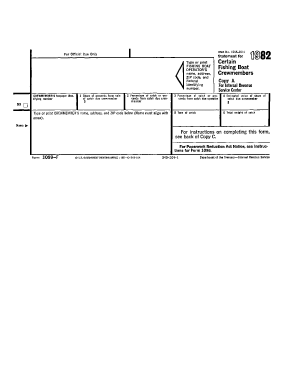

1099f Form

What is the 1099-F?

The 1099-F form, officially known as the IRS 1099-F, is a tax document used to report certain types of income other than wages, salaries, and tips. This form is primarily issued to individuals or businesses that have received payments for services rendered, which may include freelance work or contract jobs. The 1099-F is crucial for both the payer and the payee, as it helps ensure accurate reporting of income to the IRS.

How to Use the 1099-F

Using the 1099-F involves a few key steps to ensure compliance with IRS regulations. First, the payer must complete the form with accurate information about the recipient, including their name, address, and taxpayer identification number. Next, the total amount paid during the tax year must be reported in the appropriate box. Both parties should keep a copy for their records, as this document may be required during tax filing. Proper use of the 1099-F helps avoid potential penalties for misreporting income.

Steps to Complete the 1099-F

Completing the 1099-F form requires attention to detail. Follow these steps:

- Gather necessary information about the recipient, including their full name, address, and taxpayer identification number.

- Fill out the payer's information at the top of the form, ensuring accuracy.

- Report the total amount paid in the designated box.

- Sign and date the form to certify its accuracy.

- Distribute copies to the recipient and the IRS by the filing deadline.

Legal Use of the 1099-F

The legal use of the 1099-F is governed by IRS guidelines, which dictate when and how this form should be issued. It is essential for businesses to issue a 1099-F when payments exceed a certain threshold, typically $600, to ensure compliance with tax laws. Failure to issue the form or to report income accurately can lead to penalties and interest charges from the IRS. Understanding the legal implications of the 1099-F is vital for both employers and employees.

Filing Deadlines / Important Dates

Filing deadlines for the 1099-F form are crucial for timely compliance. Generally, the form must be sent to recipients by January 31 of the following year. Additionally, the IRS requires that the form be filed by the end of February if submitting by mail, or by March 31 if filing electronically. Keeping track of these dates helps avoid penalties and ensures that all income is reported accurately within the required timeframe.

Who Issues the Form

The 1099-F form is typically issued by businesses or individuals who have paid for services rendered. This includes employers, contractors, and freelance clients. It is the responsibility of the payer to complete and distribute the form to the recipient and the IRS. Understanding who is required to issue the 1099-F is essential for compliance and accurate reporting of income.

Quick guide on how to complete 1099f

Complete 1099f effortlessly on any device

Online document management has increasingly become favored among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage 1099f on any platform with airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

How to modify and eSign 1099f with ease

- Find 1099f and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you want to send your form: by email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign 1099f and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is employee health insurance and why is it important?

Employee health insurance provides coverage for medical expenses incurred by employees. It is crucial for attracting and retaining talent, ensuring employee well-being, and reducing absenteeism. Offering comprehensive employee health insurance can enhance your company’s reputation and demonstrate your commitment to your workforce.

-

How can airSlate SignNow simplify the process of enrolling employees in health insurance?

airSlate SignNow allows businesses to efficiently manage the enrollment process for employee health insurance by digitizing documents and ensuring secure electronic signatures. This streamlines the administration and saves time, making it easier for HR to handle health insurance paperwork. Our platform helps create a more organized and hassle-free onboarding experience for new hires.

-

What are the key benefits of using airSlate SignNow for employee health insurance documents?

Using airSlate SignNow for employee health insurance documents ensures that all forms are correctly filled and securely signed. This reduces the risk of errors and potential delays in coverage and compliance. Additionally, it provides a clear audit trail for all signed documents, enhancing accountability and transparency.

-

Is airSlate SignNow compliant with health insurance regulations?

Yes, airSlate SignNow is designed to comply with industry standards and regulations related to employee health insurance. Our platform adheres to legal requirements for electronic signatures and document security, ensuring that your health insurance documents are handled in accordance with applicable laws. This helps protect both your business and your employees.

-

What pricing options does airSlate SignNow offer for small businesses regarding employee health insurance documentation?

airSlate SignNow offers flexible pricing plans that cater to small businesses looking to manage employee health insurance documentation efficiently. We provide cost-effective solutions tailored to your document needs, combining ease of use with affordability. This allows small businesses to access essential tools without breaking the budget.

-

Can airSlate SignNow integrate with existing HR systems for managing employee health insurance?

Absolutely! airSlate SignNow seamlessly integrates with various HR systems to streamline the management of employee health insurance processes. By connecting with your existing platforms, you can automatically synchronize data and reduce administrative burdens, making it easier to manage health insurance efficiently.

-

How does electronic signing improve the employee health insurance enrollment process?

Electronic signing improves the employee health insurance enrollment process by making it faster and more efficient. With airSlate SignNow, employees can sign documents from anywhere, signNowly reducing paperwork delays and ensuring timely submissions. This enhances the overall experience for both employees and HR departments.

Get more for 1099f

Find out other 1099f

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement