buyer's business and the intended use of the purchased items. Typically, businesses that resell products or use them in manufacturing processes qualify for exemption. Non-profit organizations and government entities may also be eligible. It is crucial to verify specific eligibility requirements with your state’s Department of Revenue to ensure compliance.

Form Submission Methods

The 27 0032 form can be submitted in various ways, depending on the seller's preferences and state regulations. Common submission methods include:

- Presenting a physical copy of the completed form at the time of purchase.

- Submitting the form electronically if the seller accepts digital documentation.

- Mailing the form to the seller in advance of the purchase, if required.

Examples of Using the 27 0032

Practical examples of using the 27 0032 form include a retail store purchasing inventory for resale or a manufacturing company buying raw materials. In both cases, the businesses would present the buyers exemption certificate to avoid paying sales tax on their purchases. These scenarios highlight the form's importance in facilitating tax-exempt transactions, ultimately supporting business operations and growth.

Quick guide on how to complete 27 0032

Complete 27 0032 effortlessly on any device

Web-based document management has become favored among companies and individuals. It presents an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the accurate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 27 0032 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign 27 0032 without hassle

- Obtain 27 0032 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management within a few clicks from a device of your choice. Modify and eSign 27 0032 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 27 0032?

Form 27 0032 is a document crucial for complying with specific regulatory requirements related to business processes. By using airSlate SignNow, you can easily eSign and manage form 27 0032, enhancing accuracy and efficiency in document handling.

-

How can airSlate SignNow help me with form 27 0032?

airSlate SignNow simplifies the process of sending and eSigning form 27 0032. Our platform is designed to streamline document workflows, ensuring that your form 27 0032 is completed accurately and swiftly, saving you time and reducing the risk of errors.

-

Is there a free trial available for form 27 0032 management?

Yes, airSlate SignNow offers a free trial that allows you to explore all features related to managing documents like form 27 0032. This trial gives you the chance to experience our cost-effective solution before making a financial commitment.

-

What are the key features for managing form 27 0032 in airSlate SignNow?

Key features for managing form 27 0032 in airSlate SignNow include customizable templates, secure eSignature options, and automated workflow capabilities. These features ensure that your form 27 0032 is processed accurately and efficiently.

-

Can I integrate airSlate SignNow with other tools for handling form 27 0032?

Absolutely! airSlate SignNow supports integrations with a variety of productivity and business software. This flexibility enhances your ability to manage form 27 0032 alongside other critical tools, streamlining your overall document management process.

-

What benefits does airSlate SignNow provide for form 27 0032 processing?

Using airSlate SignNow for form 27 0032 processing offers numerous benefits, including improved turnaround times, reduced paperwork, and enhanced compliance. Our intuitive platform ensures that you can manage form 27 0032 efficiently, allowing your business to focus on growth.

-

Is airSlate SignNow compliant with legal standards for form 27 0032?

Yes, airSlate SignNow is fully compliant with relevant legal standards for electronic signatures. You can confidently eSign form 27 0032 knowing that our platform adheres to regulations, ensuring that your documents remain valid and enforceable.

Get more for 27 0032

Find out other 27 0032

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT