Distribution Worksheet Form

What is the Distribution Worksheet

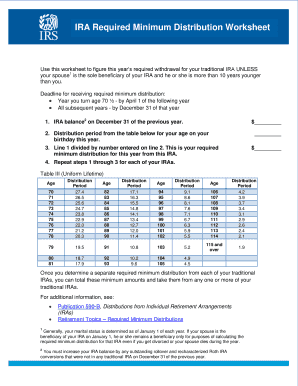

The IRA required minimum distribution worksheet is a crucial tool for individuals who must calculate their required minimum distributions (RMDs) from their Individual Retirement Accounts (IRAs). This worksheet helps determine the minimum amount that must be withdrawn each year once the account holder reaches the age of seventy-two. The calculations are based on the account balance and the account holder’s life expectancy, as defined by IRS tables.

How to use the Distribution Worksheet

To effectively use the IRA RMD worksheet, begin by gathering your IRA account statements to find the balance as of December thirty-first of the previous year. Next, locate your age on the IRS life expectancy table to determine your distribution factor. Multiply your account balance by this factor to arrive at your required minimum distribution for the year. This process must be repeated annually, as account balances and life expectancy factors may change.

Steps to complete the Distribution Worksheet

Completing the IRA required minimum distribution worksheet involves several steps:

- Gather your IRA account balance as of December thirty-first of the prior year.

- Consult the IRS life expectancy tables to find your specific distribution factor based on your age.

- Perform the calculation by dividing your account balance by the distribution factor.

- Document the calculated RMD on the worksheet for your records.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that govern the required minimum distributions from IRAs. According to IRS regulations, account holders must begin taking distributions by April first of the year following the year they turn seventy-two. Failure to withdraw the required amount may result in a hefty penalty, which is fifty percent of the amount that should have been withdrawn.

Legal use of the Distribution Worksheet

The IRA required minimum distribution worksheet is legally recognized as a valid method for calculating RMDs, provided that it is completed accurately and in accordance with IRS guidelines. Utilizing this worksheet ensures compliance with federal regulations, helping to avoid penalties associated with non-compliance. It is advisable to keep records of your calculations and withdrawals for tax purposes.

Filing Deadlines / Important Dates

Understanding the filing deadlines related to the IRA required minimum distribution is essential for compliance. The key date to remember is April first of the year following the year you turn seventy-two. This is the deadline for your first RMD. Subsequent distributions must be taken by December thirty-first of each year. Marking these dates on your calendar can help ensure timely compliance and avoid penalties.

Quick guide on how to complete distribution worksheet

Complete Distribution Worksheet effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly substitute to conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents promptly without delays. Handle Distribution Worksheet on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Distribution Worksheet without hassle

- Locate Distribution Worksheet and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign instrument, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Select how you want to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choice. Adjust and eSign Distribution Worksheet and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a required minimum distribution worksheet?

A required minimum distribution worksheet is a tool that helps you calculate the minimum amount you must withdraw from your retirement account each year after signNowing a certain age. Using this worksheet can ensure compliance with IRS regulations regarding minimum distributions. By keeping track of these distributions, you can avoid potential penalties and manage your retirement savings more effectively.

-

How can the required minimum distribution worksheet benefit my retirement planning?

Using the required minimum distribution worksheet is essential for effective retirement planning, as it helps you determine your annual withdrawal amounts accurately. This tool enables you to align your financial needs with IRS requirements, preventing tax penalties. It can also assist you in strategizing your withdrawals to help maximize your retirement savings.

-

Is there a cost associated with the required minimum distribution worksheet?

The cost of accessing the required minimum distribution worksheet may vary depending on the service provider you choose. airSlate SignNow offers competitive pricing for its eSign and document management solutions, which may include features like the distribution worksheet. It's advisable to check the specific pricing details on the airSlate SignNow website to find the best plan that fits your needs.

-

Can I customize the required minimum distribution worksheet in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the required minimum distribution worksheet according to your specific needs. This means you can modify fields, add additional data, or alter the layout to better suit your preferences. Customization ensures that you have all the relevant information easily accessible, making retirement planning more efficient.

-

What features does the required minimum distribution worksheet offer?

The required minimum distribution worksheet includes essential features such as automatic calculations for your required withdrawals, space for inputting your account details, and clear instructions for use. Additionally, airSlate SignNow provides an intuitive interface that simplifies the process, making it easier for you to keep track of your distribution requirements over time.

-

How does airSlate SignNow ensure the security of my required minimum distribution worksheet?

airSlate SignNow prioritizes your data security through industry-standard encryption and secure data storage. When using the required minimum distribution worksheet, you can rest assured that your sensitive financial information is protected. Regular security audits and compliance with data protection regulations further enhance the trustworthiness of our platform.

-

What integrations are available for the required minimum distribution worksheet?

airSlate SignNow offers a variety of integrations that can enhance the functionality of your required minimum distribution worksheet. You can integrate with popular financial tools and accounting software, allowing for seamless data transfer and better data management. This simplifies the overall process, giving you a comprehensive solution for your retirement planning needs.

Get more for Distribution Worksheet

- Waiver liability house 497427241 form

- Waiver and release from liability for adult for scout function form

- Waiver and release from liability for adult for lodge membership form

- Waiver liability land 497427244 form

- Waiver and release from liability for adult for intramural sports form

- Release minor child 497427246 form

- Waiver and release from liability for adult for aerobic sports form

- Waiver release liability 497427248 form

Find out other Distribution Worksheet

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free