Form 8873

What is the Form 8873

The Form 8873 is a tax form used by businesses to claim the credit for the employer's share of social security and Medicare taxes paid on employee wages. This form is essential for employers seeking to reduce their tax liabilities and ensure compliance with IRS regulations. Understanding the purpose of Form 8873 is crucial for accurate tax reporting and maximizing potential credits.

How to use the Form 8873

Using the Form 8873 involves several steps to ensure proper completion and submission. First, gather all necessary information regarding employee wages and the corresponding taxes paid. Next, fill out the form accurately, detailing the amounts eligible for the credit. It is important to follow the instructions provided by the IRS to avoid errors that could delay processing or result in penalties. Once completed, the form should be submitted along with your tax return.

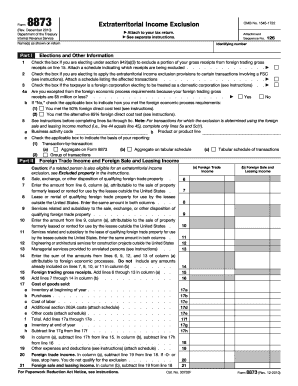

Steps to complete the Form 8873

Completing the Form 8873 requires careful attention to detail. Start by entering your business information, including the Employer Identification Number (EIN). Then, list the total wages paid to employees and the amount of social security and Medicare taxes paid. Ensure that you calculate the credit amount correctly based on the IRS guidelines. Review all entries for accuracy before submitting the form. This thorough approach helps prevent mistakes and ensures compliance with tax laws.

Legal use of the Form 8873

The legal use of Form 8873 is governed by IRS regulations, which stipulate that the form must be filled out accurately to qualify for the tax credit. Employers must maintain records supporting the amounts claimed on the form, as these may be requested during an audit. Using the form correctly not only helps in claiming eligible credits but also ensures adherence to federal tax laws, thereby avoiding potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8873 are aligned with the overall tax return deadlines. Typically, the form must be submitted by the due date of your business tax return. It is essential to keep track of these dates to ensure timely filing and avoid penalties. Mark your calendar with important dates related to tax filing to stay organized and compliant.

Required Documents

To complete the Form 8873, certain documents are necessary. These include payroll records that detail employee wages, social security, and Medicare tax payments. Additionally, any documentation related to previous tax credits claimed may be helpful for reference. Having these documents readily available simplifies the completion process and ensures accurate reporting.

Eligibility Criteria

Eligibility for using Form 8873 is primarily determined by the type of business and the wages paid to employees. Businesses must meet specific criteria outlined by the IRS to qualify for the tax credit. This includes being subject to social security and Medicare taxes and having paid these taxes on eligible wages. Understanding these criteria is vital for businesses to take advantage of the available credits effectively.

Quick guide on how to complete form 8873

Effortlessly Prepare Form 8873 on Any Device

Online document administration has gained traction among organizations and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage Form 8873 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Alter and eSign Form 8873 with Ease

- Obtain Form 8873 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with specialized tools offered by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Modify and eSign Form 8873 and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 8873 and why do I need it?

Form 8873 is a tax form used to claim tax credits related to the American Opportunity Tax Credit. It's essential for eligible taxpayers to complete this form accurately to ensure they receive the maximum tax benefits. Utilizing airSlate SignNow simplifies the process of filling out and submitting form 8873 securely.

-

How does airSlate SignNow help in filling out form 8873?

airSlate SignNow provides an intuitive interface to fill out form 8873 easily. With our platform, users can input their data, sign the form electronically, and send it to the necessary parties without hassle. This ensures that your form 8873 is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for form 8873?

Yes, airSlate SignNow offers various pricing plans that are both cost-effective and suited for different business needs. You can select a package that best aligns with your usage frequency and features required for processing form 8873. Evaluate our pricing options to find the perfect fit for your needs.

-

Can I integrate airSlate SignNow with other software to manage form 8873?

Absolutely! airSlate SignNow supports integrations with a variety of popular software applications, allowing you to streamline your workflow when handling form 8873. This seamless integration improves your document management and ensures that all relevant information is consolidated in one place.

-

What are the benefits of using airSlate SignNow for handling form 8873?

Using airSlate SignNow to manage form 8873 offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows for quick document turnaround and reduces the risk of errors signNowly, making the filing process smoother and stress-free.

-

Is it easy to track the status of my submitted form 8873 on airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all submitted documents, including form 8873. You can easily monitor the status of your submission, ensuring you are always informed about its progress. This level of visibility helps you manage your documents more effectively.

-

What features does airSlate SignNow offer for eSigning form 8873?

airSlate SignNow offers robust eSigning features that make signing form 8873 effortless. Users can sign documents electronically, assign signing roles, and manage the signing process from any device. This not only expedites the process but also ensures compliance and security.

Get more for Form 8873

- Waiver and release from liability for minor child for deep sea fishing vessel form

- Waiver release liability agreement 497427210 form

- Release participation form

- Waiver and release from liability for adult for rally participation form

- Waiver release participation form

- Liability paragliding form

- Waiver and release from liability for adult for sorority function form

- Waiver and release from liability for minor child for sorority function form

Find out other Form 8873

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online